Atlantic Bakers makes bread flour and has supplied the follo

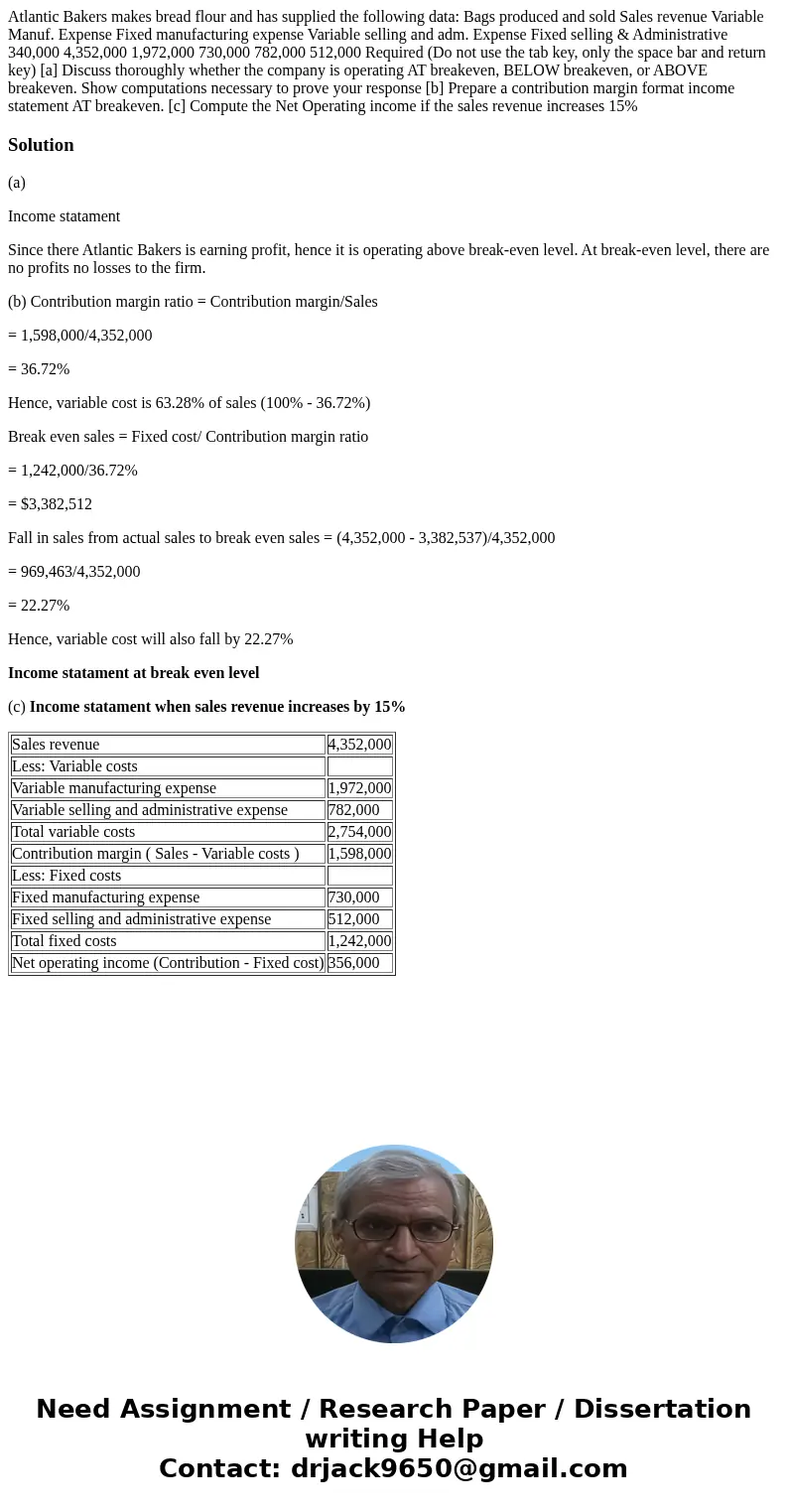

Atlantic Bakers makes bread flour and has supplied the following data: Bags produced and sold Sales revenue Variable Manuf. Expense Fixed manufacturing expense Variable selling and adm. Expense Fixed selling & Administrative 340,000 4,352,000 1,972,000 730,000 782,000 512,000 Required (Do not use the tab key, only the space bar and return key) [a] Discuss thoroughly whether the company is operating AT breakeven, BELOW breakeven, or ABOVE breakeven. Show computations necessary to prove your response [b] Prepare a contribution margin format income statement AT breakeven. [c] Compute the Net Operating income if the sales revenue increases 15%

Solution

(a)

Income statament

Since there Atlantic Bakers is earning profit, hence it is operating above break-even level. At break-even level, there are no profits no losses to the firm.

(b) Contribution margin ratio = Contribution margin/Sales

= 1,598,000/4,352,000

= 36.72%

Hence, variable cost is 63.28% of sales (100% - 36.72%)

Break even sales = Fixed cost/ Contribution margin ratio

= 1,242,000/36.72%

= $3,382,512

Fall in sales from actual sales to break even sales = (4,352,000 - 3,382,537)/4,352,000

= 969,463/4,352,000

= 22.27%

Hence, variable cost will also fall by 22.27%

Income statament at break even level

(c) Income statament when sales revenue increases by 15%

| Sales revenue | 4,352,000 |

| Less: Variable costs | |

| Variable manufacturing expense | 1,972,000 |

| Variable selling and administrative expense | 782,000 |

| Total variable costs | 2,754,000 |

| Contribution margin ( Sales - Variable costs ) | 1,598,000 |

| Less: Fixed costs | |

| Fixed manufacturing expense | 730,000 |

| Fixed selling and administrative expense | 512,000 |

| Total fixed costs | 1,242,000 |

| Net operating income (Contribution - Fixed cost) | 356,000 |

Homework Sourse

Homework Sourse