Cost of goods sold cost of goods sold Gross margin 52eeee So

Cost of goods sold cost of goods sold Gross margin 52e,eee

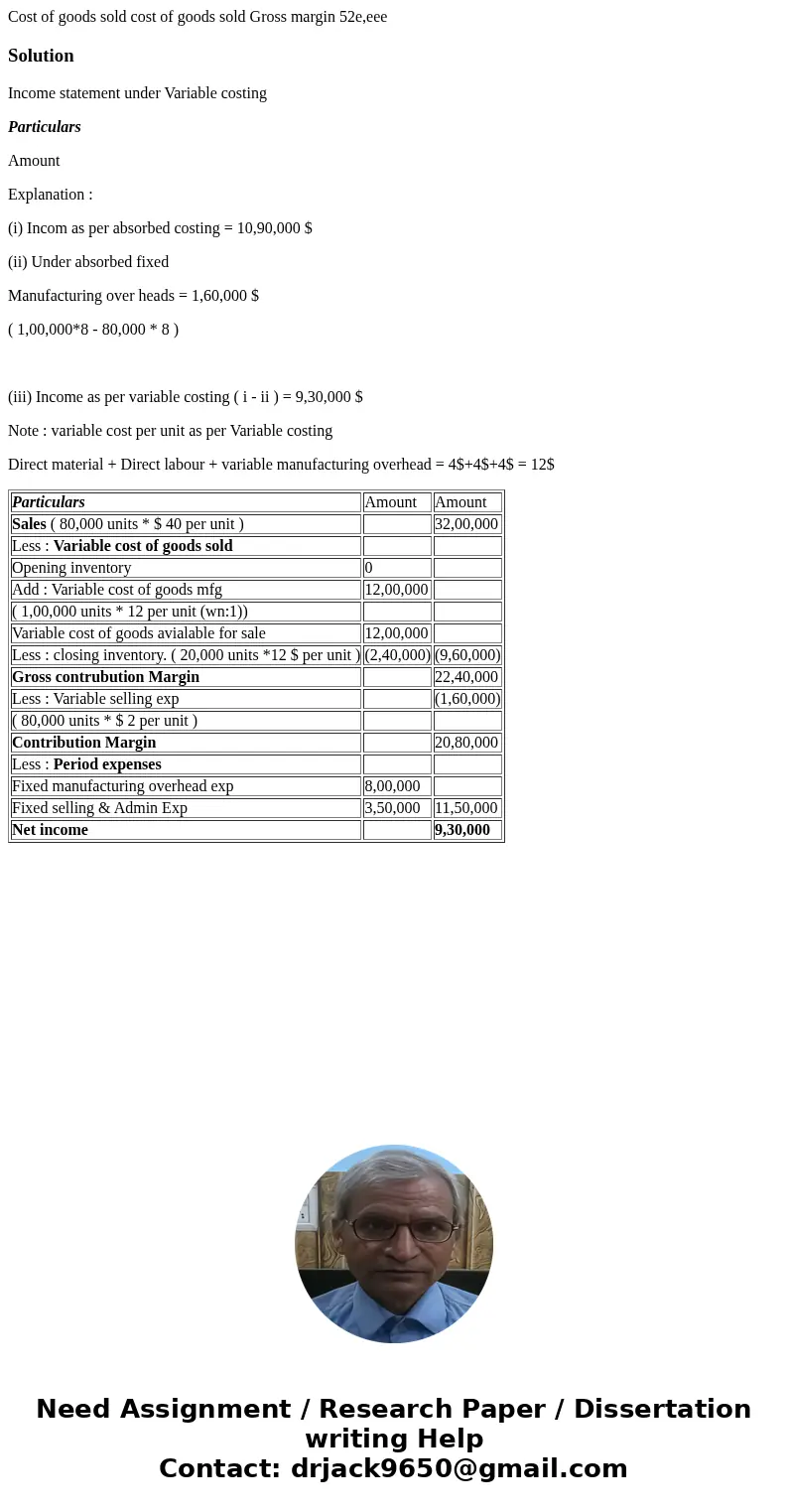

Solution

Income statement under Variable costing

Particulars

Amount

Explanation :

(i) Incom as per absorbed costing = 10,90,000 $

(ii) Under absorbed fixed

Manufacturing over heads = 1,60,000 $

( 1,00,000*8 - 80,000 * 8 )

(iii) Income as per variable costing ( i - ii ) = 9,30,000 $

Note : variable cost per unit as per Variable costing

Direct material + Direct labour + variable manufacturing overhead = 4$+4$+4$ = 12$

| Particulars | Amount | Amount |

| Sales ( 80,000 units * $ 40 per unit ) | 32,00,000 | |

| Less : Variable cost of goods sold | ||

| Opening inventory | 0 | |

| Add : Variable cost of goods mfg | 12,00,000 | |

| ( 1,00,000 units * 12 per unit (wn:1)) | ||

| Variable cost of goods avialable for sale | 12,00,000 | |

| Less : closing inventory. ( 20,000 units *12 $ per unit ) | (2,40,000) | (9,60,000) |

| Gross contrubution Margin | 22,40,000 | |

| Less : Variable selling exp | (1,60,000) | |

| ( 80,000 units * $ 2 per unit ) | ||

| Contribution Margin | 20,80,000 | |

| Less : Period expenses | ||

| Fixed manufacturing overhead exp | 8,00,000 | |

| Fixed selling & Admin Exp | 3,50,000 | 11,50,000 |

| Net income | 9,30,000 |

Homework Sourse

Homework Sourse