Dont worry what is Figure 53 in question It just list down a

Don’t worry what is Figure 5.3 in question It just list down all the financial ratios name and formula

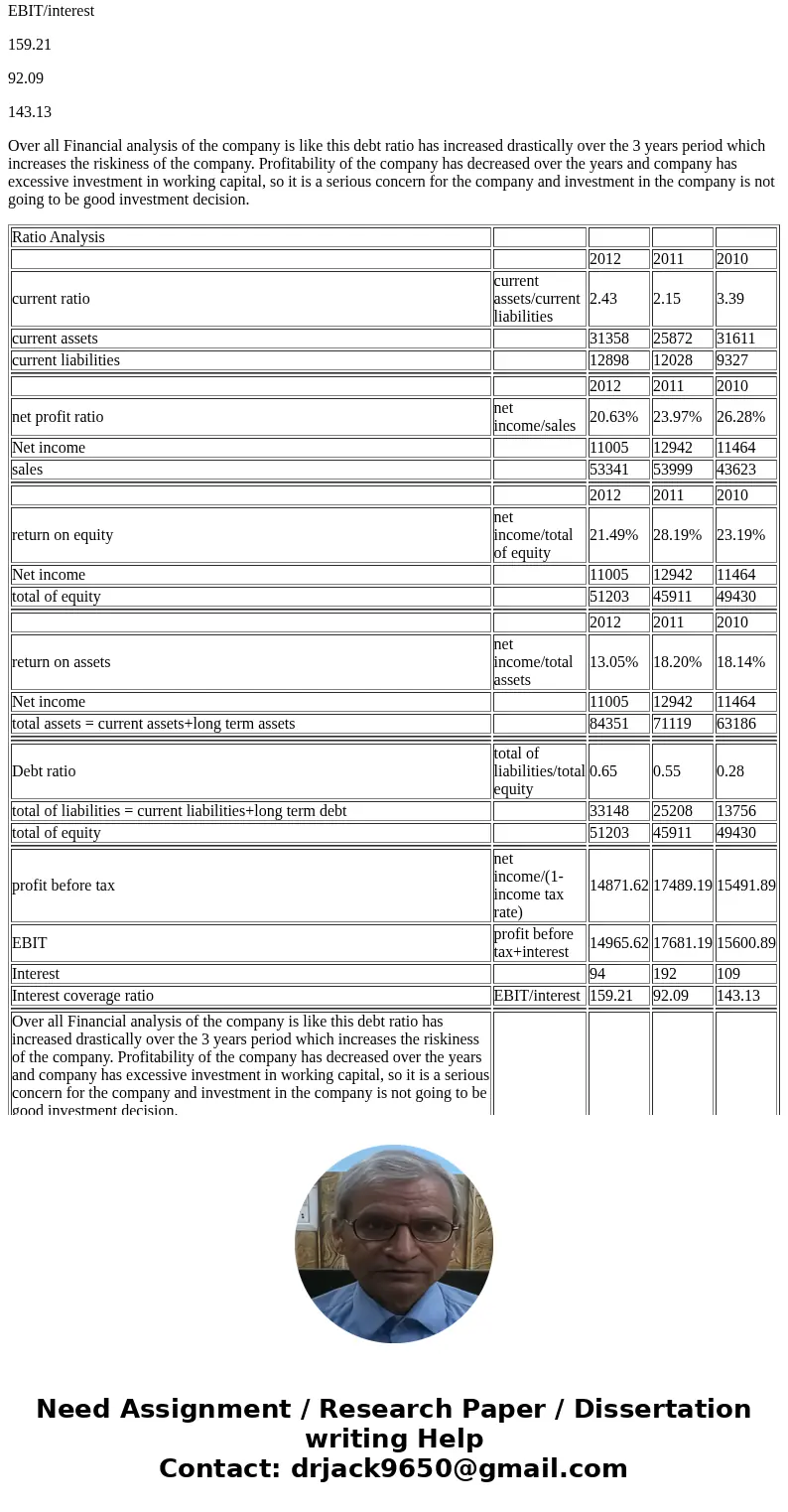

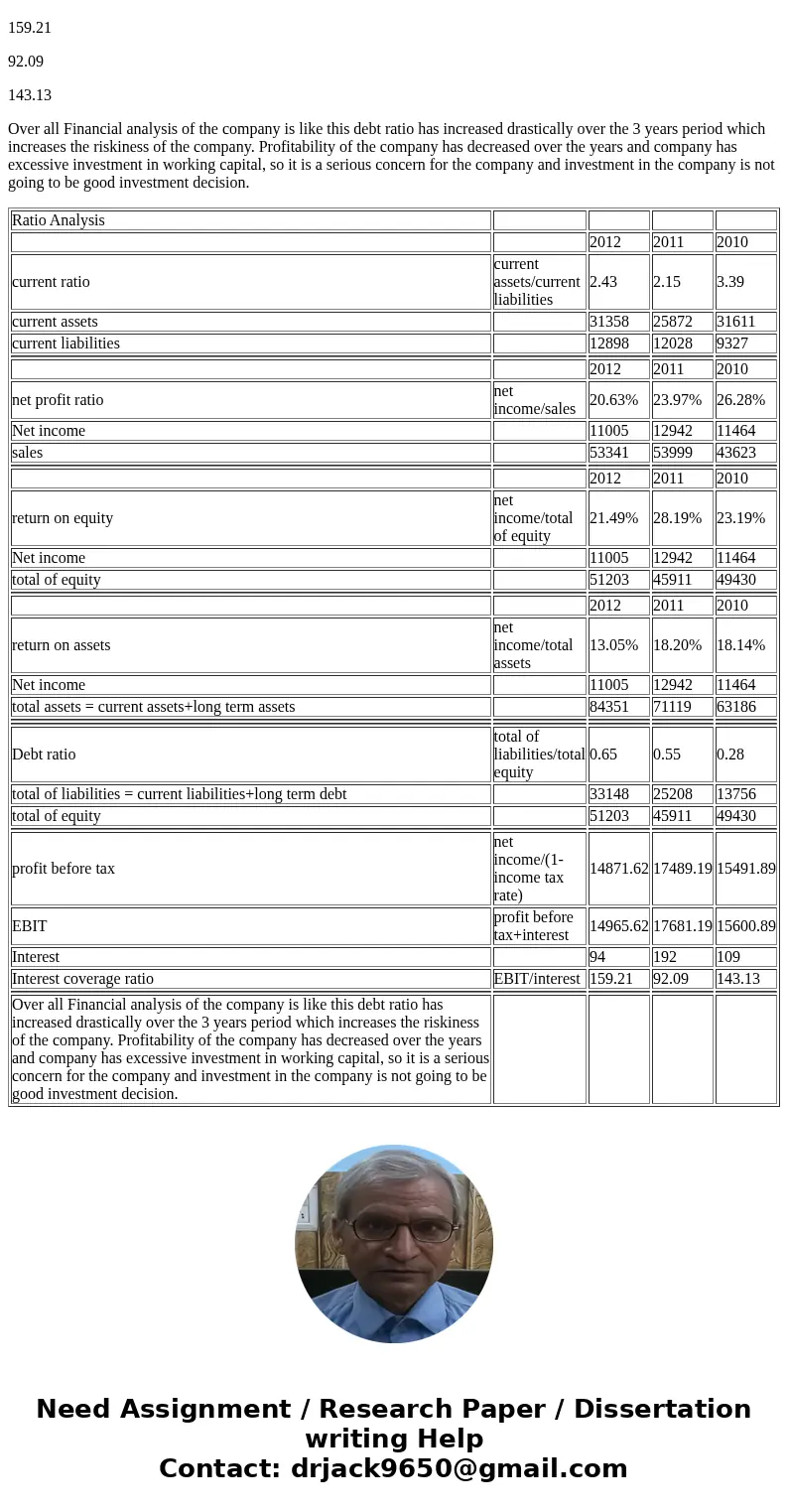

Excerpts from the 2012 financial report of Intel, a computer-processor manufacturer, are as follows (dollars in millions). 2012 2011 2010 Balance Sheet Current assets Long-term assets Current liabilities Long-term debt Shareholders\' equity Income Statement Sales Net income Interest expense $31,358 52,993 12,898 20,250 51,203 $25,872 5,247 12,028 13,180 45,911 $31,611 31,575 9,327 4,429 49,430 $53,341 11,005 94 $53,999 12,942 192 $43,623 11,464 109 Review this information, calculate relevant ratios from Figure 5-3, and explain why Intel appears to be a good or poor investment. The tax rate was 26 percent. luded the following financial statements in a loanSolution

Ratio Analysis

2012

2011

2010

current ratio

current assets/current liabilities

2.43

2.15

3.39

current assets

31358

25872

31611

current liabilities

12898

12028

9327

2012

2011

2010

net profit ratio

net income/sales

20.63%

23.97%

26.28%

Net income

11005

12942

11464

sales

53341

53999

43623

2012

2011

2010

return on equity

net income/total of equity

21.49%

28.19%

23.19%

Net income

11005

12942

11464

total of equity

51203

45911

49430

2012

2011

2010

return on assets

net income/total assets

13.05%

18.20%

18.14%

Net income

11005

12942

11464

total assets = current assets+long term assets

84351

71119

63186

Debt ratio

total of liabilities/total equity

0.65

0.55

0.28

total of liabilities = current liabilities+long term debt

33148

25208

13756

total of equity

51203

45911

49430

profit before tax

net income/(1-income tax rate)

14871.62

17489.19

15491.89

EBIT

profit before tax+interest

14965.62

17681.19

15600.89

Interest

94

192

109

Interest coverage ratio

EBIT/interest

159.21

92.09

143.13

Over all Financial analysis of the company is like this debt ratio has increased drastically over the 3 years period which increases the riskiness of the company. Profitability of the company has decreased over the years and company has excessive investment in working capital, so it is a serious concern for the company and investment in the company is not going to be good investment decision.

| Ratio Analysis | ||||

| 2012 | 2011 | 2010 | ||

| current ratio | current assets/current liabilities | 2.43 | 2.15 | 3.39 |

| current assets | 31358 | 25872 | 31611 | |

| current liabilities | 12898 | 12028 | 9327 | |

| 2012 | 2011 | 2010 | ||

| net profit ratio | net income/sales | 20.63% | 23.97% | 26.28% |

| Net income | 11005 | 12942 | 11464 | |

| sales | 53341 | 53999 | 43623 | |

| 2012 | 2011 | 2010 | ||

| return on equity | net income/total of equity | 21.49% | 28.19% | 23.19% |

| Net income | 11005 | 12942 | 11464 | |

| total of equity | 51203 | 45911 | 49430 | |

| 2012 | 2011 | 2010 | ||

| return on assets | net income/total assets | 13.05% | 18.20% | 18.14% |

| Net income | 11005 | 12942 | 11464 | |

| total assets = current assets+long term assets | 84351 | 71119 | 63186 | |

| Debt ratio | total of liabilities/total equity | 0.65 | 0.55 | 0.28 |

| total of liabilities = current liabilities+long term debt | 33148 | 25208 | 13756 | |

| total of equity | 51203 | 45911 | 49430 | |

| profit before tax | net income/(1-income tax rate) | 14871.62 | 17489.19 | 15491.89 |

| EBIT | profit before tax+interest | 14965.62 | 17681.19 | 15600.89 |

| Interest | 94 | 192 | 109 | |

| Interest coverage ratio | EBIT/interest | 159.21 | 92.09 | 143.13 |

| Over all Financial analysis of the company is like this debt ratio has increased drastically over the 3 years period which increases the riskiness of the company. Profitability of the company has decreased over the years and company has excessive investment in working capital, so it is a serious concern for the company and investment in the company is not going to be good investment decision. |

Homework Sourse

Homework Sourse