Cheryl Wilson president of Rivers Company considers 38000 to

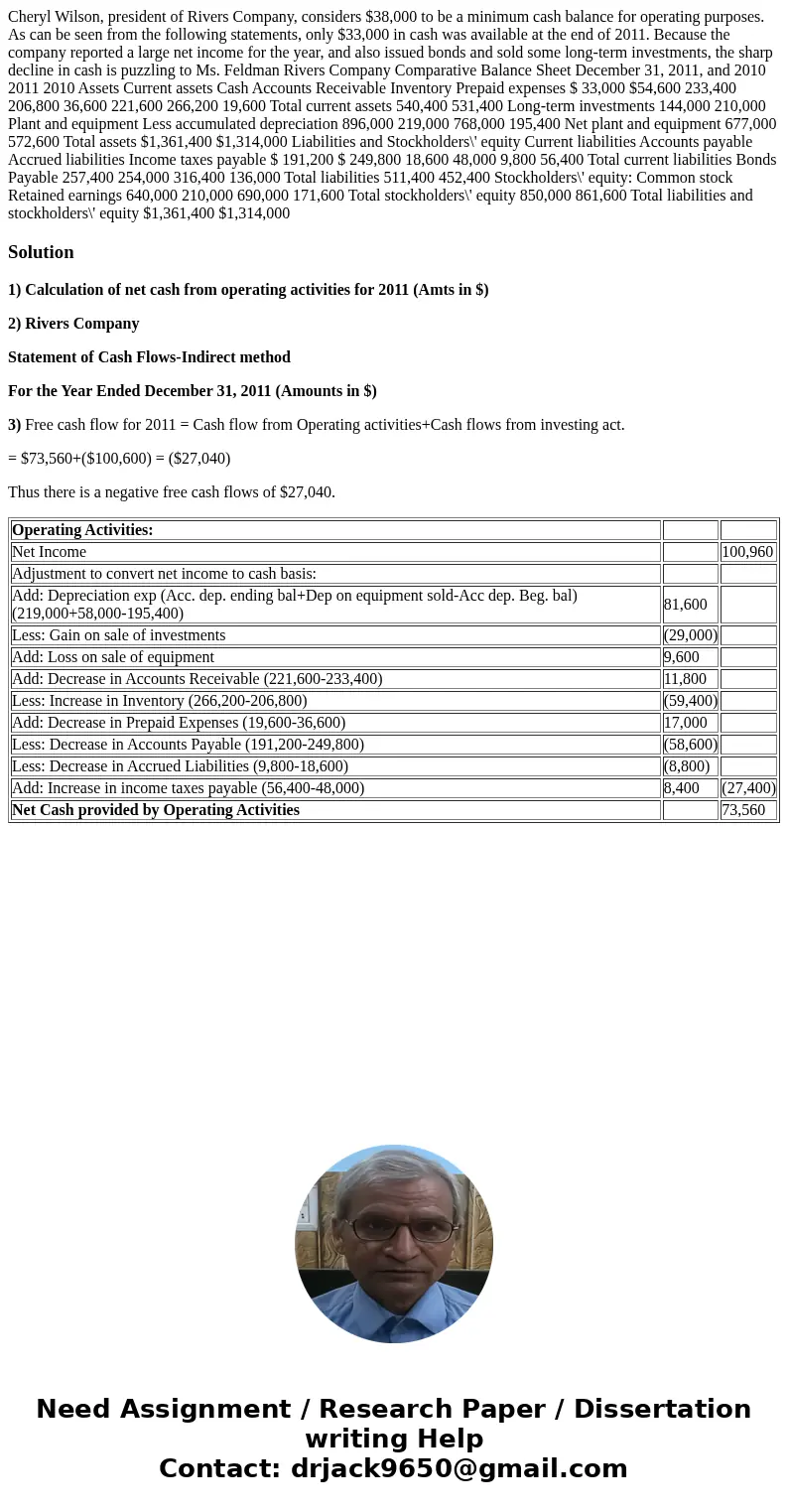

Cheryl Wilson, president of Rivers Company, considers $38,000 to be a minimum cash balance for operating purposes. As can be seen from the following statements, only $33,000 in cash was available at the end of 2011. Because the company reported a large net income for the year, and also issued bonds and sold some long-term investments, the sharp decline in cash is puzzling to Ms. Feldman Rivers Company Comparative Balance Sheet December 31, 2011, and 2010 2011 2010 Assets Current assets Cash Accounts Receivable Inventory Prepaid expenses $ 33,000 $54,600 233,400 206,800 36,600 221,600 266,200 19,600 Total current assets 540,400 531,400 Long-term investments 144,000 210,000 Plant and equipment Less accumulated depreciation 896,000 219,000 768,000 195,400 Net plant and equipment 677,000 572,600 Total assets $1,361,400 $1,314,000 Liabilities and Stockholders\' equity Current liabilities Accounts payable Accrued liabilities Income taxes payable $ 191,200 $ 249,800 18,600 48,000 9,800 56,400 Total current liabilities Bonds Payable 257,400 254,000 316,400 136,000 Total liabilities 511,400 452,400 Stockholders\' equity: Common stock Retained earnings 640,000 210,000 690,000 171,600 Total stockholders\' equity 850,000 861,600 Total liabilities and stockholders\' equity $1,361,400 $1,314,000

Solution

1) Calculation of net cash from operating activities for 2011 (Amts in $)

2) Rivers Company

Statement of Cash Flows-Indirect method

For the Year Ended December 31, 2011 (Amounts in $)

3) Free cash flow for 2011 = Cash flow from Operating activities+Cash flows from investing act.

= $73,560+($100,600) = ($27,040)

Thus there is a negative free cash flows of $27,040.

| Operating Activities: | ||

| Net Income | 100,960 | |

| Adjustment to convert net income to cash basis: | ||

| Add: Depreciation exp (Acc. dep. ending bal+Dep on equipment sold-Acc dep. Beg. bal) (219,000+58,000-195,400) | 81,600 | |

| Less: Gain on sale of investments | (29,000) | |

| Add: Loss on sale of equipment | 9,600 | |

| Add: Decrease in Accounts Receivable (221,600-233,400) | 11,800 | |

| Less: Increase in Inventory (266,200-206,800) | (59,400) | |

| Add: Decrease in Prepaid Expenses (19,600-36,600) | 17,000 | |

| Less: Decrease in Accounts Payable (191,200-249,800) | (58,600) | |

| Less: Decrease in Accrued Liabilities (9,800-18,600) | (8,800) | |

| Add: Increase in income taxes payable (56,400-48,000) | 8,400 | (27,400) |

| Net Cash provided by Operating Activities | 73,560 |

Homework Sourse

Homework Sourse