0 O eztomheducationcomhmtpx During the year ended December

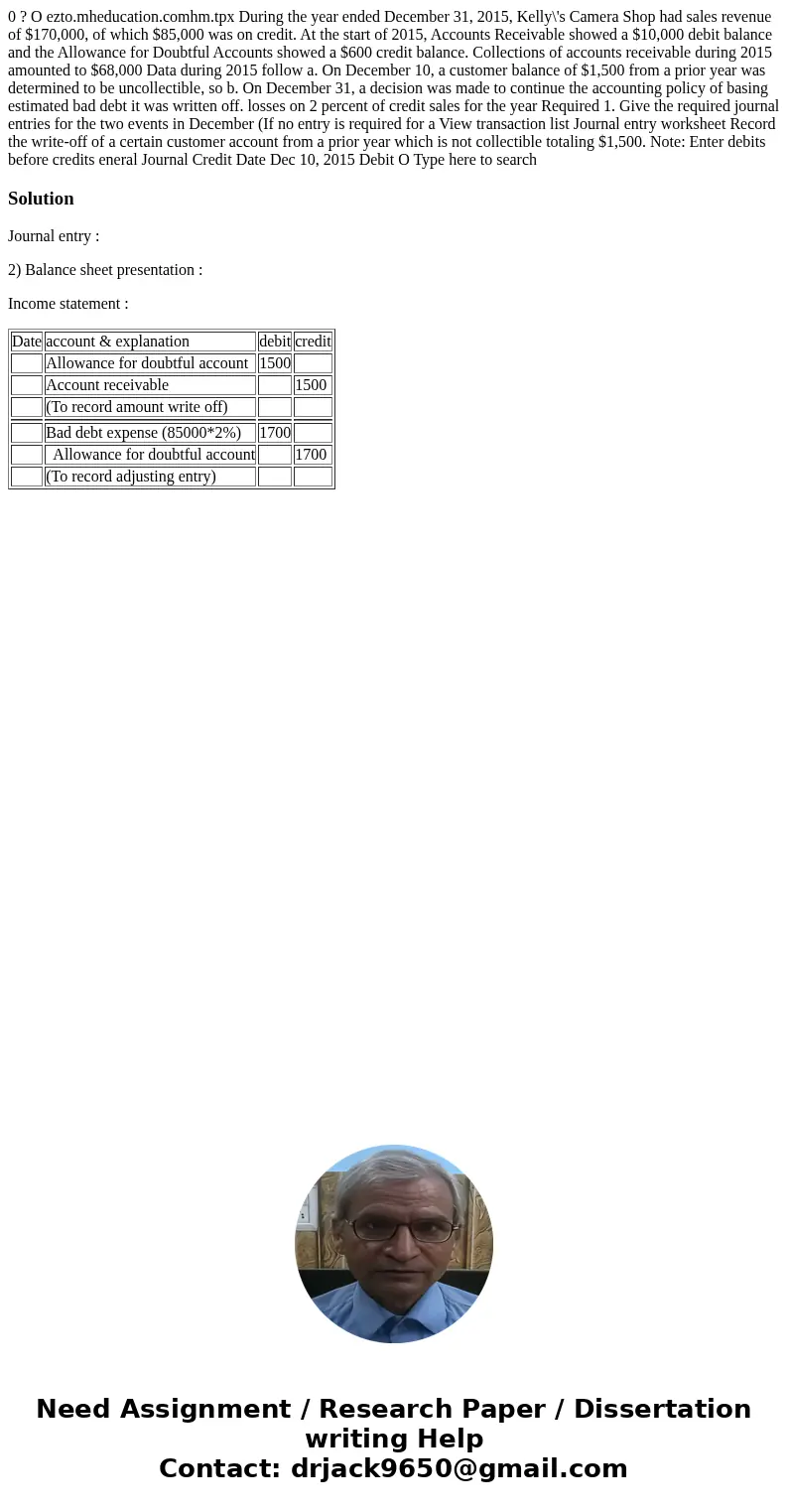

0 ? O ezto.mheducation.comhm.tpx During the year ended December 31, 2015, Kelly\'s Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2015, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of accounts receivable during 2015 amounted to $68,000 Data during 2015 follow a. On December 10, a customer balance of $1,500 from a prior year was determined to be uncollectible, so b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt it was written off. losses on 2 percent of credit sales for the year Required 1. Give the required journal entries for the two events in December (If no entry is required for a View transaction list Journal entry worksheet Record the write-off of a certain customer account from a prior year which is not collectible totaling $1,500. Note: Enter debits before credits eneral Journal Credit Date Dec 10, 2015 Debit O Type here to search

Solution

Journal entry :

2) Balance sheet presentation :

Income statement :

| Date | account & explanation | debit | credit |

| Allowance for doubtful account | 1500 | ||

| Account receivable | 1500 | ||

| (To record amount write off) | |||

| Bad debt expense (85000*2%) | 1700 | ||

| Allowance for doubtful account | 1700 | ||

| (To record adjusting entry) |

Homework Sourse

Homework Sourse