10 marks Question 2 Word Processing Service Ltd uses the str

Solution

Solution:

Journal Entries

Date

General Journal

Debit

Credit

July.1, 2016

Computer (6500+500+250) (Note 1)

$7,250

Cash

$7,250

Nov.3, 2016

Repair and Maintenance Expense (Refer Note 1)

$440

Accounts Payable or Cash

$440

Dec.31, 2016

Depreciation Expense (Refer Note 2)

$750

Accumulated Depreciation

$750

Dec.31, 2017

Depreciation Expense

$1,500

Accumulated Depreciation

$1,500

Jan.1, 2018

Computer (Refer Note 2)

$1,800

Cash

$1,800

Note 1 ----

These journal entries are based on the concept of revenue expenditure and capital expenditure and the depreciation using straight line method.

Capital Expenditure

Capital Expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increase the earning capacity of an existing fixed asset.

The cost of acquisition includes cost of purchase of fixed assets plus additional costs incurred in bringing the fixed asset into its present location and condition (i.e. delivery cost, installation charges, legal charges etc.)

Revenue Expenditure

It incurred on fixed assets include costs that are aimed at ‘maintaining’ rather than enhancing the earning capacity of the assets. These are costs that are incurred on a regular basis and the benefit from these costs is obtained over a relatively short period of time. For example – Repair Costs, Maintenance Charges, Repairing Costs etc.

Nov.3, 2016 – Entry explanation

It means the expenditure incurred with respect to ordinary repair is treated as Revenue Expenditure and is recorded as Repair and Maintenance Expense.

Jan 1, 2018 – Entry Explanation

Since this expenditure upgrade the computer operating efficiency and capacity. It is treated as Capital Expenditure and increase the value of asset.

Note 2 – Depreciation Expenses

Annual Depreciation Expense (using straight line method) = (Cost of Asset 7,250 – Salvage Value 1250)/Useful Life 4 yrs

= $1,500

Depreciation Expense for Year 2016

Depreciation Expenses to be recorded for 6 months in Year 2016 from July 1 to Dec 31 = Annual Depreciation 1,500 / 2 = $750

Depreciation Expense for Year 2017

Annual Depreciation Expense = $1,500

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

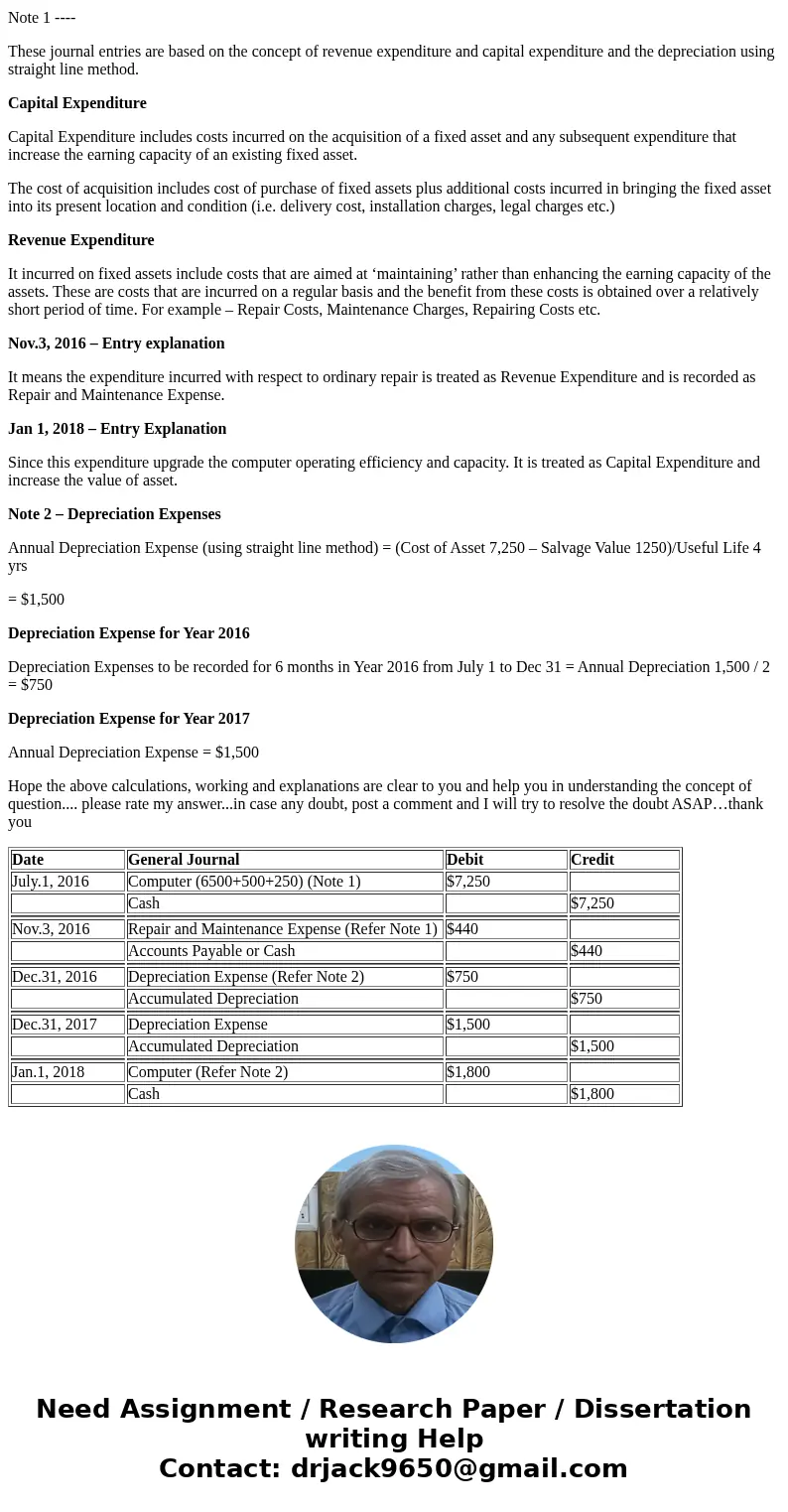

| Date | General Journal | Debit | Credit |

| July.1, 2016 | Computer (6500+500+250) (Note 1) | $7,250 | |

| Cash | $7,250 | ||

| Nov.3, 2016 | Repair and Maintenance Expense (Refer Note 1) | $440 | |

| Accounts Payable or Cash | $440 | ||

| Dec.31, 2016 | Depreciation Expense (Refer Note 2) | $750 | |

| Accumulated Depreciation | $750 | ||

| Dec.31, 2017 | Depreciation Expense | $1,500 | |

| Accumulated Depreciation | $1,500 | ||

| Jan.1, 2018 | Computer (Refer Note 2) | $1,800 | |

| Cash | $1,800 |

Homework Sourse

Homework Sourse