500 and the variable cost actvity SolutionSolution 1 a b As

Solution

Solution 1:

a.

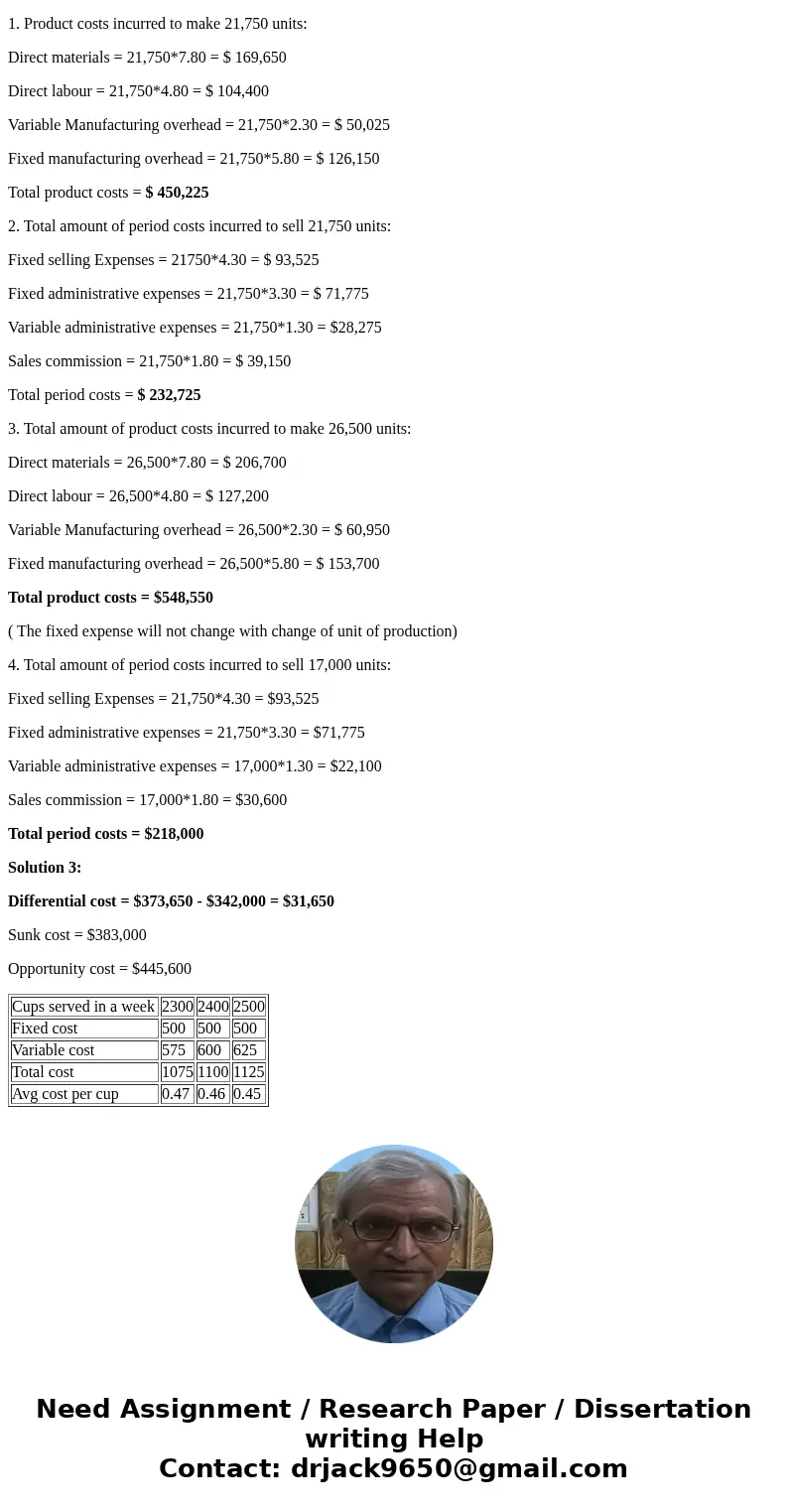

b. As the average cost per cup of coffee decreases, the number of cups of coffee served in a week increases.

Solution 2:

Product Costs = Direct Materials + Direct Labour + Manufacturing Overhead.

Whereas, Period Costs mean the other expenses which are not related to manufacturing.

1. Product costs incurred to make 21,750 units:

Direct materials = 21,750*7.80 = $ 169,650

Direct labour = 21,750*4.80 = $ 104,400

Variable Manufacturing overhead = 21,750*2.30 = $ 50,025

Fixed manufacturing overhead = 21,750*5.80 = $ 126,150

Total product costs = $ 450,225

2. Total amount of period costs incurred to sell 21,750 units:

Fixed selling Expenses = 21750*4.30 = $ 93,525

Fixed administrative expenses = 21,750*3.30 = $ 71,775

Variable administrative expenses = 21,750*1.30 = $28,275

Sales commission = 21,750*1.80 = $ 39,150

Total period costs = $ 232,725

3. Total amount of product costs incurred to make 26,500 units:

Direct materials = 26,500*7.80 = $ 206,700

Direct labour = 26,500*4.80 = $ 127,200

Variable Manufacturing overhead = 26,500*2.30 = $ 60,950

Fixed manufacturing overhead = 26,500*5.80 = $ 153,700

Total product costs = $548,550

( The fixed expense will not change with change of unit of production)

4. Total amount of period costs incurred to sell 17,000 units:

Fixed selling Expenses = 21,750*4.30 = $93,525

Fixed administrative expenses = 21,750*3.30 = $71,775

Variable administrative expenses = 17,000*1.30 = $22,100

Sales commission = 17,000*1.80 = $30,600

Total period costs = $218,000

Solution 3:

Differential cost = $373,650 - $342,000 = $31,650

Sunk cost = $383,000

Opportunity cost = $445,600

| Cups served in a week | 2300 | 2400 | 2500 |

| Fixed cost | 500 | 500 | 500 |

| Variable cost | 575 | 600 | 625 |

| Total cost | 1075 | 1100 | 1125 |

| Avg cost per cup | 0.47 | 0.46 | 0.45 |

Homework Sourse

Homework Sourse