Question 3 2 points Buxton Company produces several types of

Solution

Answers

Working

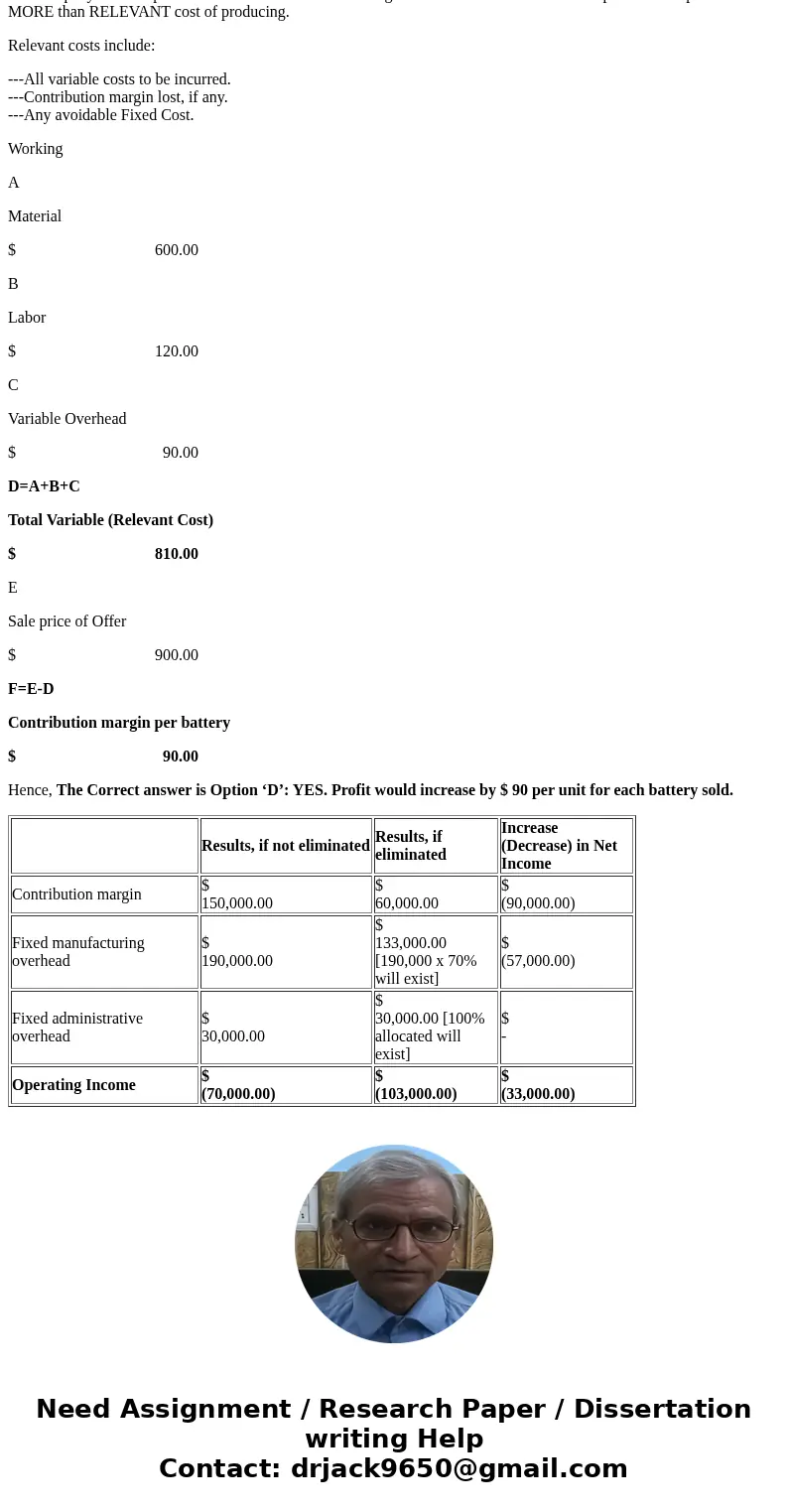

Results, if not eliminated

Results, if eliminated

Increase (Decrease) in Net Income

Contribution margin

$ 150,000.00

$ 60,000.00

$ (90,000.00)

Fixed manufacturing overhead

$ 190,000.00

$ 133,000.00 [190,000 x 70% will exist]

$ (57,000.00)

Fixed administrative overhead

$ 30,000.00

$ 30,000.00 [100% allocated will exist]

$ -

Operating Income

$ (70,000.00)

$ (103,000.00)

$ (33,000.00)

The above working shows that Net Income would decrease by $ 33,000 if it is eliminated.

Hence, The correct answer is Option ‘A’: No. Profit would decrease by $ 33,000

The company can accept offer without it’s normal sale being affected. The Offer shall be accepted if Offer price is MORE than RELEVANT cost of producing.

Relevant costs include:

---All variable costs to be incurred.

---Contribution margin lost, if any.

---Any avoidable Fixed Cost.

Working

A

Material

$ 600.00

B

Labor

$ 120.00

C

Variable Overhead

$ 90.00

D=A+B+C

Total Variable (Relevant Cost)

$ 810.00

E

Sale price of Offer

$ 900.00

F=E-D

Contribution margin per battery

$ 90.00

Hence, The Correct answer is Option ‘D’: YES. Profit would increase by $ 90 per unit for each battery sold.

| Results, if not eliminated | Results, if eliminated | Increase (Decrease) in Net Income | |

| Contribution margin | $ 150,000.00 | $ 60,000.00 | $ (90,000.00) |

| Fixed manufacturing overhead | $ 190,000.00 | $ 133,000.00 [190,000 x 70% will exist] | $ (57,000.00) |

| Fixed administrative overhead | $ 30,000.00 | $ 30,000.00 [100% allocated will exist] | $ - |

| Operating Income | $ (70,000.00) | $ (103,000.00) | $ (33,000.00) |

Homework Sourse

Homework Sourse