J Wellington Farquhar IV gave gifts to the following recipie

J. Wellington Farquhar IV gave gifts to the following recipients this year:

A vacation home in the Hamptons to his wife, Becky, valued at $3,800,000.

An Asten-Marten automobile, worth $175,000 to his daughter, Amber, as a law school graduation present.

$160,000 cash to his son, J. Wellington V, for his birthday.

A Central Park West condominium, worth $2,600,000, to his daughter, Muffy, as a wedding present.

$35,000 to each of his 13 nieces and nephews.

$520,000 to his brother, Aloysius.

$410,000 to his sister-in-law, Mabel.

$775,000 to the American Red Cross, a qualified charitable organization. (Note: Charitable Contributions are fully deductible net of the annual exclusion.)

$271,000 to Hunter College, his alma mater.(Note: Charitable Contributions are fully deductible net of the annual exclusion.)

In addition, he had previously given taxable gifts in previous years amounting to $495,770, in which he had previously paid $138,026 in gift taxes, and claimed previous unified credits amounting to $52,410.

Required: Calculate the following:

1) J Wellington’s net taxable gifts this year

2) His tax base

3) The tax liability on his tax base

4) The tax liability on his prior gifts at current rates

5) His current year’s tax liability

6) His remaining unified credit, if any

This is to be submitted in class on Thursday.

Solution

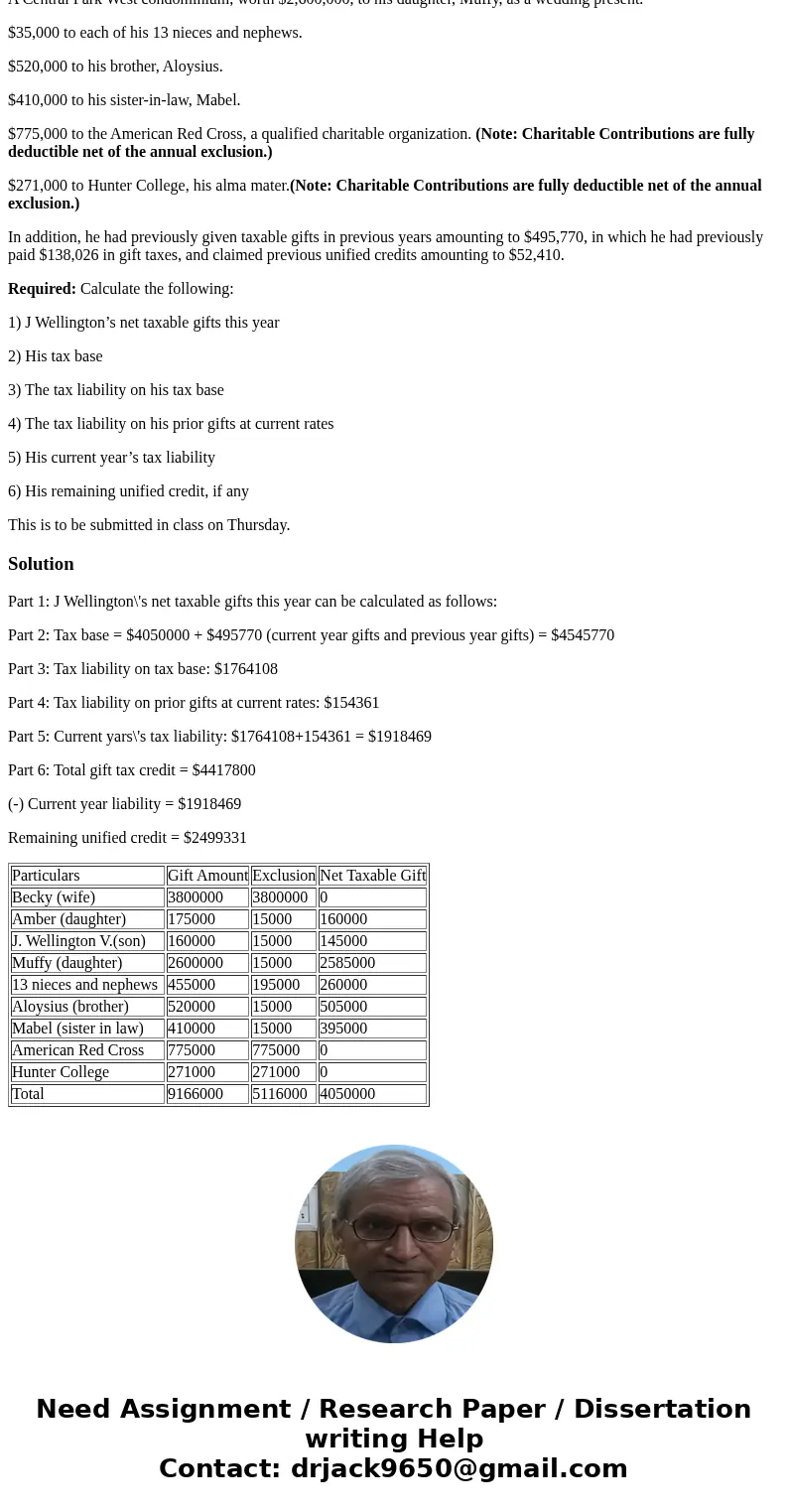

Part 1: J Wellington\'s net taxable gifts this year can be calculated as follows:

Part 2: Tax base = $4050000 + $495770 (current year gifts and previous year gifts) = $4545770

Part 3: Tax liability on tax base: $1764108

Part 4: Tax liability on prior gifts at current rates: $154361

Part 5: Current yars\'s tax liability: $1764108+154361 = $1918469

Part 6: Total gift tax credit = $4417800

(-) Current year liability = $1918469

Remaining unified credit = $2499331

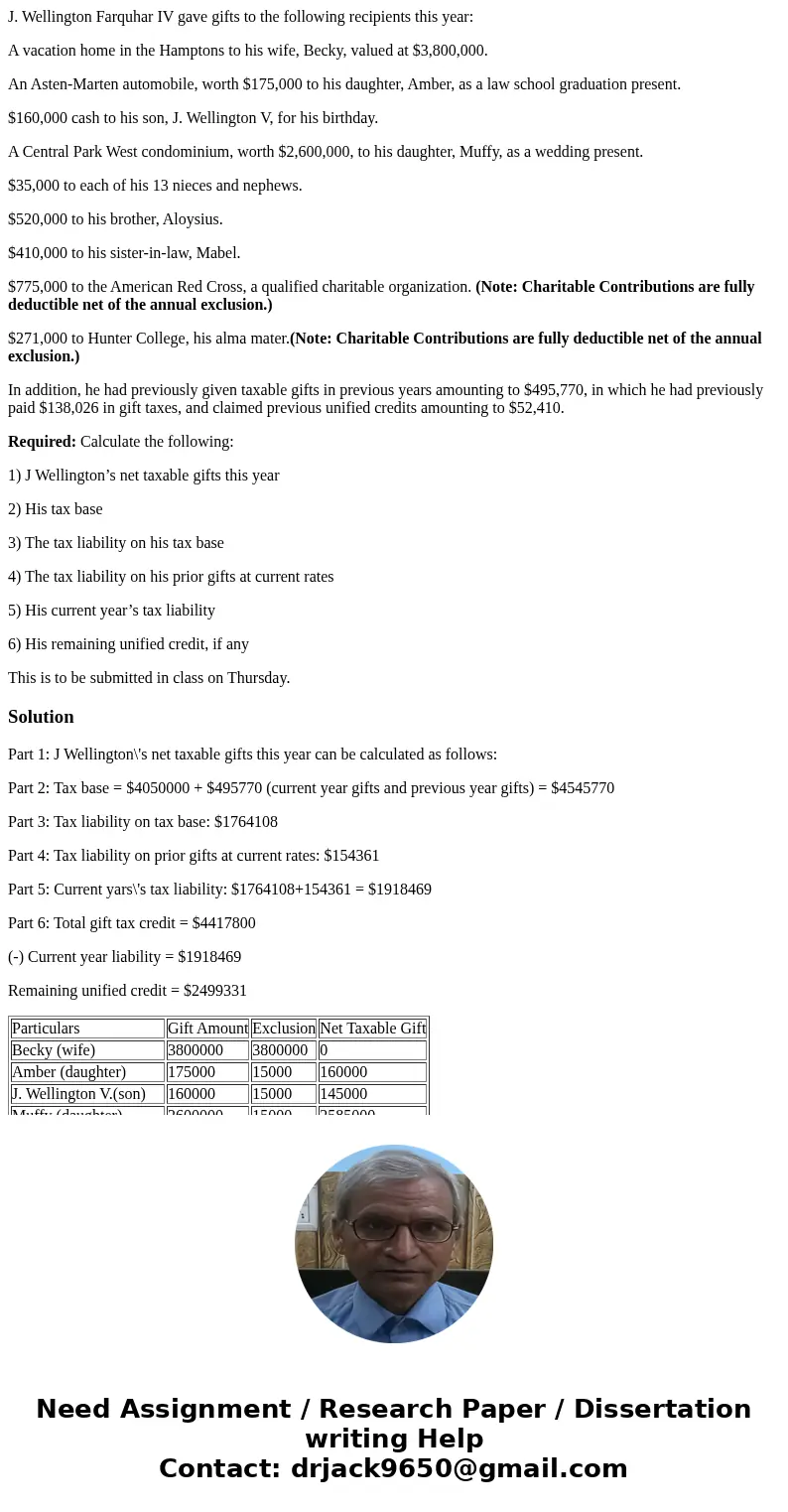

| Particulars | Gift Amount | Exclusion | Net Taxable Gift |

| Becky (wife) | 3800000 | 3800000 | 0 |

| Amber (daughter) | 175000 | 15000 | 160000 |

| J. Wellington V.(son) | 160000 | 15000 | 145000 |

| Muffy (daughter) | 2600000 | 15000 | 2585000 |

| 13 nieces and nephews | 455000 | 195000 | 260000 |

| Aloysius (brother) | 520000 | 15000 | 505000 |

| Mabel (sister in law) | 410000 | 15000 | 395000 |

| American Red Cross | 775000 | 775000 | 0 |

| Hunter College | 271000 | 271000 | 0 |

| Total | 9166000 | 5116000 | 4050000 |

Homework Sourse

Homework Sourse