On January 2 2018 Sanborn Tobacco Inc bought 10 of Jackson I

On January 2, 2018, Sanborn Tobacco Inc. bought 10% of Jackson Industry’s capital stock for $104 million. Jackson Industry’s net income for the year ended December 31, 2018, was $134 million. The fair value of the shares held by Sanborn was $126 million at December 31, 2018. During 2018, Jackson declared a dividend of $74 million.

Required:

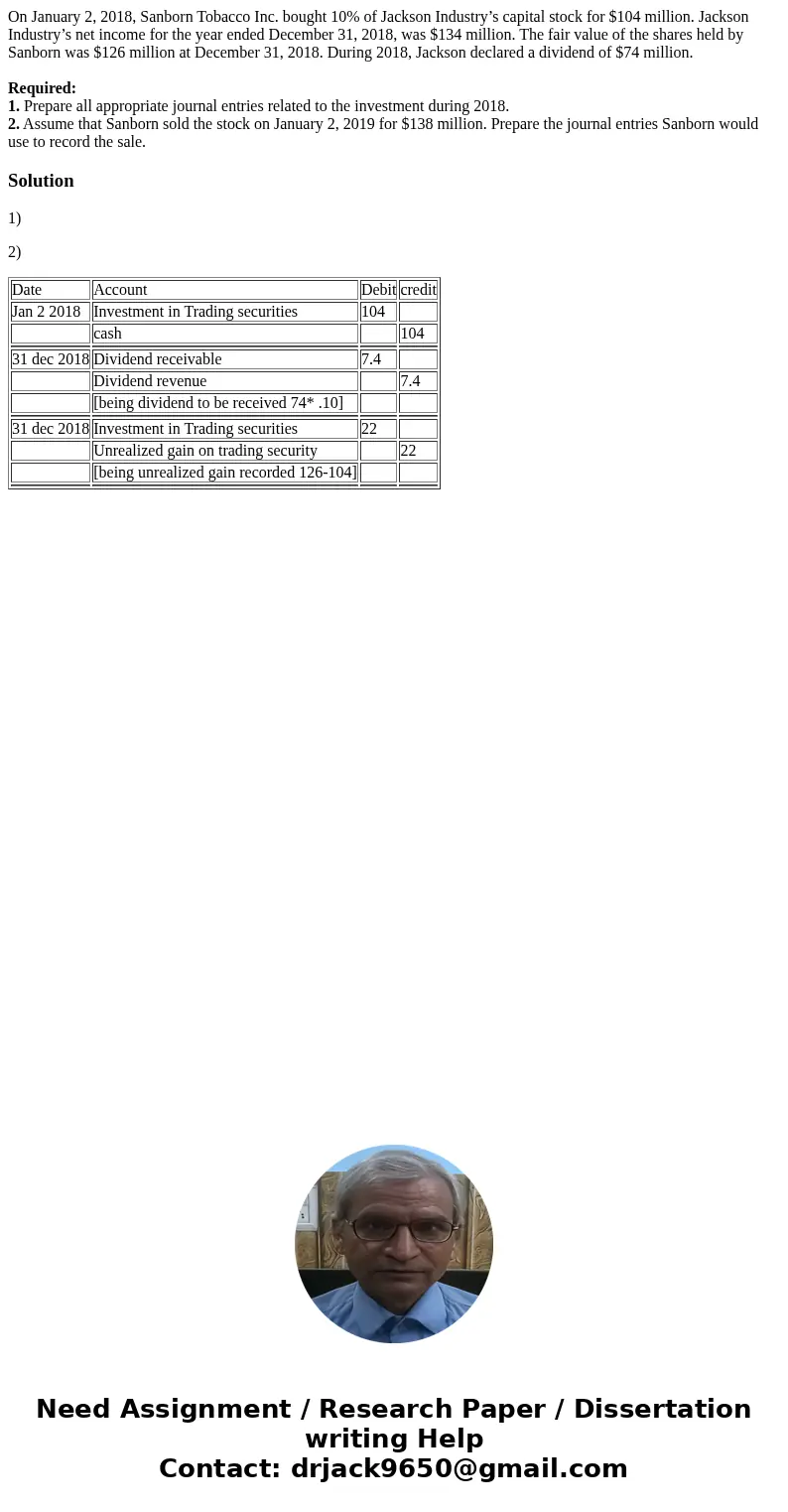

1. Prepare all appropriate journal entries related to the investment during 2018.

2. Assume that Sanborn sold the stock on January 2, 2019 for $138 million. Prepare the journal entries Sanborn would use to record the sale.

Solution

1)

2)

| Date | Account | Debit | credit |

| Jan 2 2018 | Investment in Trading securities | 104 | |

| cash | 104 | ||

| 31 dec 2018 | Dividend receivable | 7.4 | |

| Dividend revenue | 7.4 | ||

| [being dividend to be received 74* .10] | |||

| 31 dec 2018 | Investment in Trading securities | 22 | |

| Unrealized gain on trading security | 22 | ||

| [being unrealized gain recorded 126-104] | |||

Homework Sourse

Homework Sourse