Brett placed in service a new 1400000 sevenyear class asset

Brett placed in service a new $1,400,000 seven-year class asset on August 2, 2017. On December 2, 2017, he placed in service $800,000 of used five-year class assets. Brett can\'t decide whether to use 179 on the 5-year property or the 7-year property. If Brett elects 179 and takes additional first-year depreciation on each eligible asset, what is the maximum cost recovery deduction under each of his two alternatives for these purchases in 2017?

Solution

Section 179 seta a maximum deduction limit of $500,000 for the tax year 2017. To avail the benefits of 179 the equipment must be purchased and put to service by 31/12/2017.

Another limit for the cost of equipment which can be putpfor 179 deduction in 2017 is $2,000,000. Hence both the assets of Brett cannot be claimed together for deduction in the same year.

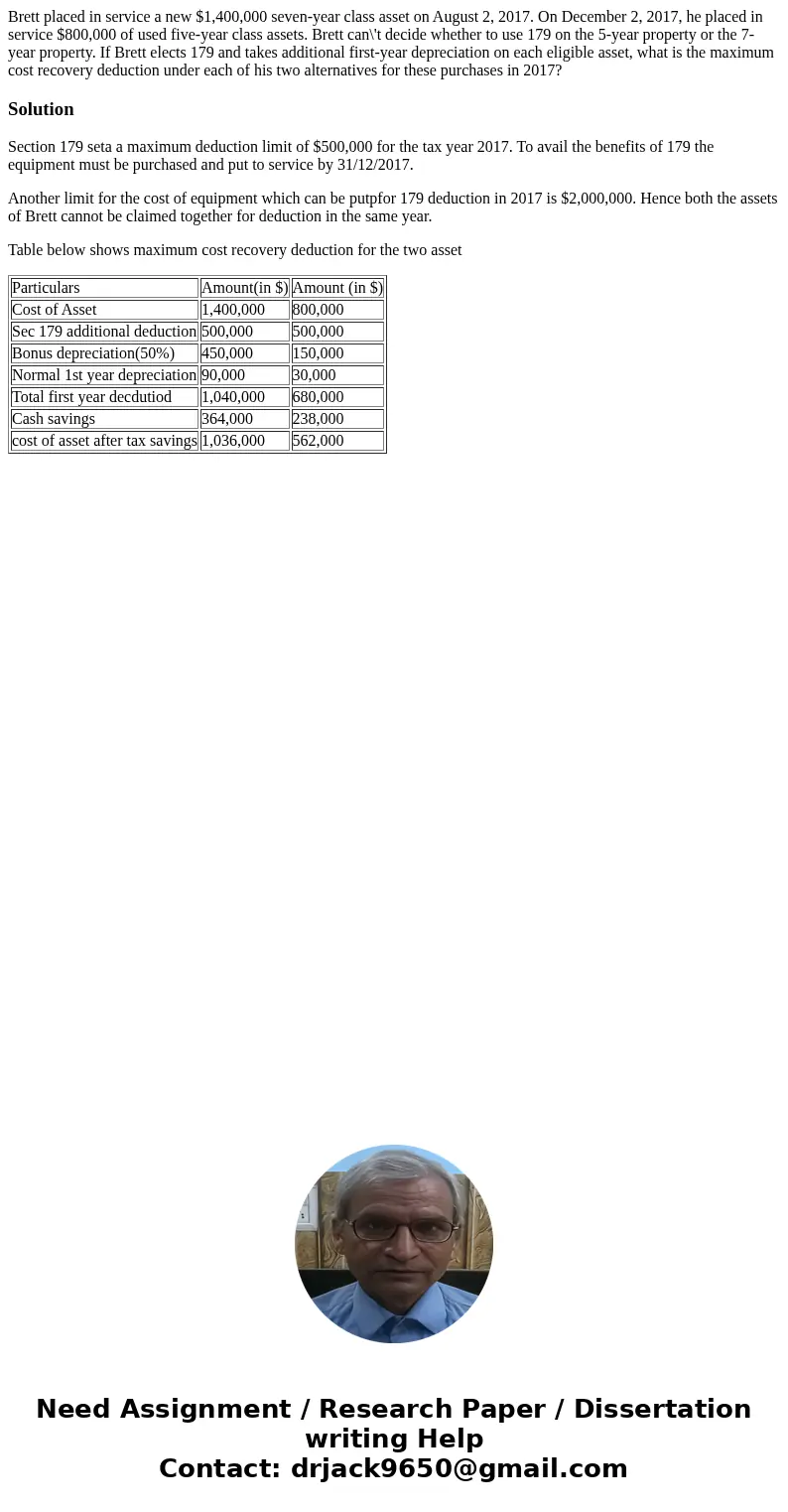

Table below shows maximum cost recovery deduction for the two asset

| Particulars | Amount(in $) | Amount (in $) |

| Cost of Asset | 1,400,000 | 800,000 |

| Sec 179 additional deduction | 500,000 | 500,000 |

| Bonus depreciation(50%) | 450,000 | 150,000 |

| Normal 1st year depreciation | 90,000 | 30,000 |

| Total first year decdutiod | 1,040,000 | 680,000 |

| Cash savings | 364,000 | 238,000 |

| cost of asset after tax savings | 1,036,000 | 562,000 |

Homework Sourse

Homework Sourse