need help with the wrong answers Check my work mode This sh

need help with the wrong answers

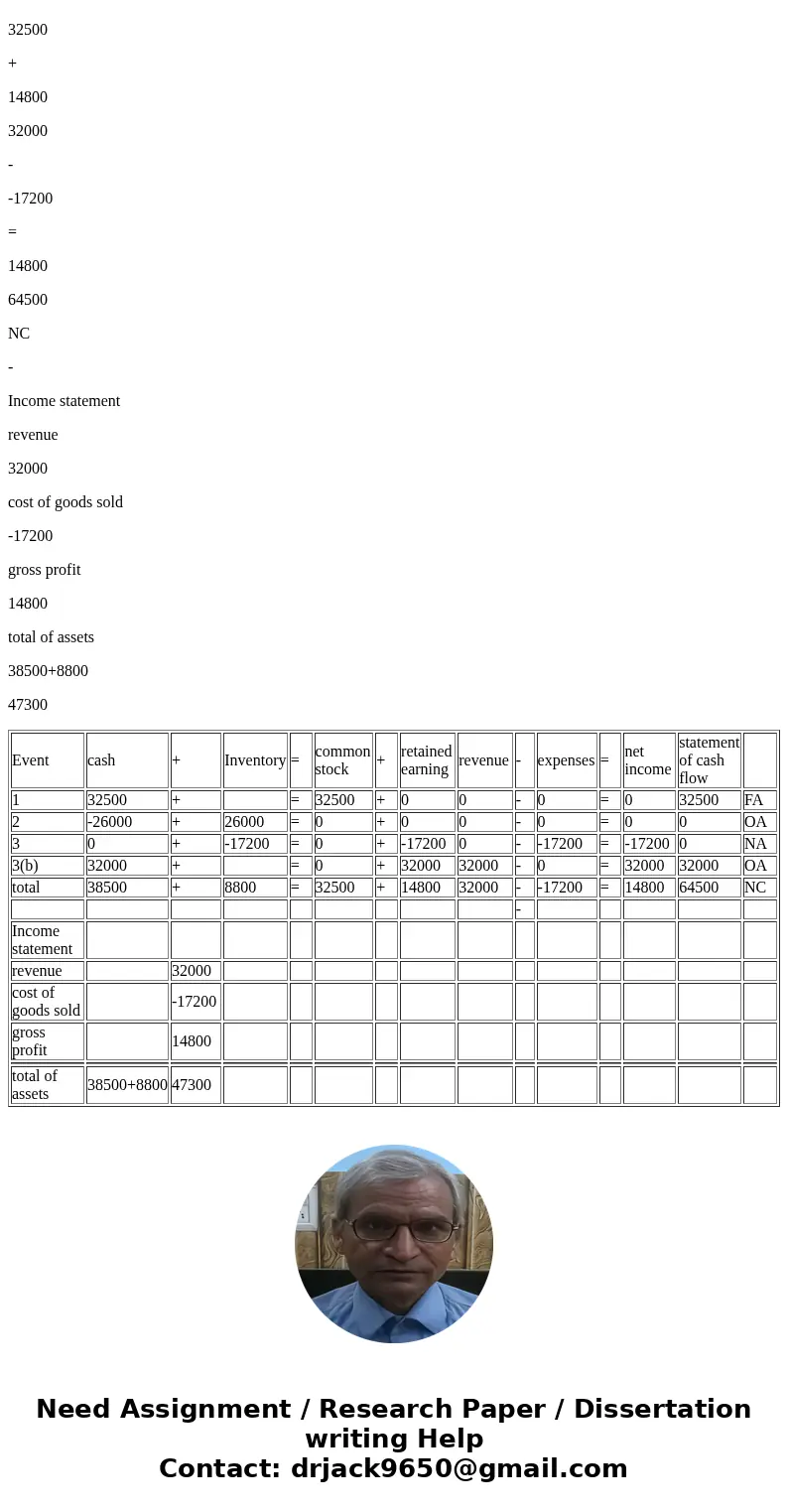

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate com pleti 2 Exercise 3-3 Effect of inventory transactions on financial statements: Perpetual system LO 3-1 Dan Watson started a small merchandising business in 2018. The business experienced the following events during its first year of operation. Assume that Watson uses the perpetual inventory system points 1. Acquired $32,500 cash from the issue of common stock 2. Purchased inventory for $26,000 cash 3. Sold inventory costing $17.200 for $32,000 cash Required a. Record the events in a horizontal statement model. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity. NC for net change in cash and NA to indicate the element is not affected by the event. b. Prepare an income statement for 2018 (use the multistep format). c. What is the amount of total assets at the end of the period? 3 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Record the events in a horizontal statement model. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, NC for net change in cash and NA to indicate the element is not affected by the event. (Enter any decreases to account balances and cash outflows with DAN WATSON MERCHANDISING Effect of Events on Financial StatementSolution

Event

cash

+

Inventory

=

common stock

+

retained earning

revenue

-

expenses

=

net income

statement of cash flow

1

32500

+

=

32500

+

0

0

-

0

=

0

32500

FA

2

-26000

+

26000

=

0

+

0

0

-

0

=

0

0

OA

3

0

+

-17200

=

0

+

-17200

0

-

-17200

=

-17200

0

NA

3(b)

32000

+

=

0

+

32000

32000

-

0

=

32000

32000

OA

total

38500

+

8800

=

32500

+

14800

32000

-

-17200

=

14800

64500

NC

-

Income statement

revenue

32000

cost of goods sold

-17200

gross profit

14800

total of assets

38500+8800

47300

| Event | cash | + | Inventory | = | common stock | + | retained earning | revenue | - | expenses | = | net income | statement of cash flow | |

| 1 | 32500 | + | = | 32500 | + | 0 | 0 | - | 0 | = | 0 | 32500 | FA | |

| 2 | -26000 | + | 26000 | = | 0 | + | 0 | 0 | - | 0 | = | 0 | 0 | OA |

| 3 | 0 | + | -17200 | = | 0 | + | -17200 | 0 | - | -17200 | = | -17200 | 0 | NA |

| 3(b) | 32000 | + | = | 0 | + | 32000 | 32000 | - | 0 | = | 32000 | 32000 | OA | |

| total | 38500 | + | 8800 | = | 32500 | + | 14800 | 32000 | - | -17200 | = | 14800 | 64500 | NC |

| - | ||||||||||||||

| Income statement | ||||||||||||||

| revenue | 32000 | |||||||||||||

| cost of goods sold | -17200 | |||||||||||||

| gross profit | 14800 | |||||||||||||

| total of assets | 38500+8800 | 47300 |

Homework Sourse

Homework Sourse