ConnectClass Accoul M MHE Reader general ledgerBing r Acct

Connect-Class: Accoul M MHE Reader general ledger-Bing r ? Acct l Exam 1 Summ × Acct Prin l Exam 1-AC How to Take a Screen S | + v ? ? ?fù ? https: /howard blackboard.com bbcswebdav pid-2194337 dt content rid-6124953-1/courses/ACCT20180201 805 Acct%201%20Exam%201 Comprehensive problem- The Accounting Cycle On August 1, 2018, David McKinsey created a company, McKinsey Consulting. The following transactions occurred during the company\'s first month Aug Anthony invested $120,000 cash and computer equipment worth $50,000 in the com- pany in exchange for common stock. The company rented furnished office space by prepaying $4,500 for the first 5 month\'s rent 1 The company purchased $5,000 of office supplies on credit 1 The company paid $4,800 for the premium on a 12-month insurance policy 8 The company agreed to perform a long tem consulting contract for a client, Mr. Roo- ney, who paid $30,000 upfront to McKinsey Consulting. 14 The company paid $7,000 for two weeks\' salaries eamed by employees 24 The company collected $60,000 from consulting services performed for Ms. Tate. 28 The company paid $7,000 for two weeks\' salaries eamed by employees. 29 The company paid $1,900 for repairs to the company\'s computer. 30 The company paid $1,200 for this month\'s telephone bill 30 The company paid $1,800 for dividends. 1. Prepare joumal entries to record McKinsey Consulting\'s transactions for its first month of operations. SKIP A LINE BETWEEN EACH JOURNAL ENTRY. Explanations are not required. 2. Post the journal entries to the general ledger and calculate each account\'s ending balance. 3. Prepare an unadjusted trial balance on the trial balance worksheet. List the accounts in the correct order, On August 31, McKinsey Consulting reviewed its books and noted the following a. One month\'s insurance coverage has expired b. At the end of the month, $1,900 of office supplies is still available c. This month\'s depreciation on the computer equipment is $3,500 d. Employees earned $1,850 of unpaid and unrecorded salaries for the pod August 29-31 e. The company eamed $5,250 of consulting fees that are not yet billed at month-end f. On August 31, the unearned balance on Mr. Rooney\'s consulting contract is $20,000 Record the company\'s rent expense for August. 4. Prepare adjusting journal entries to record these transactions. SKIP A LINE BETWEEN EACH JOUR-

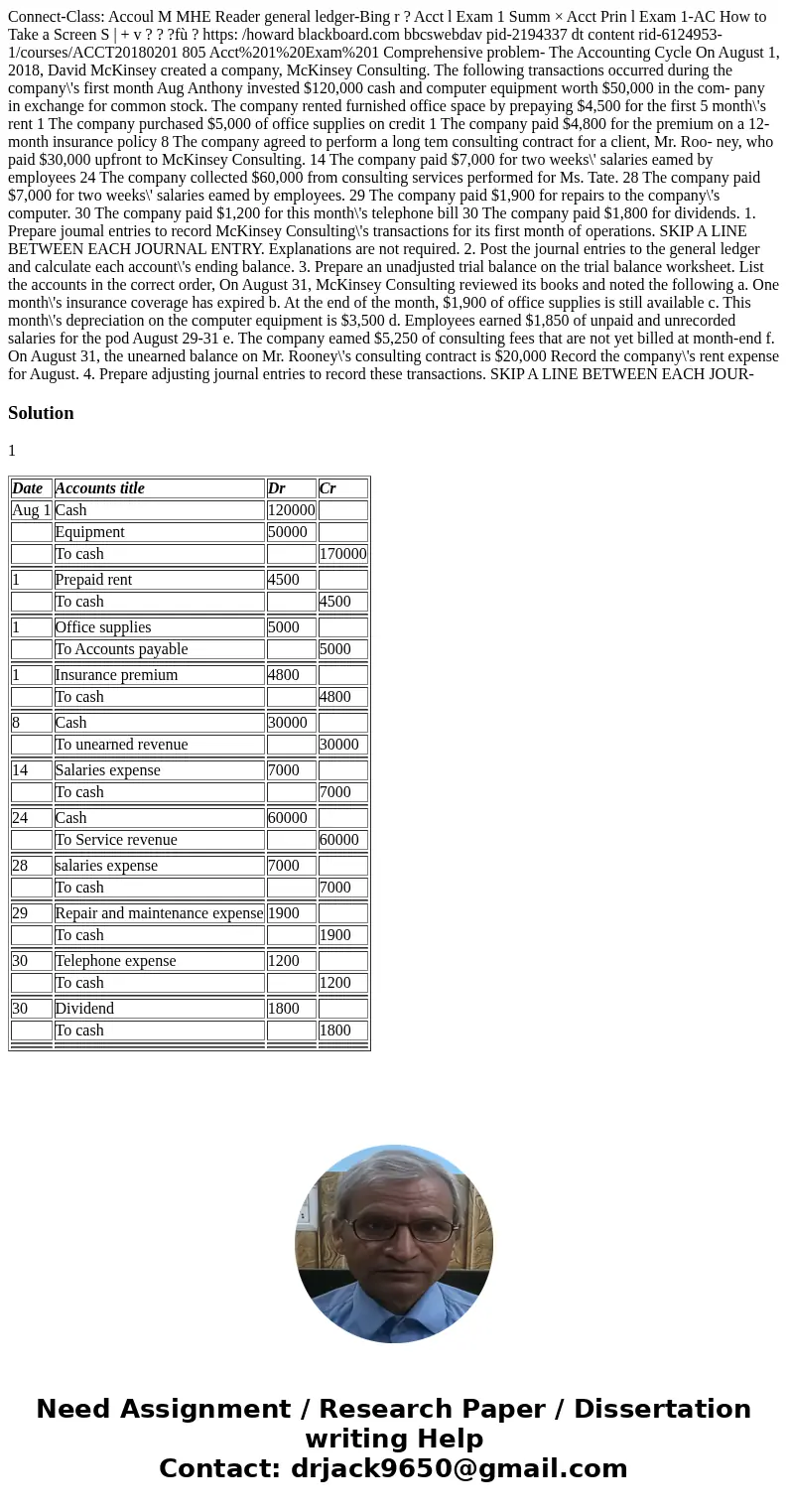

Solution

1

| Date | Accounts title | Dr | Cr |

| Aug 1 | Cash | 120000 | |

| Equipment | 50000 | ||

| To cash | 170000 | ||

| 1 | Prepaid rent | 4500 | |

| To cash | 4500 | ||

| 1 | Office supplies | 5000 | |

| To Accounts payable | 5000 | ||

| 1 | Insurance premium | 4800 | |

| To cash | 4800 | ||

| 8 | Cash | 30000 | |

| To unearned revenue | 30000 | ||

| 14 | Salaries expense | 7000 | |

| To cash | 7000 | ||

| 24 | Cash | 60000 | |

| To Service revenue | 60000 | ||

| 28 | salaries expense | 7000 | |

| To cash | 7000 | ||

| 29 | Repair and maintenance expense | 1900 | |

| To cash | 1900 | ||

| 30 | Telephone expense | 1200 | |

| To cash | 1200 | ||

| 30 | Dividend | 1800 | |

| To cash | 1800 | ||

Homework Sourse

Homework Sourse