Please help me find the traditional portion of this question

Please help me find the traditional portion of this question

A company is considering the adoption of an activity-based costing (ABC) system because the managers suspect that their traditional costing system distorts the product costs. This company produces and sells two products Standard and Deluxe. Their traditional costing system uses machine hours (MHs) as the allocation base for manufacturing overhead cost. The production managers decid Machine setups, and Parts administration and determined the costs for each activity. They also identified how many MHs, setups, and parts each product requires. Additional information: major activities are Assembly, Standard S120 per unit Deluxe Price Cost Direct materials (DM) Direct labor (DL) S150 per unit S32 per unit S15 per unit $36 per unit $25 per unit Units produced Activity 200,000 units 100,000 units Assembly (MHs) Machine setups (setups) Parts administration (part types) 100,000 MHs 200,000 MHs 100 setups 200 parts 400 setups 200 parts Cost Assembly Machine setups Parts administration $1,200,000 $900,000 $300 2400,00D Compared with the unit product cost calculated by the ABC system, what is the distortion (difference) created by the traditional costing system for Deluxe Product? A. B. 3 Under the traditional costing system, the product is undercosted by S0.35 per unit. Under the traditional costing system, the-product is overcosted by 0.35 per unit. Under the traditional costing system, the product is undercosted by 0.70 per unit. Under the traditional costing system, the product is overcosted by 0.70 per unit. None of the above E. Page 3 1 14_Solution

Solution:

As you specifically mentioned you need to understand the portion of traditional costing system, I am giving you the explanation and calculation of Unit Product Cost under traditional costing system

Product cost is the cost of making the product.

Under traditional costing, product cost is the sum of direct materials, direct labor, variable manufacturing overhead and fixed manufacturing overhead.

In this costing system, overheads are allocated on some suitable basis and to allocate we need to calculate a predetermined overhead rate at the beginning of year.

So, first of all we need to calculate the Predetermined Overhead Rate.

Here, Allocation base is Machine Hours

Predetermined overhead rate = total estimated manufacturing $2,400,000 / Estimated Total Machine Hours (100,000 MHs of Standard + 200,000 MHs of Deluxe)

= $2400,000 / 300,000 MHs

= $8 per machine hour

Unit Product Cost of Deluxe Product

Deluxe

Direct Materials

$36

Direct Labor

$25

Applied Overhead (Refer Note 1)

$16

Unit Product Cost

$77

Note 1 --

Total Machine Hours required for Deluxe Product (A)

200,000 MHs

Number of Units Produced (B)

100,000 Units

Machine Hours Required Per Unit (A / B)

2 MHs

Overhead Rate per MH

$8 per MH

Applied Overhead Per Unit

(Required MH per unit * Overhead Rate)

$16

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

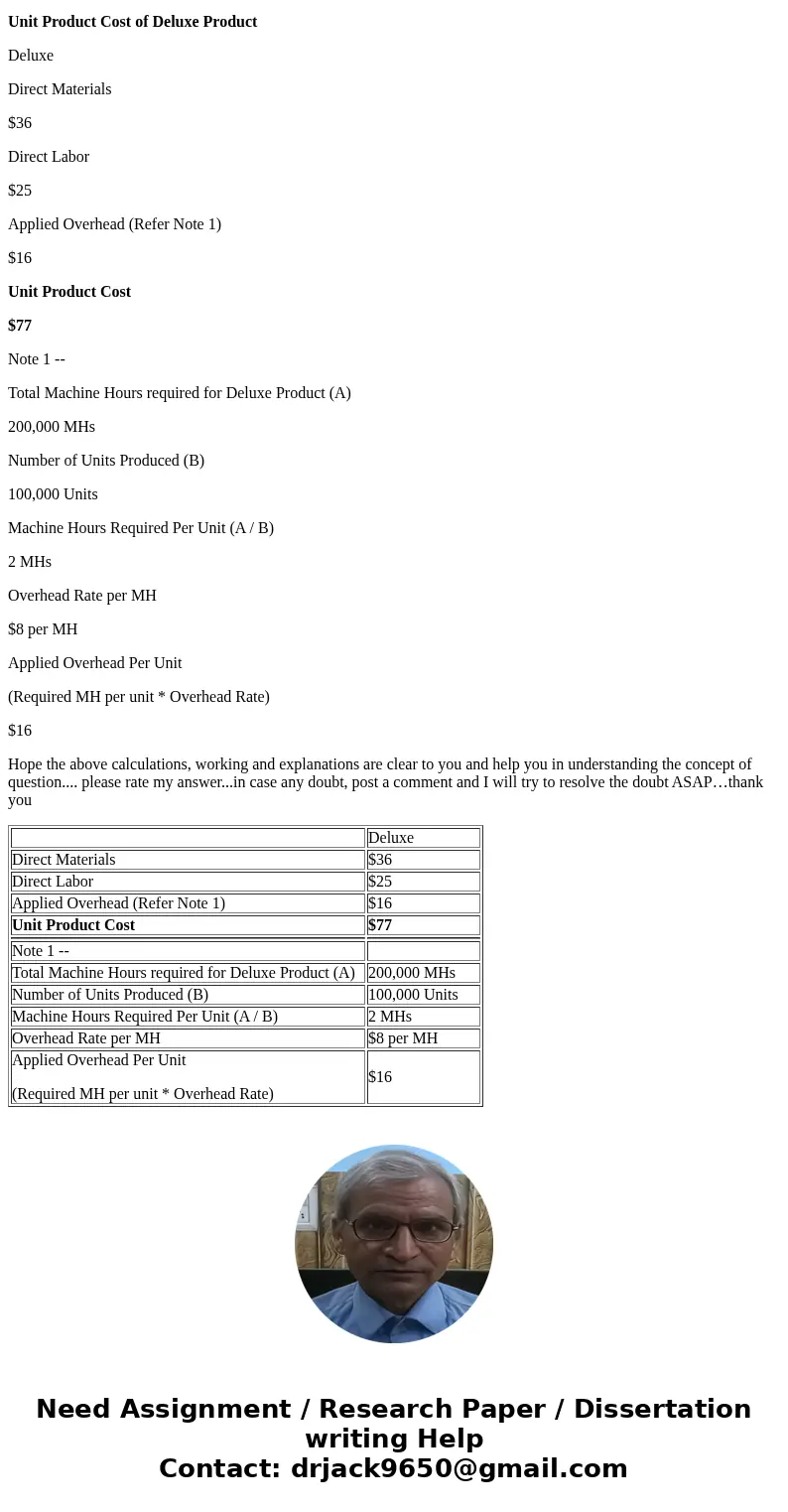

| Deluxe | |

| Direct Materials | $36 |

| Direct Labor | $25 |

| Applied Overhead (Refer Note 1) | $16 |

| Unit Product Cost | $77 |

| Note 1 -- | |

| Total Machine Hours required for Deluxe Product (A) | 200,000 MHs |

| Number of Units Produced (B) | 100,000 Units |

| Machine Hours Required Per Unit (A / B) | 2 MHs |

| Overhead Rate per MH | $8 per MH |

| Applied Overhead Per Unit (Required MH per unit * Overhead Rate) | $16 |

Homework Sourse

Homework Sourse