Window Help e Ad YN WileyPLUS xya w le PLUS cure httpsedug

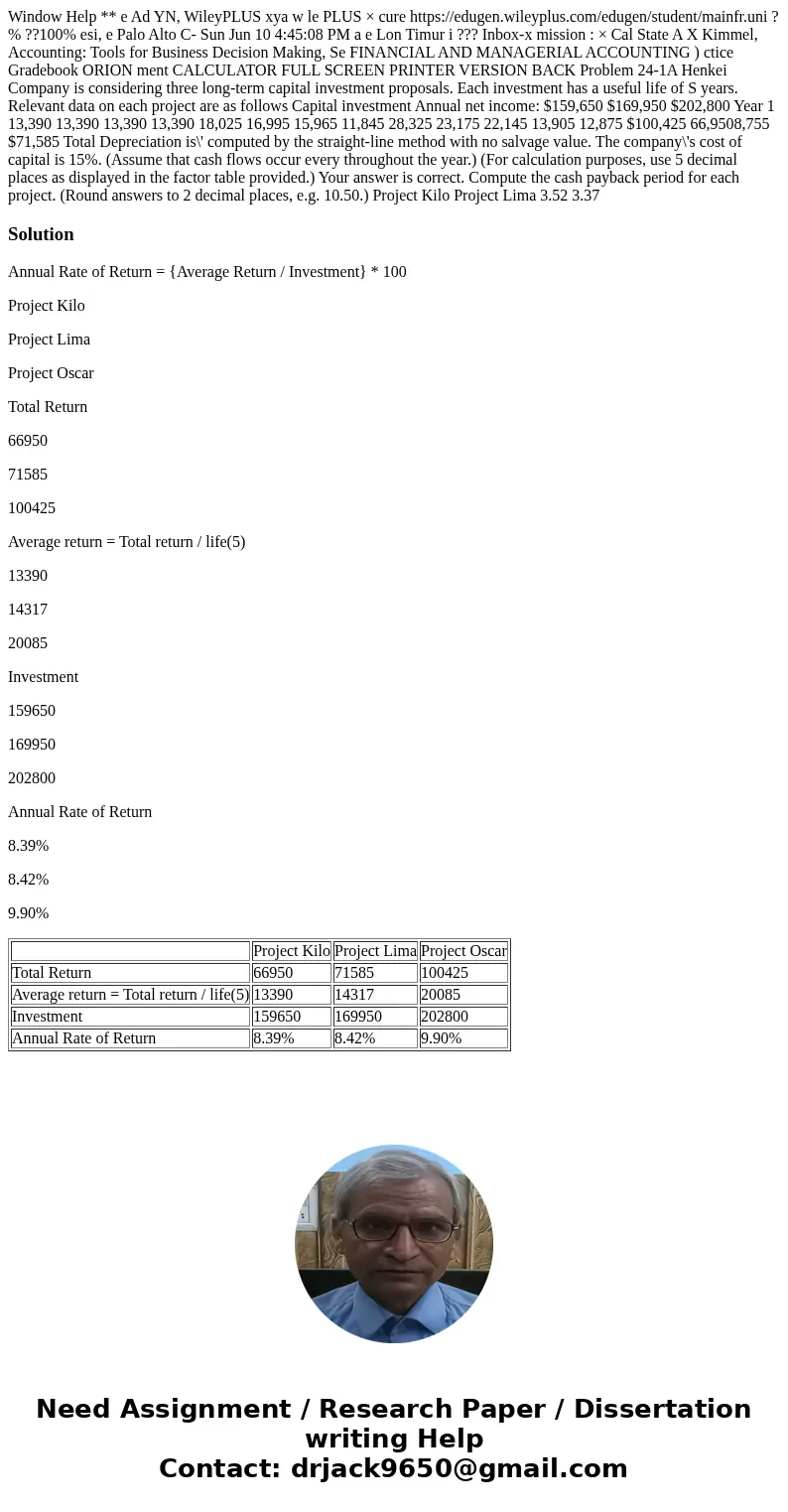

Window Help ** e Ad YN, WileyPLUS xya w le PLUS × cure https://edugen.wileyplus.com/edugen/student/mainfr.uni ? % ??100% esi, e Palo Alto C- Sun Jun 10 4:45:08 PM a e Lon Timur i ??? Inbox-x mission : × Cal State A X Kimmel, Accounting: Tools for Business Decision Making, Se FINANCIAL AND MANAGERIAL ACCOUNTING ) ctice Gradebook ORION ment CALCULATOR FULL SCREEN PRINTER VERSION BACK Problem 24-1A Henkei Company is considering three long-term capital investment proposals. Each investment has a useful life of S years. Relevant data on each project are as follows Capital investment Annual net income: $159,650 $169,950 $202,800 Year 1 13,390 13,390 13,390 13,390 18,025 16,995 15,965 11,845 28,325 23,175 22,145 13,905 12,875 $100,425 66,9508,755 $71,585 Total Depreciation is\' computed by the straight-line method with no salvage value. The company\'s cost of capital is 15%. (Assume that cash flows occur every throughout the year.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Your answer is correct. Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Kilo Project Lima 3.52 3.37

Solution

Annual Rate of Return = {Average Return / Investment} * 100

Project Kilo

Project Lima

Project Oscar

Total Return

66950

71585

100425

Average return = Total return / life(5)

13390

14317

20085

Investment

159650

169950

202800

Annual Rate of Return

8.39%

8.42%

9.90%

| Project Kilo | Project Lima | Project Oscar | |

| Total Return | 66950 | 71585 | 100425 |

| Average return = Total return / life(5) | 13390 | 14317 | 20085 |

| Investment | 159650 | 169950 | 202800 |

| Annual Rate of Return | 8.39% | 8.42% | 9.90% |

Homework Sourse

Homework Sourse