Pathp Words 0 QUESTION 15 Stapplees Company manufactures thr

Solution

a)

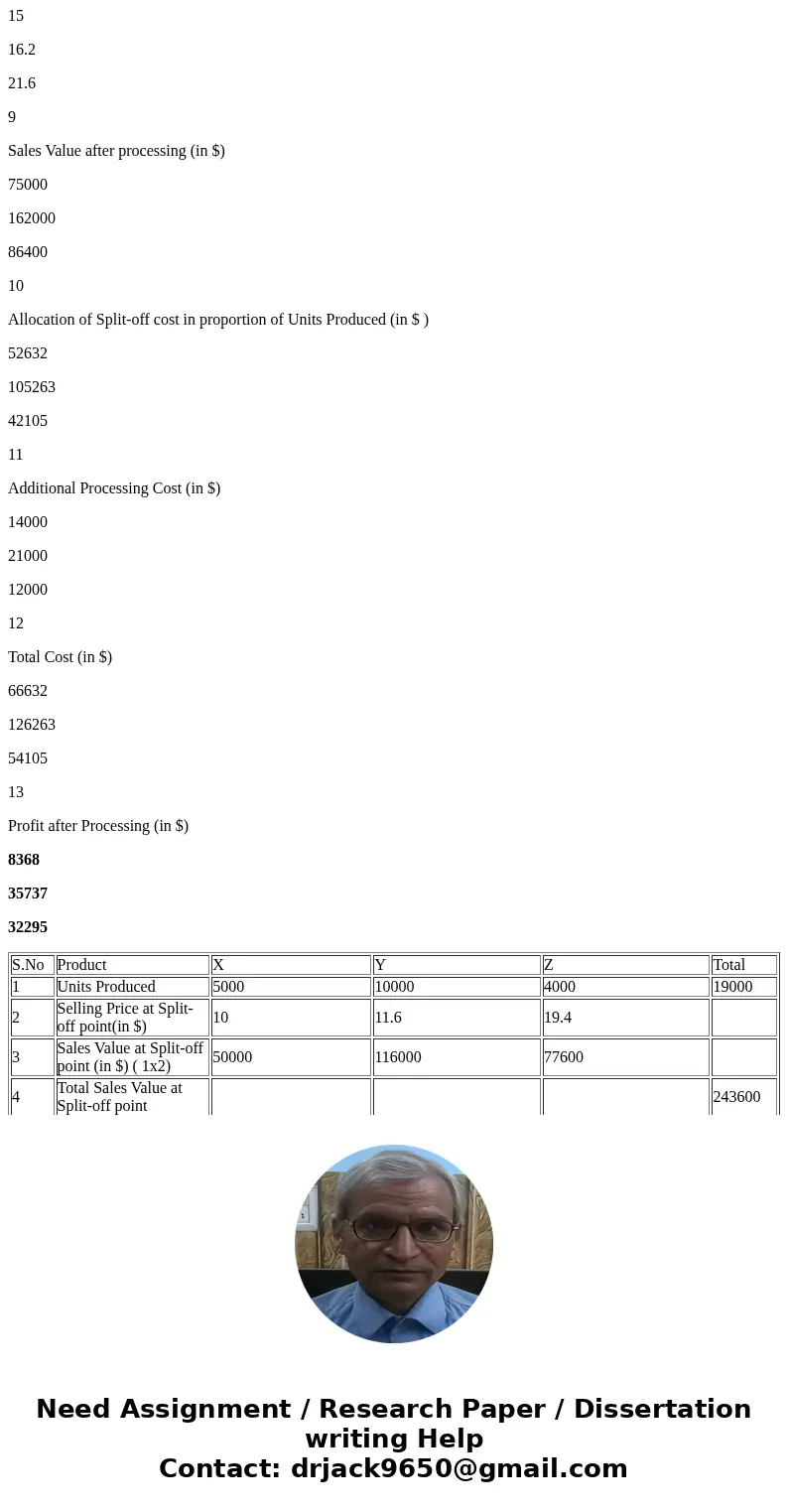

S.No

Product

X

Y

Z

Total

1

Units Produced

5000

10000

4000

19000

2

Selling Price at Split-off point(in $)

10

11.6

19.4

3

Sales Value at Split-off point (in $) ( 1x2)

50000

116000

77600

4

Total Sales Value at Split-off point

243600

5

Cost incurred up to Split-off Point

200000

6

Allocation of Split-off cost in proportion of Sales value at Split-off point (in $ )

41051

(200000*50000/243600)

95238

(200000*116000/243600)

63711

(200000*116000/243600)

7

Profit at Split-off point (3-6)

8949

20762

13889

43600

8

Selling Price after processing (in $)

15

16.2

21.6

9

Sales Value after processing (in $) (1x8)

75000

162000

86400

10

Allocation of Split-off cost in proportion of Sales value at Split-off point (in $)

41051

95238

63711

11

Additional Processing Cost (in $)

14000

21000

12000

12

Total Cost (in $) (10+11)

55051

116238

75711

13

Profit after Processing (9-12)

19949

45762

10689

14 Incremental

Profit on further 11000 25000 -3200

Processing (13-7)

It has seen from above table that for Product X & Product Y there is more profit by selling after further Processing than selling at Split-off, therefore should be processed further

In case of product Z there has been loss on further processing while there have been profit by selling at split-off , therefore should be selled at split-off.

b) Please find below

When allocation of cost is made on basis of quantity produced , Product X and Product Y should be further processed and Product Z should be sold at Split-off point.

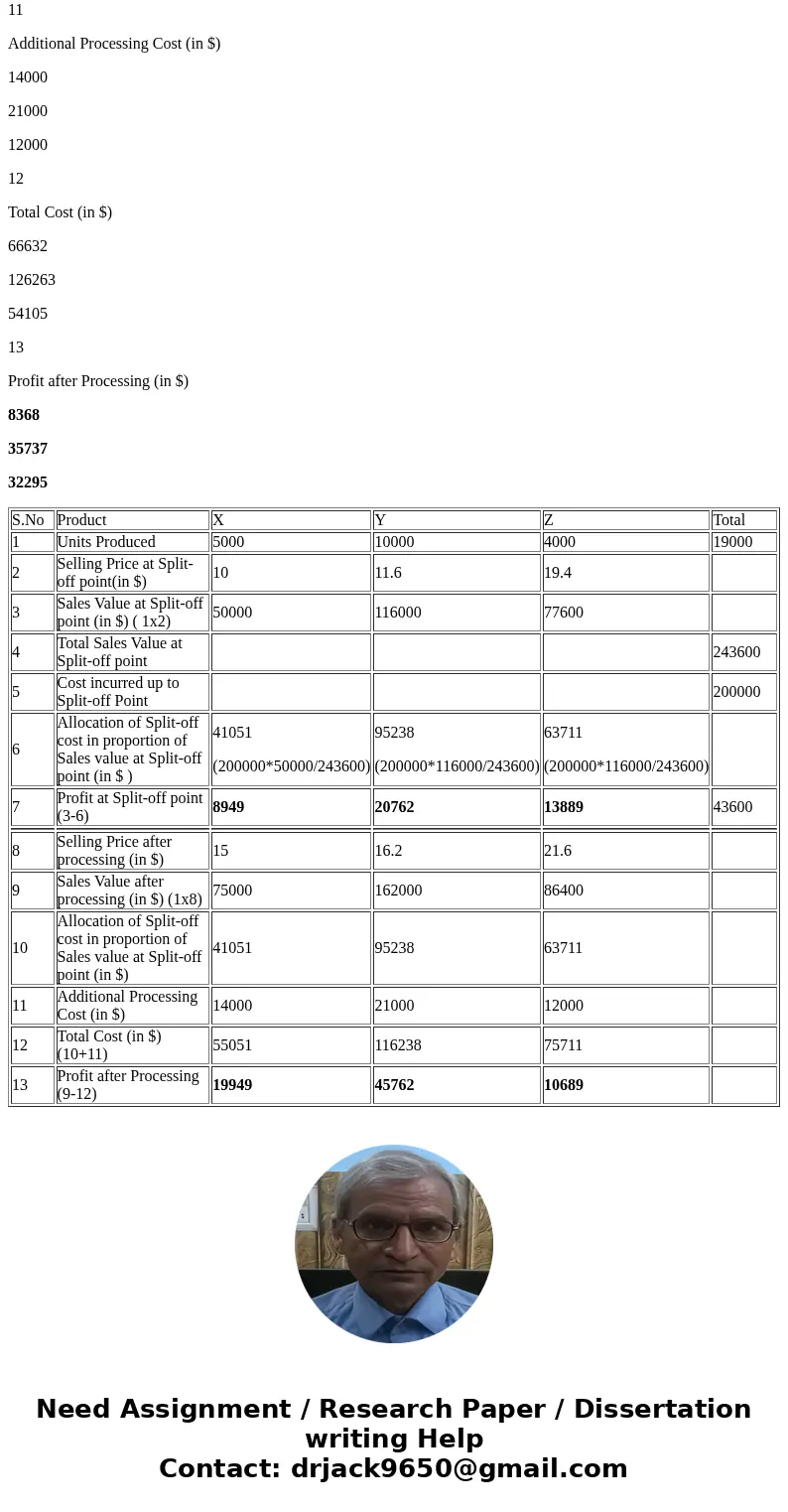

S.No

Product

X

Y

Z

Total

1

Units Produced

5000

10000

4000

19000

2

Selling Price at Split-off point(in $)

10

11.6

19.4

3

Sales Value at Split-off point (in $) ( 1x2)

50000

116000

77600

4

Total Sales Value at Split-off point (in $)

243600

5

Cost incurred up to Split-off Point(in $)

200000

6

Allocation of Split-off cost in proportion of Units Produced (in $ )

52632

(200000*5000/19000)

105263

(200000*10000/19000)

42105

(200000*4000/1900)

7

Profit at Split-off point(in $)

-2632

10737

35495

43600

8

Selling Price after processing (in $)

15

16.2

21.6

9

Sales Value after processing (in $)

75000

162000

86400

10

Allocation of Split-off cost in proportion of Units Produced (in $ )

52632

105263

42105

11

Additional Processing Cost (in $)

14000

21000

12000

12

Total Cost (in $)

66632

126263

54105

13

Profit after Processing (in $)

8368

35737

32295

| S.No | Product | X | Y | Z | Total |

| 1 | Units Produced | 5000 | 10000 | 4000 | 19000 |

| 2 | Selling Price at Split-off point(in $) | 10 | 11.6 | 19.4 | |

| 3 | Sales Value at Split-off point (in $) ( 1x2) | 50000 | 116000 | 77600 | |

| 4 | Total Sales Value at Split-off point | 243600 | |||

| 5 | Cost incurred up to Split-off Point | 200000 | |||

| 6 | Allocation of Split-off cost in proportion of Sales value at Split-off point (in $ ) | 41051 (200000*50000/243600) | 95238 (200000*116000/243600) | 63711 (200000*116000/243600) | |

| 7 | Profit at Split-off point (3-6) | 8949 | 20762 | 13889 | 43600 |

| 8 | Selling Price after processing (in $) | 15 | 16.2 | 21.6 | |

| 9 | Sales Value after processing (in $) (1x8) | 75000 | 162000 | 86400 | |

| 10 | Allocation of Split-off cost in proportion of Sales value at Split-off point (in $) | 41051 | 95238 | 63711 | |

| 11 | Additional Processing Cost (in $) | 14000 | 21000 | 12000 | |

| 12 | Total Cost (in $) (10+11) | 55051 | 116238 | 75711 | |

| 13 | Profit after Processing (9-12) | 19949 | 45762 | 10689 |

Homework Sourse

Homework Sourse