The cost of an asset is 1020000 and its residual value is 16

The cost of an asset is $1,020,000, and its residual value is $160,000. Estimated useful life of the asset is five years. Calculate depreciation for the second year using the double-declining-balance method of depreciation. (Do not round any intermediate calculations, and round your final answer to the nearest dollar.) OA. $244,800 OB. $172,000 OC. $344,000 O D. $204,000

Solution

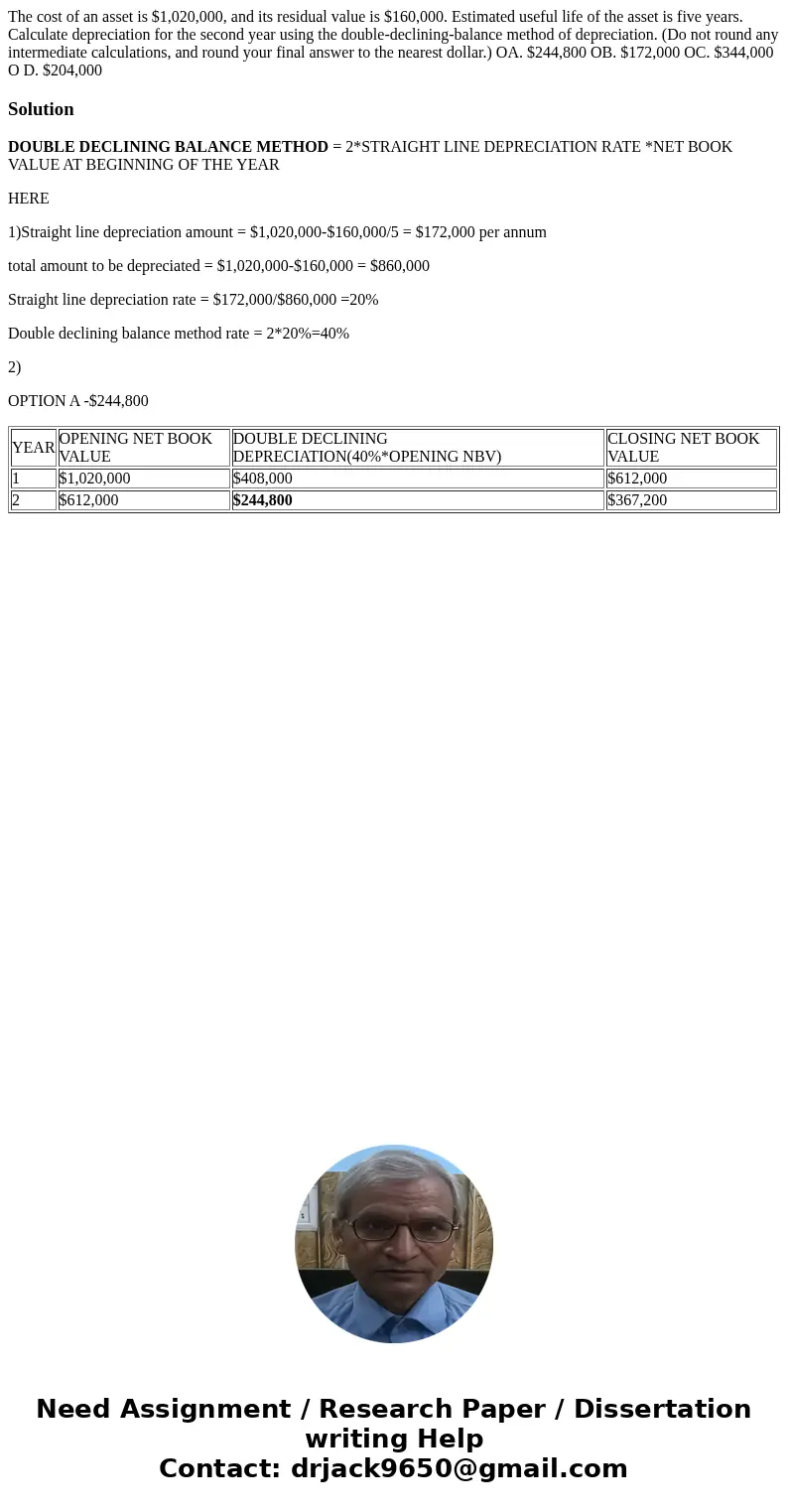

DOUBLE DECLINING BALANCE METHOD = 2*STRAIGHT LINE DEPRECIATION RATE *NET BOOK VALUE AT BEGINNING OF THE YEAR

HERE

1)Straight line depreciation amount = $1,020,000-$160,000/5 = $172,000 per annum

total amount to be depreciated = $1,020,000-$160,000 = $860,000

Straight line depreciation rate = $172,000/$860,000 =20%

Double declining balance method rate = 2*20%=40%

2)

OPTION A -$244,800

| YEAR | OPENING NET BOOK VALUE | DOUBLE DECLINING DEPRECIATION(40%*OPENING NBV) | CLOSING NET BOOK VALUE |

| 1 | $1,020,000 | $408,000 | $612,000 |

| 2 | $612,000 | $244,800 | $367,200 |

Homework Sourse

Homework Sourse