On January 1 a customer paid X Company 21600 in advance for

On January 1, a customer paid X Company $21,600 in advance for cleaning services. The cleaning was going to be done once in January, ance in February, once in so the payment was recorded as Deferred Revenue. What will be the result of the adjusting entry on January 317 O a $5,400 decrease in the Cash account on the Balance Sheet a balance of ss,400 in the Deferred Revenue account on the Balance Sheet a $5,400 increase in the Cash account on the Balance Sheet revenue of $5,400 a $5,400 increase in the Deferred Revenue account on the Balance Sheet on the Income Statement a $5,400 decrease in the Retained Earmings account on the Balance Sheet Tries 1/3 2

Solution

Revenue of $5,400 reported in Income Statement.

So Deferred Revenue will decrease in the balance sheet and Revenue will increase in the income statement as a result of adjusting entry.

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

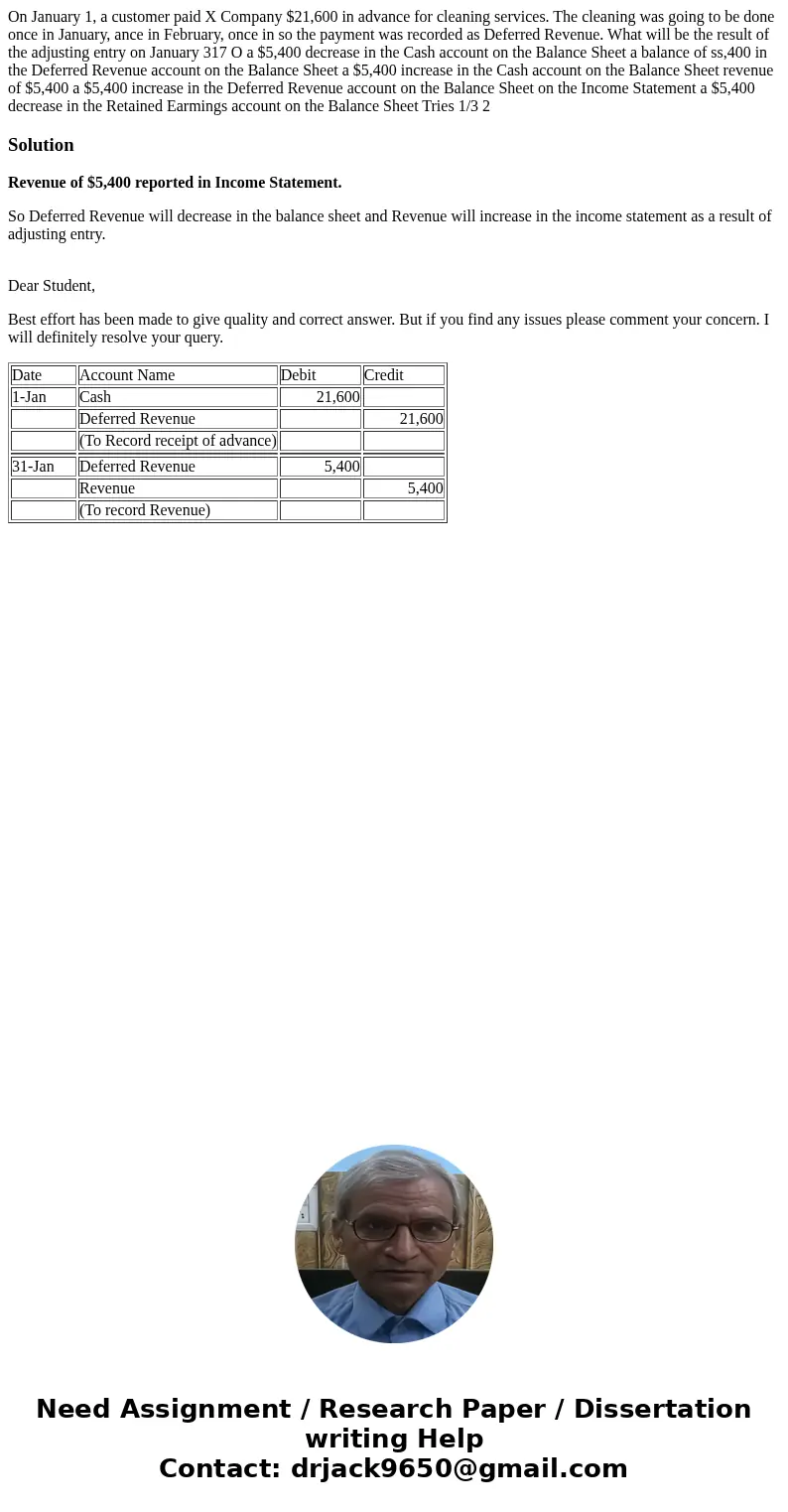

| Date | Account Name | Debit | Credit |

| 1-Jan | Cash | 21,600 | |

| Deferred Revenue | 21,600 | ||

| (To Record receipt of advance) | |||

| 31-Jan | Deferred Revenue | 5,400 | |

| Revenue | 5,400 | ||

| (To record Revenue) |

Homework Sourse

Homework Sourse