On December 31 2017 Jellison purchased 6 000 of merchandise

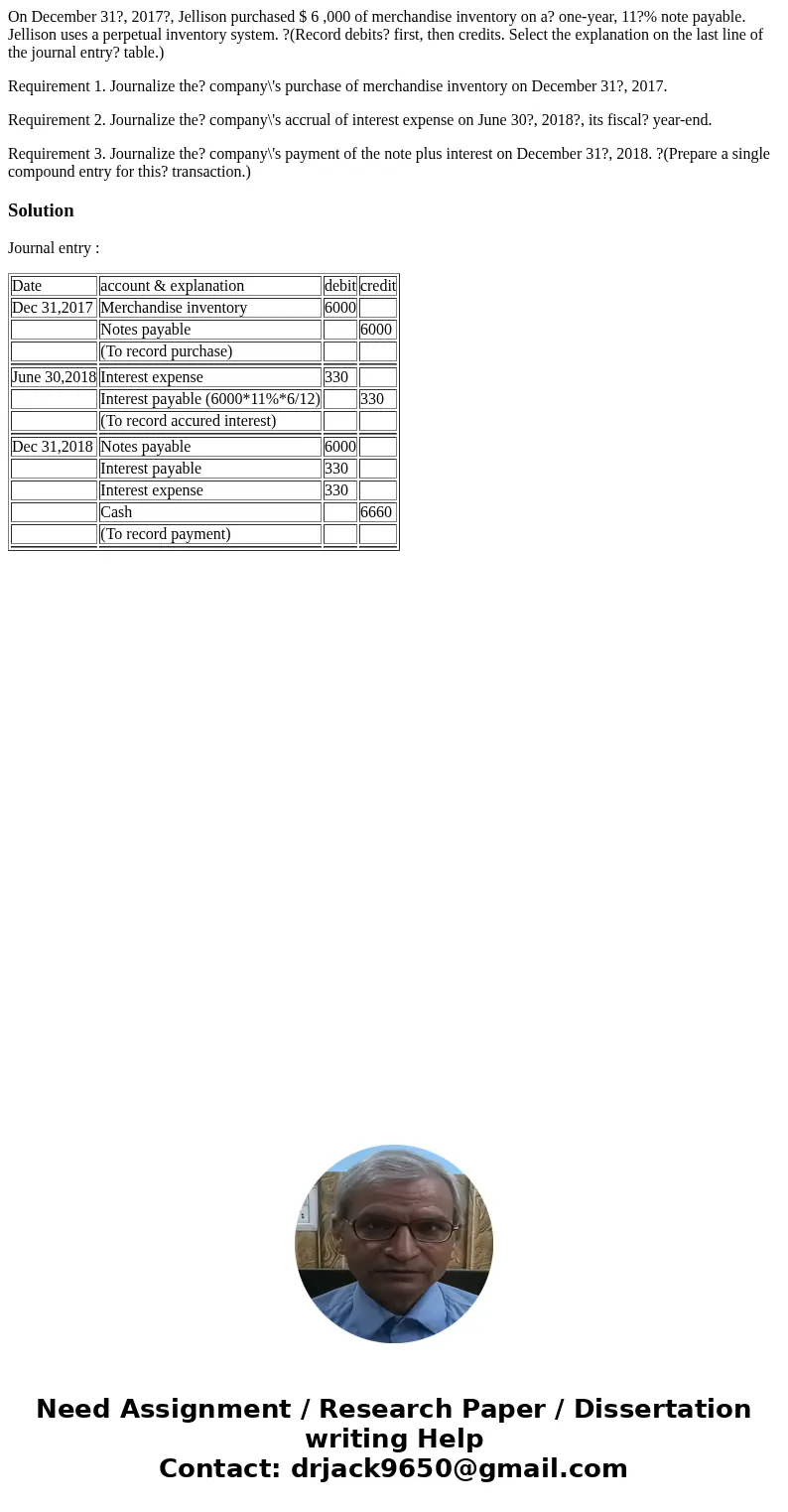

On December 31?, 2017?, Jellison purchased $ 6 ,000 of merchandise inventory on a? one-year, 11?% note payable. Jellison uses a perpetual inventory system. ?(Record debits? first, then credits. Select the explanation on the last line of the journal entry? table.)

Requirement 1. Journalize the? company\'s purchase of merchandise inventory on December 31?, 2017.

Requirement 2. Journalize the? company\'s accrual of interest expense on June 30?, 2018?, its fiscal? year-end.

Requirement 3. Journalize the? company\'s payment of the note plus interest on December 31?, 2018. ?(Prepare a single compound entry for this? transaction.)

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Dec 31,2017 | Merchandise inventory | 6000 | |

| Notes payable | 6000 | ||

| (To record purchase) | |||

| June 30,2018 | Interest expense | 330 | |

| Interest payable (6000*11%*6/12) | 330 | ||

| (To record accured interest) | |||

| Dec 31,2018 | Notes payable | 6000 | |

| Interest payable | 330 | ||

| Interest expense | 330 | ||

| Cash | 6660 | ||

| (To record payment) | |||

Homework Sourse

Homework Sourse