Course NUT4553101M Xe The Following Transactic C eztomhed

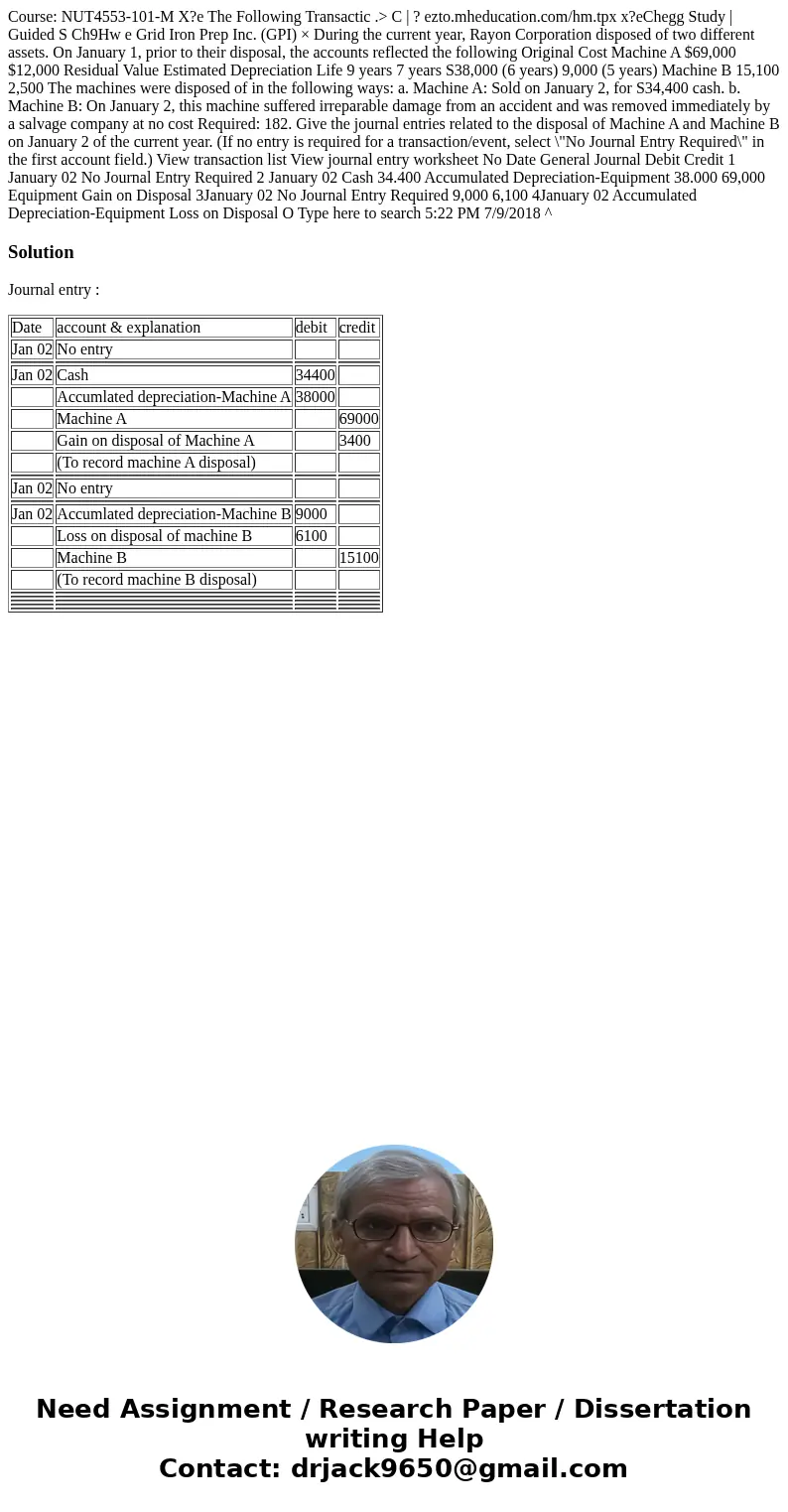

Course: NUT4553-101-M X?e The Following Transactic .> C | ? ezto.mheducation.com/hm.tpx x?eChegg Study | Guided S Ch9Hw e Grid Iron Prep Inc. (GPI) × During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following Original Cost Machine A $69,000 $12,000 Residual Value Estimated Depreciation Life 9 years 7 years S38,000 (6 years) 9,000 (5 years) Machine B 15,100 2,500 The machines were disposed of in the following ways: a. Machine A: Sold on January 2, for S34,400 cash. b. Machine B: On January 2, this machine suffered irreparable damage from an accident and was removed immediately by a salvage company at no cost Required: 182. Give the journal entries related to the disposal of Machine A and Machine B on January 2 of the current year. (If no entry is required for a transaction/event, select \"No Journal Entry Required\" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 January 02 No Journal Entry Required 2 January 02 Cash 34.400 Accumulated Depreciation-Equipment 38.000 69,000 Equipment Gain on Disposal 3January 02 No Journal Entry Required 9,000 6,100 4January 02 Accumulated Depreciation-Equipment Loss on Disposal O Type here to search 5:22 PM 7/9/2018 ^

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Jan 02 | No entry | ||

| Jan 02 | Cash | 34400 | |

| Accumlated depreciation-Machine A | 38000 | ||

| Machine A | 69000 | ||

| Gain on disposal of Machine A | 3400 | ||

| (To record machine A disposal) | |||

| Jan 02 | No entry | ||

| Jan 02 | Accumlated depreciation-Machine B | 9000 | |

| Loss on disposal of machine B | 6100 | ||

| Machine B | 15100 | ||

| (To record machine B disposal) | |||

Homework Sourse

Homework Sourse