Exercise 55 Presented below are transactions related to Bogn

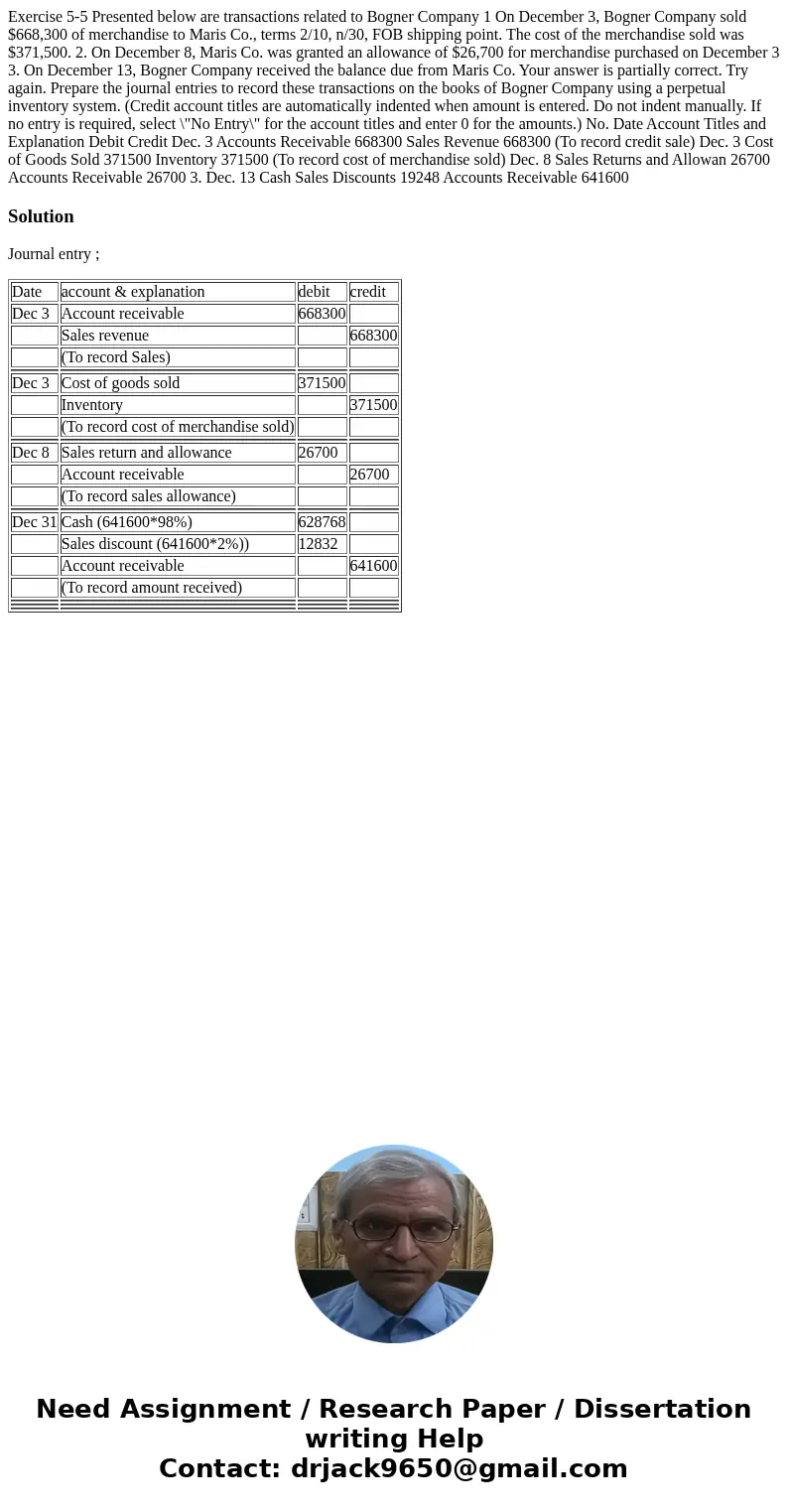

Exercise 5-5 Presented below are transactions related to Bogner Company 1 On December 3, Bogner Company sold $668,300 of merchandise to Maris Co., terms 2/10, n/30, FOB shipping point. The cost of the merchandise sold was $371,500. 2. On December 8, Maris Co. was granted an allowance of $26,700 for merchandise purchased on December 3 3. On December 13, Bogner Company received the balance due from Maris Co. Your answer is partially correct. Try again. Prepare the journal entries to record these transactions on the books of Bogner Company using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit Dec. 3 Accounts Receivable 668300 Sales Revenue 668300 (To record credit sale) Dec. 3 Cost of Goods Sold 371500 Inventory 371500 (To record cost of merchandise sold) Dec. 8 Sales Returns and Allowan 26700 Accounts Receivable 26700 3. Dec. 13 Cash Sales Discounts 19248 Accounts Receivable 641600

Solution

Journal entry ;

| Date | account & explanation | debit | credit |

| Dec 3 | Account receivable | 668300 | |

| Sales revenue | 668300 | ||

| (To record Sales) | |||

| Dec 3 | Cost of goods sold | 371500 | |

| Inventory | 371500 | ||

| (To record cost of merchandise sold) | |||

| Dec 8 | Sales return and allowance | 26700 | |

| Account receivable | 26700 | ||

| (To record sales allowance) | |||

| Dec 31 | Cash (641600*98%) | 628768 | |

| Sales discount (641600*2%)) | 12832 | ||

| Account receivable | 641600 | ||

| (To record amount received) | |||

Homework Sourse

Homework Sourse