W Wiley infr un eyPLUS Kimmel Accounting 6e ACCT ACCT 221222

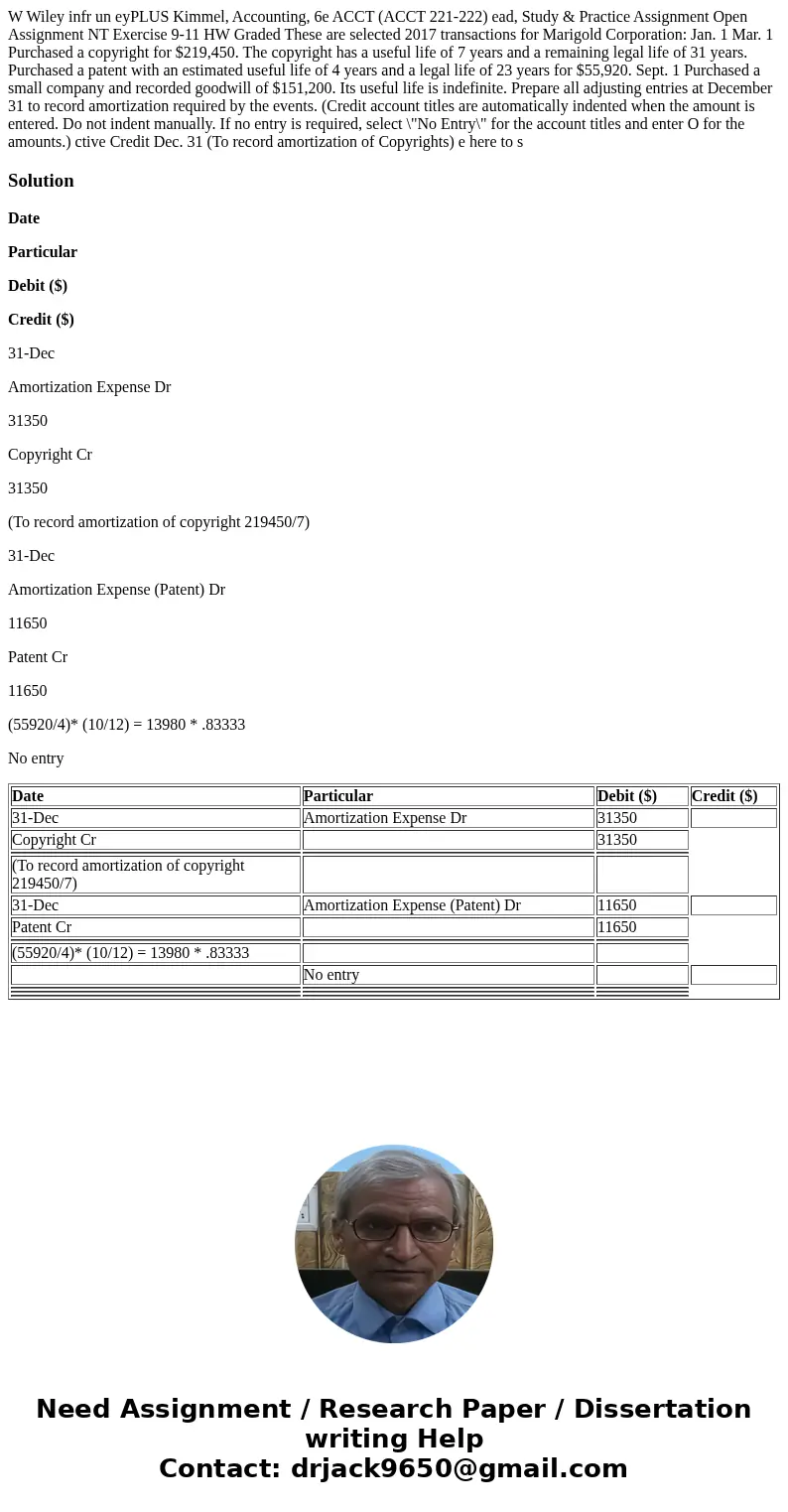

W Wiley infr un eyPLUS Kimmel, Accounting, 6e ACCT (ACCT 221-222) ead, Study & Practice Assignment Open Assignment NT Exercise 9-11 HW Graded These are selected 2017 transactions for Marigold Corporation: Jan. 1 Mar. 1 Purchased a copyright for $219,450. The copyright has a useful life of 7 years and a remaining legal life of 31 years. Purchased a patent with an estimated useful life of 4 years and a legal life of 23 years for $55,920. Sept. 1 Purchased a small company and recorded goodwill of $151,200. Its useful life is indefinite. Prepare all adjusting entries at December 31 to record amortization required by the events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter O for the amounts.) ctive Credit Dec. 31 (To record amortization of Copyrights) e here to s

Solution

Date

Particular

Debit ($)

Credit ($)

31-Dec

Amortization Expense Dr

31350

Copyright Cr

31350

(To record amortization of copyright 219450/7)

31-Dec

Amortization Expense (Patent) Dr

11650

Patent Cr

11650

(55920/4)* (10/12) = 13980 * .83333

No entry

| Date | Particular | Debit ($) | Credit ($) |

| 31-Dec | Amortization Expense Dr | 31350 | |

| Copyright Cr | 31350 | ||

| (To record amortization of copyright 219450/7) | |||

| 31-Dec | Amortization Expense (Patent) Dr | 11650 | |

| Patent Cr | 11650 | ||

| (55920/4)* (10/12) = 13980 * .83333 | |||

| No entry | |||

Homework Sourse

Homework Sourse