8 Assume that Cane normally produces and sells 78000 Betas a

8. Assume that Cane normally produces and sells 78,000 Betas and 98,000 Alphas per year. If Cane discontinues the Beta product line, its sales representatives could increase sales of Alpha by 11,000 units. If Cane discontinues the Beta product line, how much would profits increase or decrease?

IThe following Information apples to the questions displayed belowj Cane Company manufactures two products called Alpha and Beta that sell for $210 and $172, respectively. Each product uses only one type of raw materlal that costs $8 per pound. The company has the capacity to annually produce 128,000 units of each product. Its unit costs for each product at this level of activity are given below Direct materlals Direct labor Varlable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Alpha Beta $40 $24 34 23 36 26 28 38 25 30 Total cost per unit $199$171 The company conslders its traceable fixed manufacturing overhead to be avoldable, whereas Its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars.Solution

Answers

Alpha

Beta

TOTAL

Normal Capacity

128000 units

128000 units

256000 units

Traceable FM OH per unit

$ 33.00

$ 36.00

Total Traceable fixed MO

$ 42,24,000.00

$ 46,08,000.00

$ 88,32,000.00

Common Fixed expenses per unit

$ 33.00

$ 28.00

Total Common Fixed Cost

$ 42,24,000.00

$ 35,84,000.00

$ 78,08,000.00

Alpha

Beta

Total

Units

98000

78000

176000

Sales price per unit

$ 210.00

$ 172.00

Variable costs per unit:

DM

$ 40.00

$ 24.00

DL

$ 38.00

$ 34.00

Variable MO

$ 25.00

$ 23.00

Variable Selling expense

$ 30.00

$ 26.00

Total Unit Variable cost

$ 133.00

$ 107.00

Unit Contribution margin

$ 77.00

$ 65.00

Total contribution margin

$ 75,46,000.00

$ 50,70,000.00

$ 126,16,000.00

Traceable (avoidable) fixed cost

$ 42,24,000.00

$ 46,08,000.00

$ 88,32,000.00

Controllable margin

$ 33,22,000.00

$ 4,62,000.00

$ 37,84,000.00

Common Fixed expense

$ 78,08,000.00

Net Income (Loss)

$ (40,24,000.00)

Alpha

Units

109000

Sales price per unit

$ 210.00

Variable costs per unit:

DM

$ 40.00

DL

$ 38.00

Variable MO

$ 25.00

Variable Selling expense

$ 30.00

Total Unit Variable cost

$ 133.00

Unit Contribution margin

$ 77.00

Total contribution margin

$ 83,93,000.00

Traceable (avoidable) fixed cost

$ 42,24,000.00

Controllable margin

$ 41,69,000.00

Common Fixed expense

$ 78,08,000.00

Net Income (Loss)

$ (36,39,000.00)

Earlier Net Income (Loss)

$ (40,24,000.00)

Decrease in Loss (or Increase in Net Income)

$ 3,85,000.00

Net Loss when both Alpha and Beta were sold = $ 4,024,000

Hence, Net Loss has DECREASED when Beta is discontinued, or it can be interpreted as Net Income has INCREASED when Beta is discontinued.

Net Income has INCREASED by $ 385,000 [4024000 – 3639000]

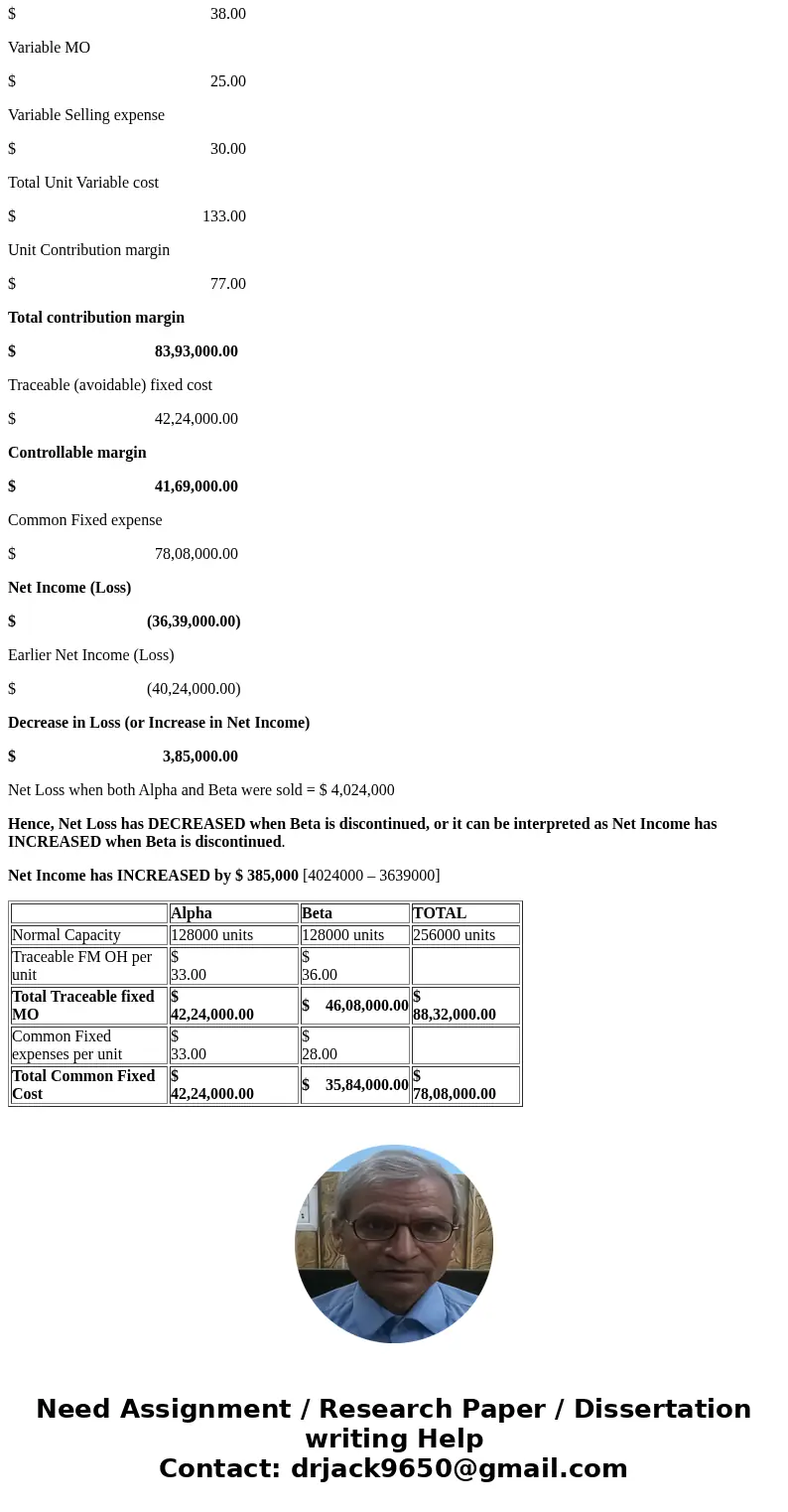

| Alpha | Beta | TOTAL | |

| Normal Capacity | 128000 units | 128000 units | 256000 units |

| Traceable FM OH per unit | $ 33.00 | $ 36.00 | |

| Total Traceable fixed MO | $ 42,24,000.00 | $ 46,08,000.00 | $ 88,32,000.00 |

| Common Fixed expenses per unit | $ 33.00 | $ 28.00 | |

| Total Common Fixed Cost | $ 42,24,000.00 | $ 35,84,000.00 | $ 78,08,000.00 |

Homework Sourse

Homework Sourse