PR 101A Liability transactionsSolution Answer 1 Journal Entr

PR 10-1A Liability transactions

Solution

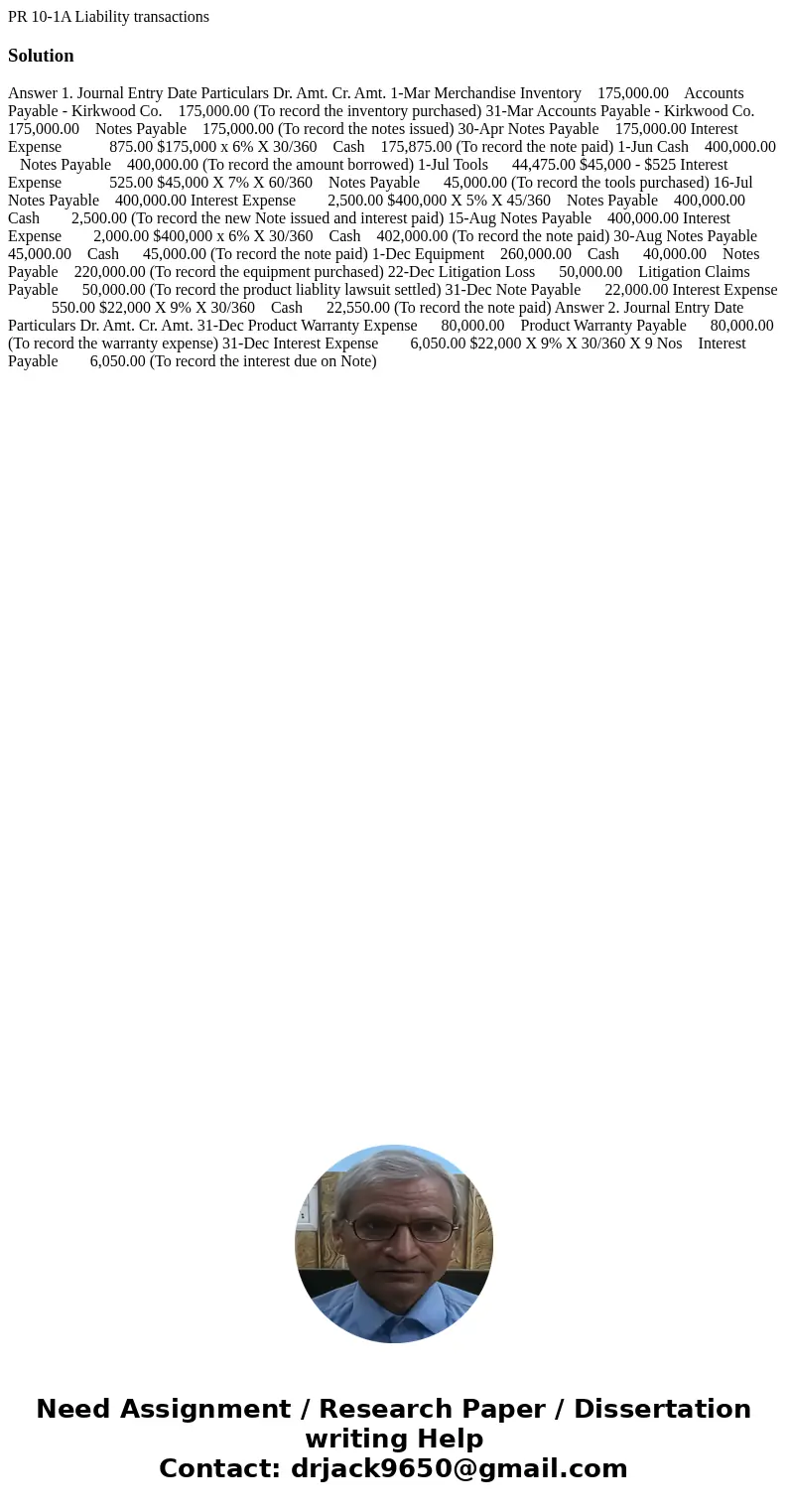

Answer 1. Journal Entry Date Particulars Dr. Amt. Cr. Amt. 1-Mar Merchandise Inventory 175,000.00 Accounts Payable - Kirkwood Co. 175,000.00 (To record the inventory purchased) 31-Mar Accounts Payable - Kirkwood Co. 175,000.00 Notes Payable 175,000.00 (To record the notes issued) 30-Apr Notes Payable 175,000.00 Interest Expense 875.00 $175,000 x 6% X 30/360 Cash 175,875.00 (To record the note paid) 1-Jun Cash 400,000.00 Notes Payable 400,000.00 (To record the amount borrowed) 1-Jul Tools 44,475.00 $45,000 - $525 Interest Expense 525.00 $45,000 X 7% X 60/360 Notes Payable 45,000.00 (To record the tools purchased) 16-Jul Notes Payable 400,000.00 Interest Expense 2,500.00 $400,000 X 5% X 45/360 Notes Payable 400,000.00 Cash 2,500.00 (To record the new Note issued and interest paid) 15-Aug Notes Payable 400,000.00 Interest Expense 2,000.00 $400,000 x 6% X 30/360 Cash 402,000.00 (To record the note paid) 30-Aug Notes Payable 45,000.00 Cash 45,000.00 (To record the note paid) 1-Dec Equipment 260,000.00 Cash 40,000.00 Notes Payable 220,000.00 (To record the equipment purchased) 22-Dec Litigation Loss 50,000.00 Litigation Claims Payable 50,000.00 (To record the product liablity lawsuit settled) 31-Dec Note Payable 22,000.00 Interest Expense 550.00 $22,000 X 9% X 30/360 Cash 22,550.00 (To record the note paid) Answer 2. Journal Entry Date Particulars Dr. Amt. Cr. Amt. 31-Dec Product Warranty Expense 80,000.00 Product Warranty Payable 80,000.00 (To record the warranty expense) 31-Dec Interest Expense 6,050.00 $22,000 X 9% X 30/360 X 9 Nos Interest Payable 6,050.00 (To record the interest due on Note)

Homework Sourse

Homework Sourse