On January 1 2018 AdamsMeneke Corporation granted 24 million

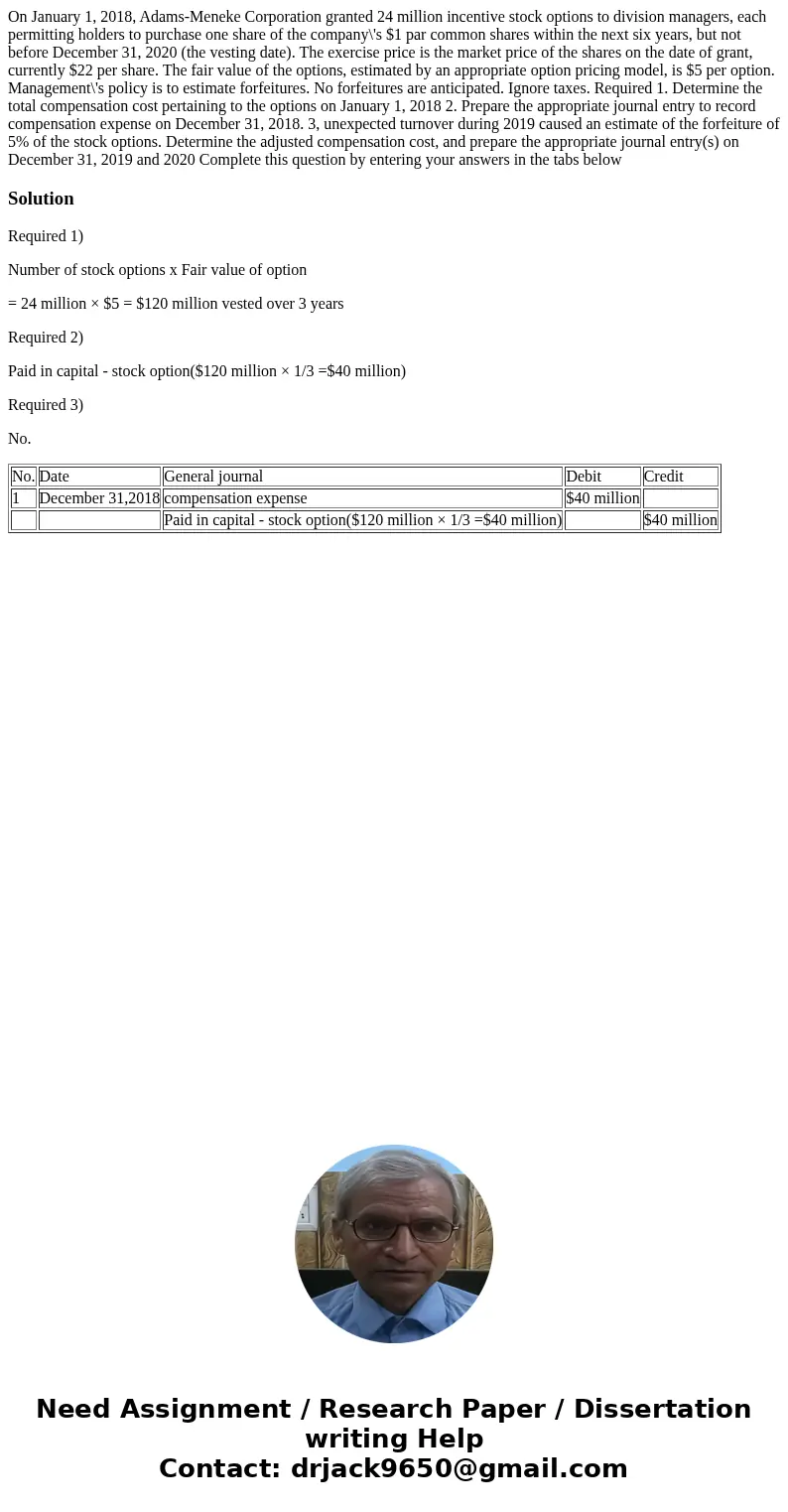

On January 1, 2018, Adams-Meneke Corporation granted 24 million incentive stock options to division managers, each permitting holders to purchase one share of the company\'s $1 par common shares within the next six years, but not before December 31, 2020 (the vesting date). The exercise price is the market price of the shares on the date of grant, currently $22 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Management\'s policy is to estimate forfeitures. No forfeitures are anticipated. Ignore taxes. Required 1. Determine the total compensation cost pertaining to the options on January 1, 2018 2. Prepare the appropriate journal entry to record compensation expense on December 31, 2018. 3, unexpected turnover during 2019 caused an estimate of the forfeiture of 5% of the stock options. Determine the adjusted compensation cost, and prepare the appropriate journal entry(s) on December 31, 2019 and 2020 Complete this question by entering your answers in the tabs below

Solution

Required 1)

Number of stock options x Fair value of option

= 24 million × $5 = $120 million vested over 3 years

Required 2)

Paid in capital - stock option($120 million × 1/3 =$40 million)

Required 3)

No.

| No. | Date | General journal | Debit | Credit |

| 1 | December 31,2018 | compensation expense | $40 million | |

| Paid in capital - stock option($120 million × 1/3 =$40 million) | $40 million |

Homework Sourse

Homework Sourse