Part 1 Suppose a project under consideration has the followi

Part 1: Suppose a project under consideration has the following stream of benefits and costs.

Year

0

1

2

3

4

5

Costs

$10,000

$6,000

$2,000

Benefits

$2,000

$4,000

$6,000

$8,000

$10,000

(a)Find the net present value of the project assuming a discount rate of 5%. Is the project worthwhile?

(b)Redo (a) assuming the discount rate is 10%. Would you recommend the project go forward?

(c)Suppose you have discovered that the benefits of the project have been overestimated and a more accurate assessment suggests that the benefit in each year is half of the original estimate. Assuming a discount rate of 5%, would you recommend the project go forward in this case? Briefly explain your answer.

Part 2: The government is contemplating a project that protects a wilderness area. The project is expected to produce annual net benefits of $100,000 into perpetuity. Assuming a discount rate of 8%, what is the net present value associated with this project?

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Costs | $10,000 | $6,000 | $2,000 | |||

| Benefits | $2,000 | $4,000 | $6,000 | $8,000 | $10,000 |

Solution

Net present value (NPV) is the difference of present value of net benefits and the initial (year 0) cost.

Net benefit (NB) = Benefit – Cost

A project could be accepted, if it has positive NPV.

a.

NPV at 5% discount rate

Year

NB

5% discount factor = 1/(1 + 0.05)^n

NB × factor

0

0 – 10,000 = -10,000

1

-10,000

1

2,000

0.9524

1,904.80

2

4,000

0.9070

3,628.00

3

6,000 – 6,000 = 0

0.8638

0

4

8,000

0.8227

6,581.60

5

10,000 – 2,000 = 8,000

0.7835

6,268.00

NPV

8,382.40

Answer: NPV is $8,382.40.

Answer: The project is worthwhile, since it has positive NPV.

b.

NPV at 10% discount rate

Year

NB

5% discount factor = 1/(1 + 0.05)^n

NB × factor

0

0 – 10,000 = -10,000

1

-10,000

1

2,000

0.9091

1,818.20

2

4,000

0.8264

3,305.60

3

6,000 – 6,000 = 0

0.7513

0

4

8,000

0.6830

5,464.00

5

10,000 – 2,000 = 8,000

0.6209

4,967.20

NPV

5,555

Answer: NPV is $5,555.

Answer: The project is recommended, since it has positive NPV.

c.

If the benefit becomes ½, net benefits in each year would be as below:

Year

Benefits, B

Costs, C

Net benefits [B – C]

0

0

10,000

-10,000

1

1,000

0

1,000

2

2,000

0

2,000

3

3,000

6,000

-3,000

4

4,000

0

4,000

5

5,000

2,000

3,000

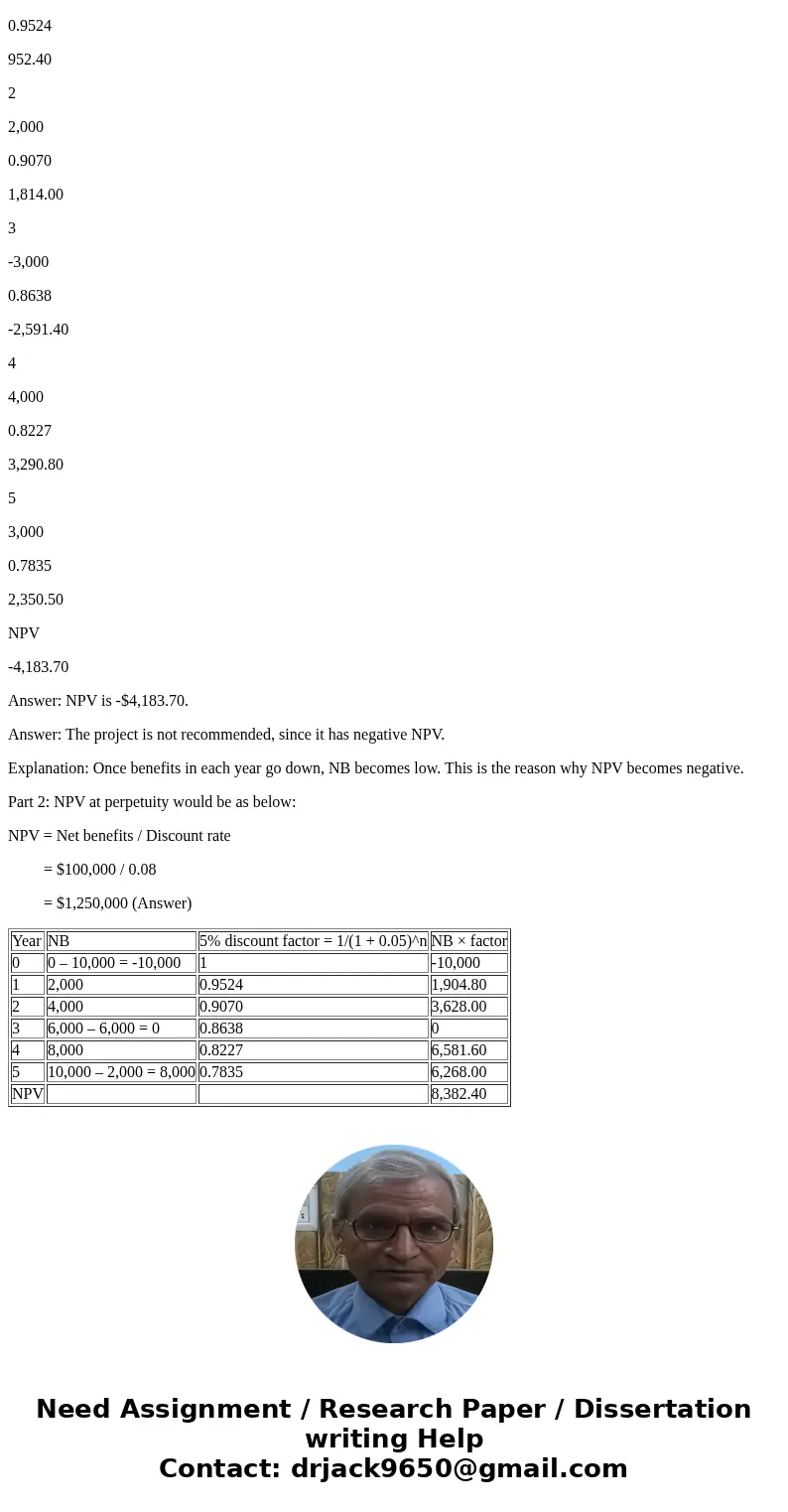

NPV at 5% discount rate

Year

NB

5% discount factor = 1/(1 + 0.05)^n

NB × factor

0

-10,000

1

-10,000

1

1,000

0.9524

952.40

2

2,000

0.9070

1,814.00

3

-3,000

0.8638

-2,591.40

4

4,000

0.8227

3,290.80

5

3,000

0.7835

2,350.50

NPV

-4,183.70

Answer: NPV is -$4,183.70.

Answer: The project is not recommended, since it has negative NPV.

Explanation: Once benefits in each year go down, NB becomes low. This is the reason why NPV becomes negative.

Part 2: NPV at perpetuity would be as below:

NPV = Net benefits / Discount rate

= $100,000 / 0.08

= $1,250,000 (Answer)

| Year | NB | 5% discount factor = 1/(1 + 0.05)^n | NB × factor |

| 0 | 0 – 10,000 = -10,000 | 1 | -10,000 |

| 1 | 2,000 | 0.9524 | 1,904.80 |

| 2 | 4,000 | 0.9070 | 3,628.00 |

| 3 | 6,000 – 6,000 = 0 | 0.8638 | 0 |

| 4 | 8,000 | 0.8227 | 6,581.60 |

| 5 | 10,000 – 2,000 = 8,000 | 0.7835 | 6,268.00 |

| NPV | 8,382.40 |

Homework Sourse

Homework Sourse