On July 1 2016 Noble Inc issued 9 bonds in the face amount o

On July 1, 2016, Noble, Inc. issued 9% bonds in the face amount of $10,000,000, which mature on July 1, 2022. The bonds were issued for $9,560,000 to yield 10%, resulting in a bond discount of $440,000. Noble uses the effective-interest method of amortizing bond discount. Interest is payable annually on June 30. At June 30, 2018, Noble\'s unamortized bond discount should be

a. $322,400.

b. $340,000.

c. $352,000.

d. $310,000.

Solution

Answer

$ 322,400 will be the amount of Unamortised Discount on Bonds Payable on June 30, 2018.

Please follow below working for the same:

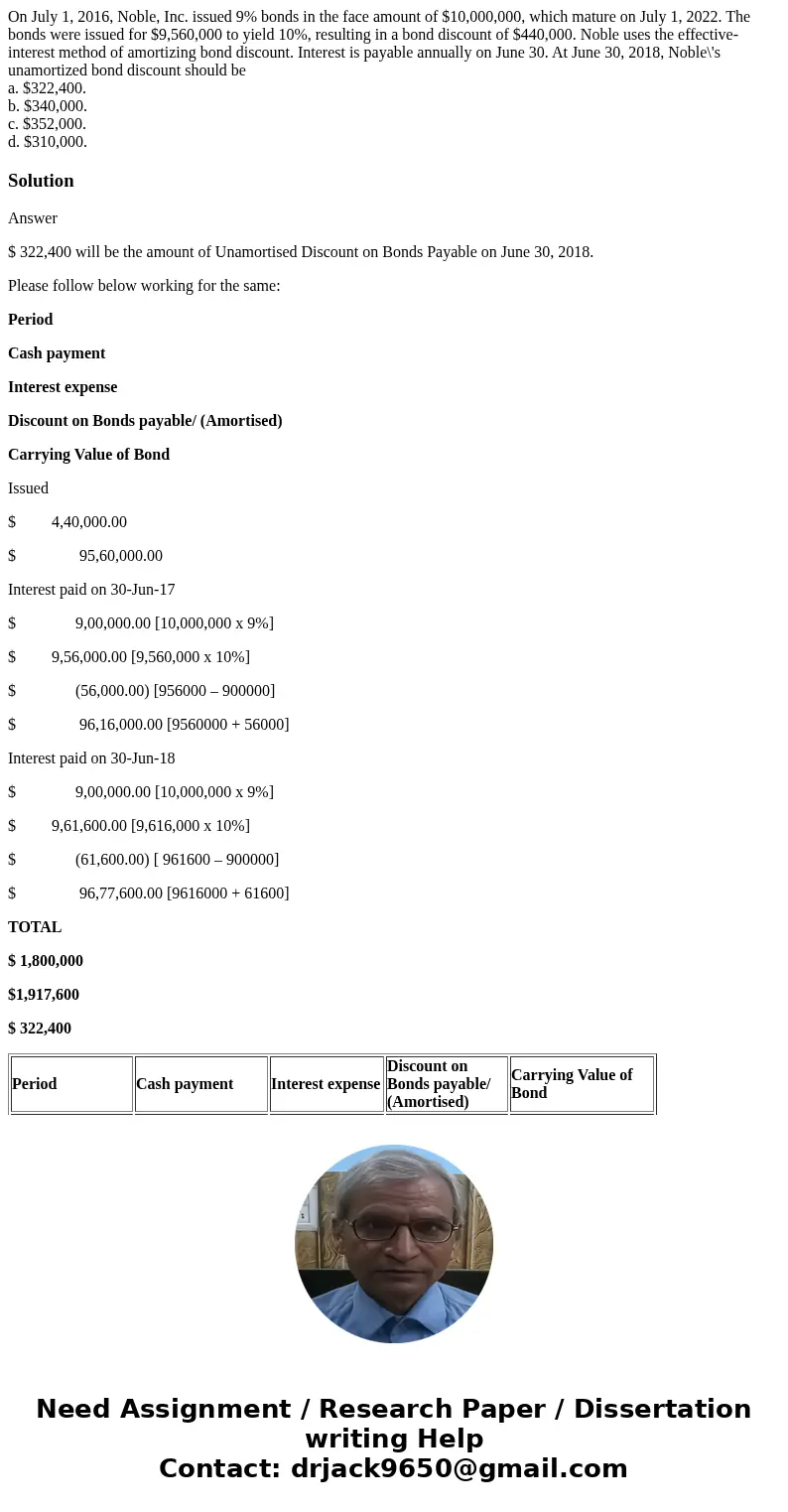

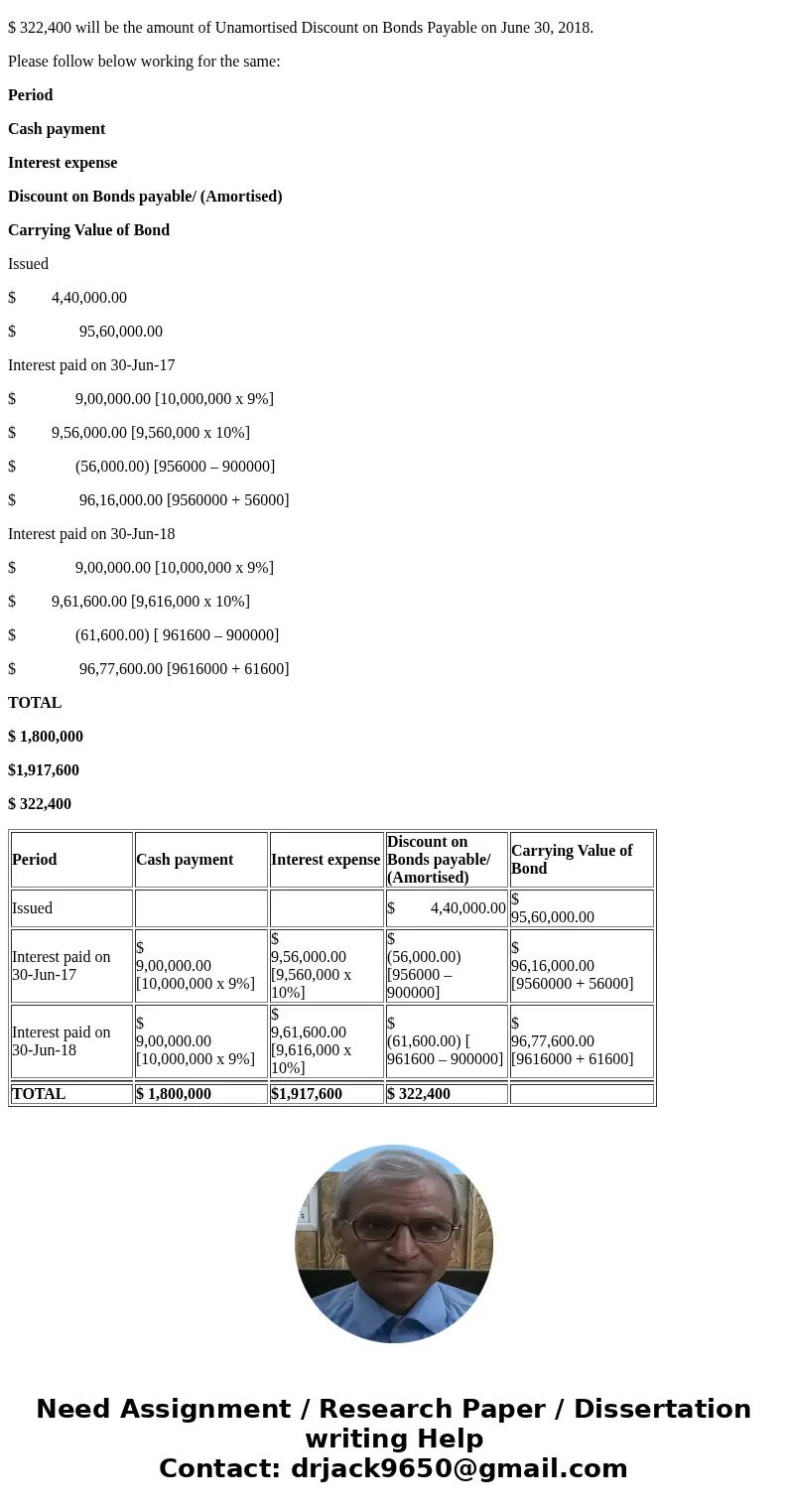

Period

Cash payment

Interest expense

Discount on Bonds payable/ (Amortised)

Carrying Value of Bond

Issued

$ 4,40,000.00

$ 95,60,000.00

Interest paid on 30-Jun-17

$ 9,00,000.00 [10,000,000 x 9%]

$ 9,56,000.00 [9,560,000 x 10%]

$ (56,000.00) [956000 – 900000]

$ 96,16,000.00 [9560000 + 56000]

Interest paid on 30-Jun-18

$ 9,00,000.00 [10,000,000 x 9%]

$ 9,61,600.00 [9,616,000 x 10%]

$ (61,600.00) [ 961600 – 900000]

$ 96,77,600.00 [9616000 + 61600]

TOTAL

$ 1,800,000

$1,917,600

$ 322,400

| Period | Cash payment | Interest expense | Discount on Bonds payable/ (Amortised) | Carrying Value of Bond |

| Issued | $ 4,40,000.00 | $ 95,60,000.00 | ||

| Interest paid on 30-Jun-17 | $ 9,00,000.00 [10,000,000 x 9%] | $ 9,56,000.00 [9,560,000 x 10%] | $ (56,000.00) [956000 – 900000] | $ 96,16,000.00 [9560000 + 56000] |

| Interest paid on 30-Jun-18 | $ 9,00,000.00 [10,000,000 x 9%] | $ 9,61,600.00 [9,616,000 x 10%] | $ (61,600.00) [ 961600 – 900000] | $ 96,77,600.00 [9616000 + 61600] |

| TOTAL | $ 1,800,000 | $1,917,600 | $ 322,400 |

Homework Sourse

Homework Sourse