QUESTION4 This information relates to Hanshew Real Estate Ag

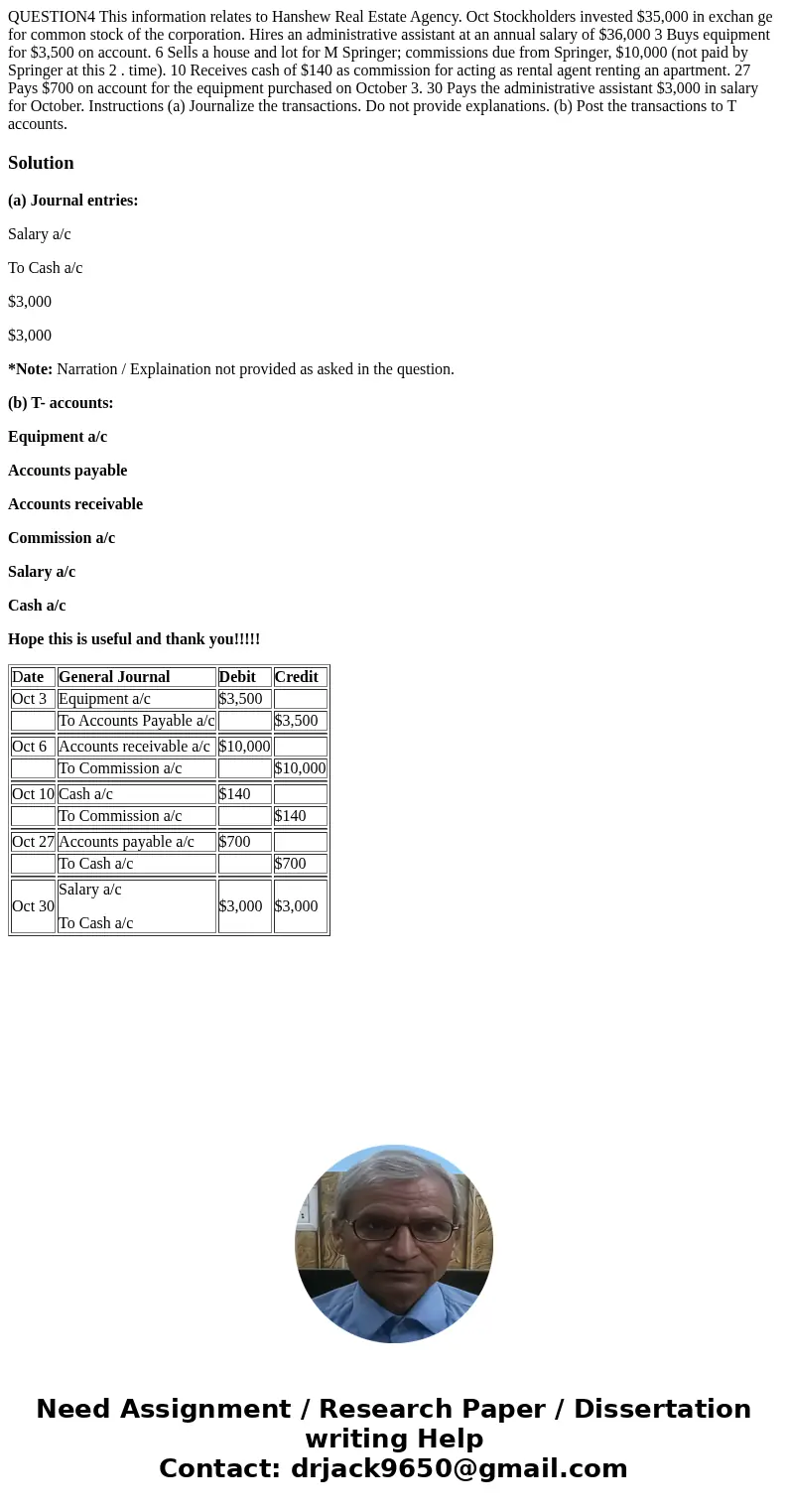

QUESTION4 This information relates to Hanshew Real Estate Agency. Oct Stockholders invested $35,000 in exchan ge for common stock of the corporation. Hires an administrative assistant at an annual salary of $36,000 3 Buys equipment for $3,500 on account. 6 Sells a house and lot for M Springer; commissions due from Springer, $10,000 (not paid by Springer at this 2 . time). 10 Receives cash of $140 as commission for acting as rental agent renting an apartment. 27 Pays $700 on account for the equipment purchased on October 3. 30 Pays the administrative assistant $3,000 in salary for October. Instructions (a) Journalize the transactions. Do not provide explanations. (b) Post the transactions to T accounts.

Solution

(a) Journal entries:

Salary a/c

To Cash a/c

$3,000

$3,000

*Note: Narration / Explaination not provided as asked in the question.

(b) T- accounts:

Equipment a/c

Accounts payable

Accounts receivable

Commission a/c

Salary a/c

Cash a/c

Hope this is useful and thank you!!!!!

| Date | General Journal | Debit | Credit |

| Oct 3 | Equipment a/c | $3,500 | |

| To Accounts Payable a/c | $3,500 | ||

| Oct 6 | Accounts receivable a/c | $10,000 | |

| To Commission a/c | $10,000 | ||

| Oct 10 | Cash a/c | $140 | |

| To Commission a/c | $140 | ||

| Oct 27 | Accounts payable a/c | $700 | |

| To Cash a/c | $700 | ||

| Oct 30 | Salary a/c To Cash a/c | $3,000 | $3,000 |

Homework Sourse

Homework Sourse