During the year Tamara had capital transactions resulting in

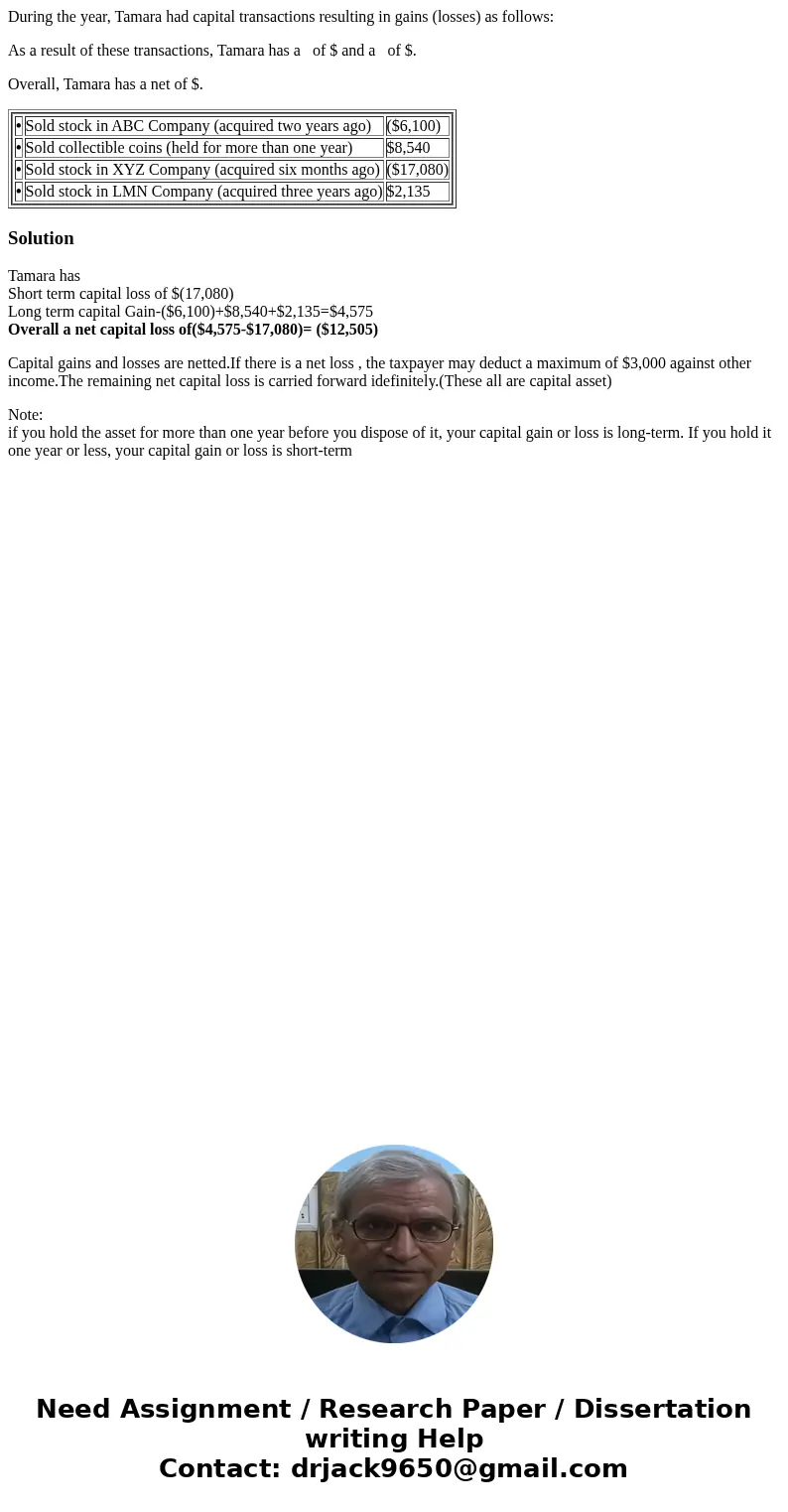

During the year, Tamara had capital transactions resulting in gains (losses) as follows:

As a result of these transactions, Tamara has a of $ and a of $.

Overall, Tamara has a net of $.

|

Solution

Tamara has

Short term capital loss of $(17,080)

Long term capital Gain-($6,100)+$8,540+$2,135=$4,575

Overall a net capital loss of($4,575-$17,080)= ($12,505)

Capital gains and losses are netted.If there is a net loss , the taxpayer may deduct a maximum of $3,000 against other income.The remaining net capital loss is carried forward idefinitely.(These all are capital asset)

Note:

if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term

Homework Sourse

Homework Sourse