Replace Equipment A machine with a book value of 246300 has

Solution

Answer

----Note: Figures within “( )” means negative (with minus sign) figures------

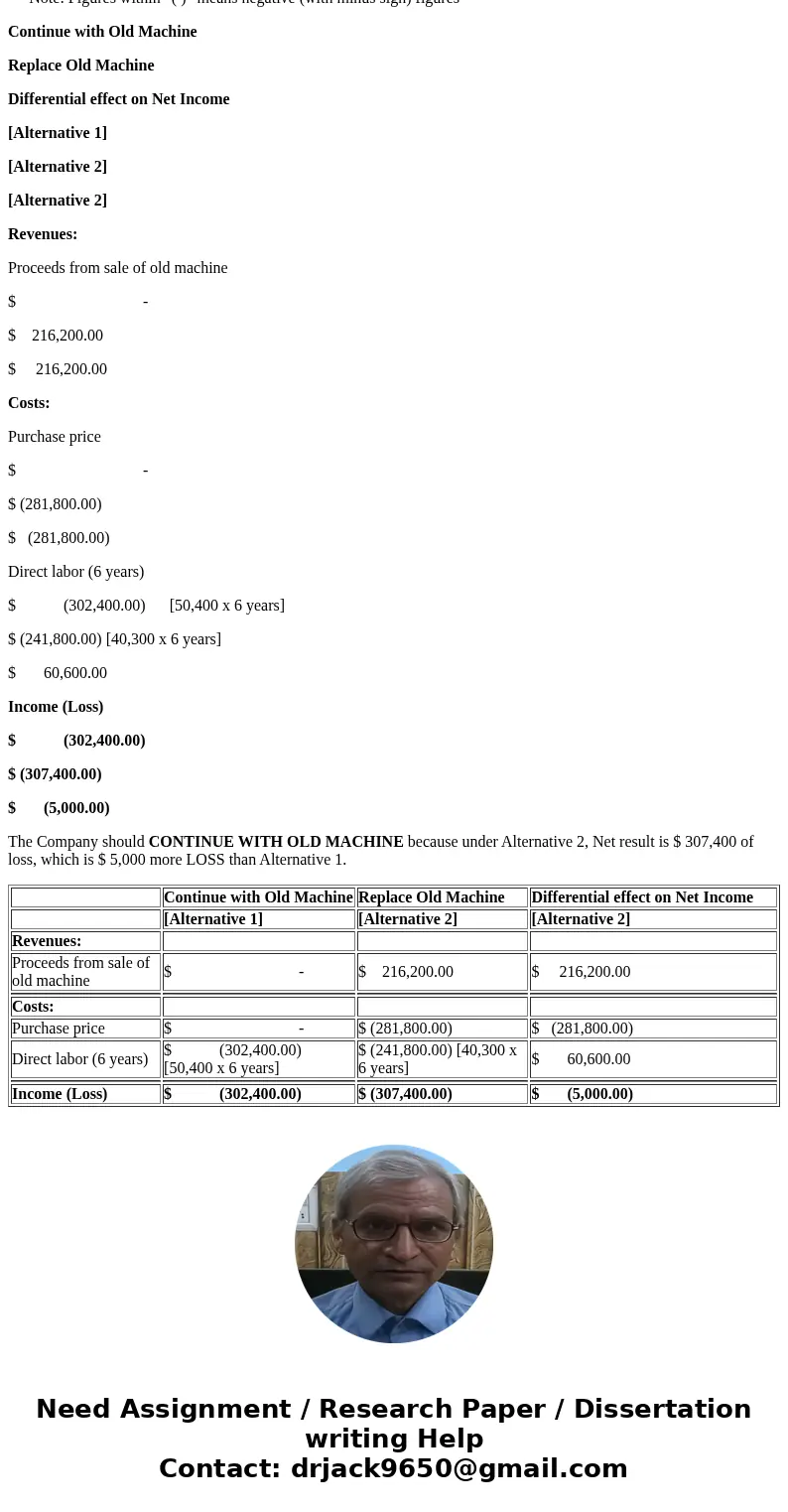

Continue with Old Machine

Replace Old Machine

Differential effect on Net Income

[Alternative 1]

[Alternative 2]

[Alternative 2]

Revenues:

Proceeds from sale of old machine

$ -

$ 216,200.00

$ 216,200.00

Costs:

Purchase price

$ -

$ (281,800.00)

$ (281,800.00)

Direct labor (6 years)

$ (302,400.00) [50,400 x 6 years]

$ (241,800.00) [40,300 x 6 years]

$ 60,600.00

Income (Loss)

$ (302,400.00)

$ (307,400.00)

$ (5,000.00)

The Company should CONTINUE WITH OLD MACHINE because under Alternative 2, Net result is $ 307,400 of loss, which is $ 5,000 more LOSS than Alternative 1.

| Continue with Old Machine | Replace Old Machine | Differential effect on Net Income | |

| [Alternative 1] | [Alternative 2] | [Alternative 2] | |

| Revenues: | |||

| Proceeds from sale of old machine | $ - | $ 216,200.00 | $ 216,200.00 |

| Costs: | |||

| Purchase price | $ - | $ (281,800.00) | $ (281,800.00) |

| Direct labor (6 years) | $ (302,400.00) [50,400 x 6 years] | $ (241,800.00) [40,300 x 6 years] | $ 60,600.00 |

| Income (Loss) | $ (302,400.00) | $ (307,400.00) | $ (5,000.00) |

Homework Sourse

Homework Sourse