Odessa Inc reports the following information concerning oper

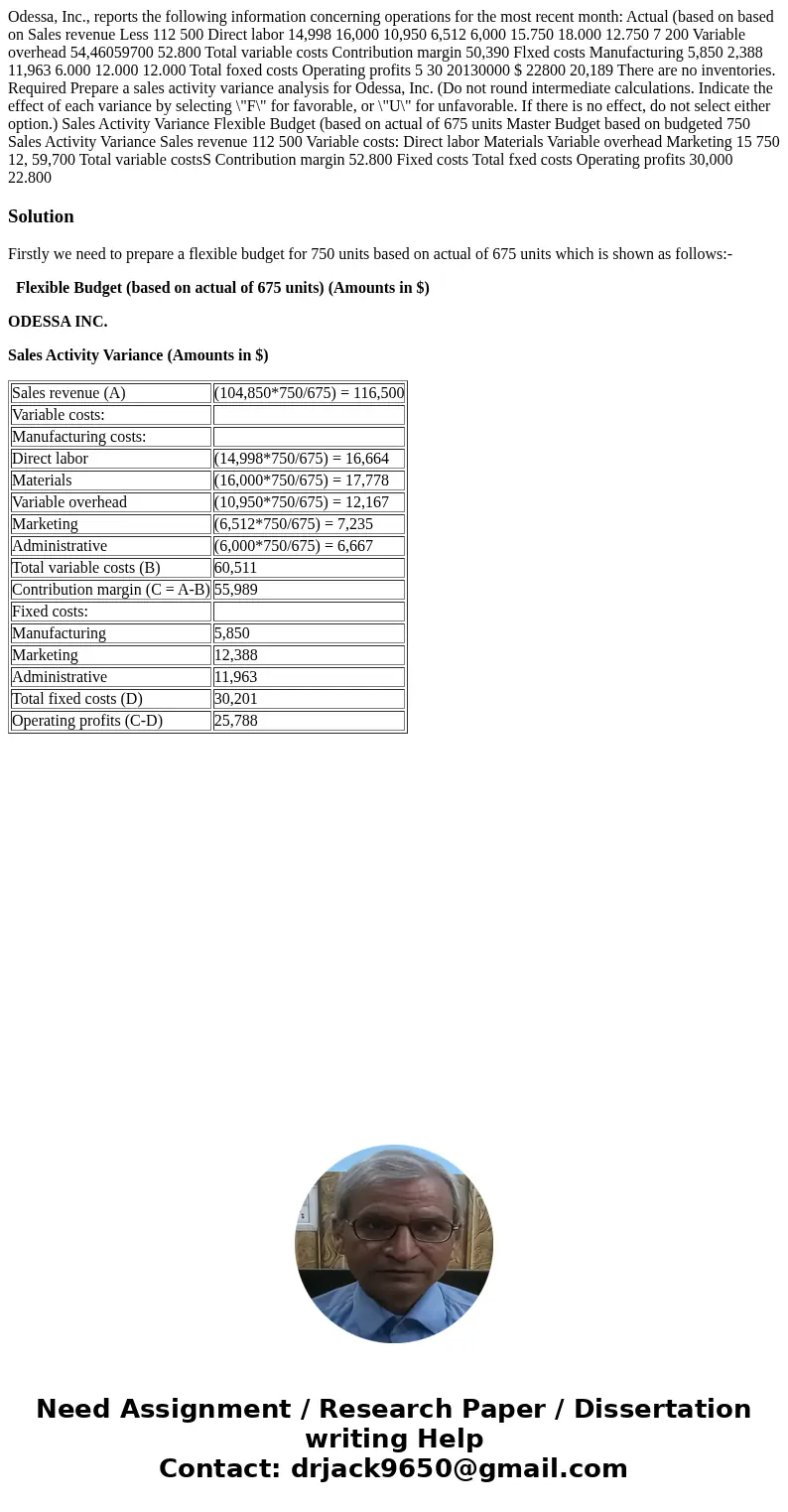

Odessa, Inc., reports the following information concerning operations for the most recent month: Actual (based on based on Sales revenue Less 112 500 Direct labor 14,998 16,000 10,950 6,512 6,000 15.750 18.000 12.750 7 200 Variable overhead 54,46059700 52.800 Total variable costs Contribution margin 50,390 Flxed costs Manufacturing 5,850 2,388 11,963 6.000 12.000 12.000 Total foxed costs Operating profits 5 30 20130000 $ 22800 20,189 There are no inventories. Required Prepare a sales activity variance analysis for Odessa, Inc. (Do not round intermediate calculations. Indicate the effect of each variance by selecting \"F\" for favorable, or \"U\" for unfavorable. If there is no effect, do not select either option.) Sales Activity Variance Flexible Budget (based on actual of 675 units Master Budget based on budgeted 750 Sales Activity Variance Sales revenue 112 500 Variable costs: Direct labor Materials Variable overhead Marketing 15 750 12, 59,700 Total variable costsS Contribution margin 52.800 Fixed costs Total fxed costs Operating profits 30,000 22.800

Solution

Firstly we need to prepare a flexible budget for 750 units based on actual of 675 units which is shown as follows:-

Flexible Budget (based on actual of 675 units) (Amounts in $)

ODESSA INC.

Sales Activity Variance (Amounts in $)

| Sales revenue (A) | (104,850*750/675) = 116,500 |

| Variable costs: | |

| Manufacturing costs: | |

| Direct labor | (14,998*750/675) = 16,664 |

| Materials | (16,000*750/675) = 17,778 |

| Variable overhead | (10,950*750/675) = 12,167 |

| Marketing | (6,512*750/675) = 7,235 |

| Administrative | (6,000*750/675) = 6,667 |

| Total variable costs (B) | 60,511 |

| Contribution margin (C = A-B) | 55,989 |

| Fixed costs: | |

| Manufacturing | 5,850 |

| Marketing | 12,388 |

| Administrative | 11,963 |

| Total fixed costs (D) | 30,201 |

| Operating profits (C-D) | 25,788 |

Homework Sourse

Homework Sourse