Exercise 102 page 490 2 5uA 3 Part 500 is used in one of Mor

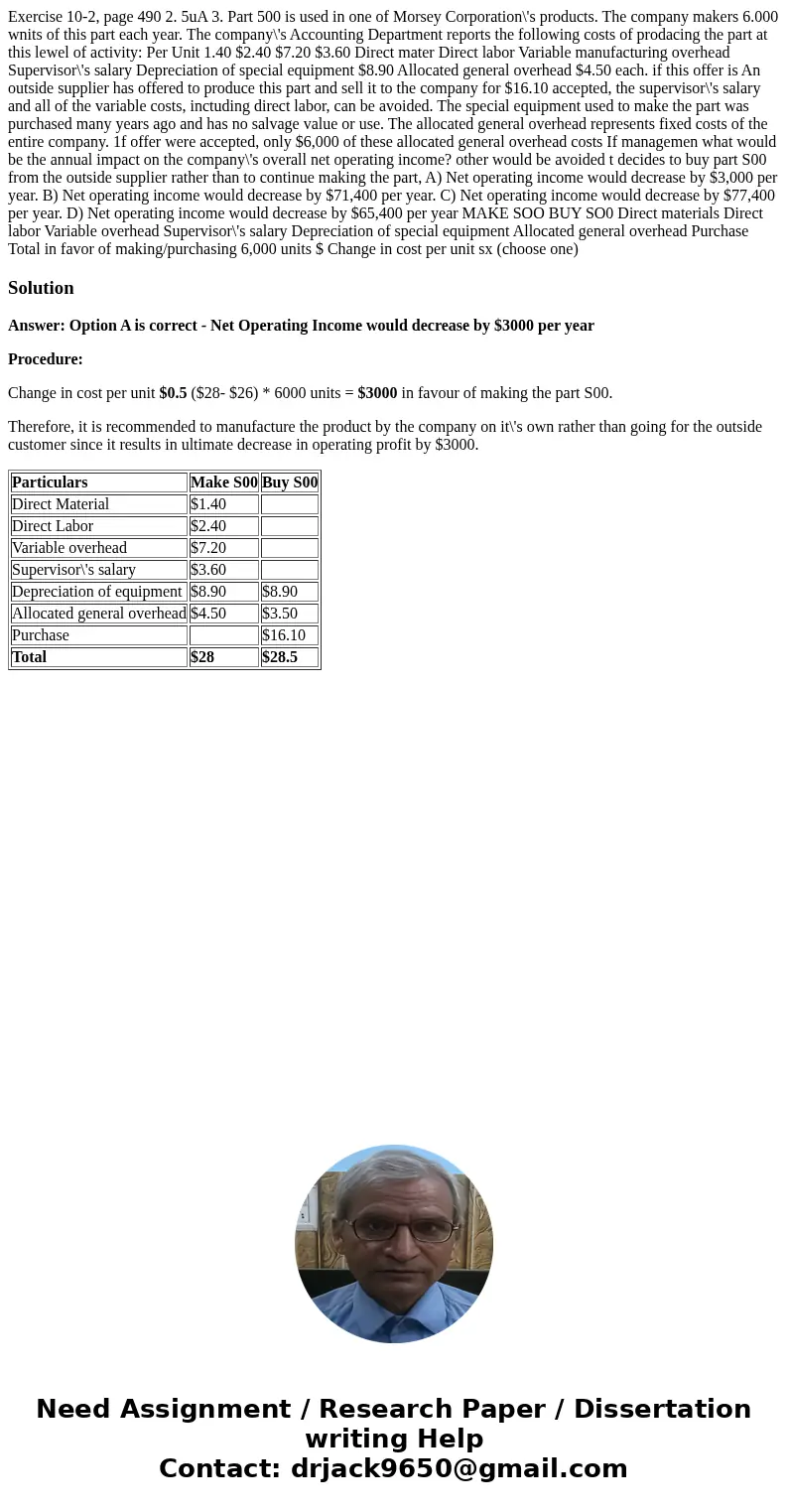

Exercise 10-2, page 490 2. 5uA 3. Part 500 is used in one of Morsey Corporation\'s products. The company makers 6.000 wnits of this part each year. The company\'s Accounting Department reports the following costs of prodacing the part at this lewel of activity: Per Unit 1.40 $2.40 $7.20 $3.60 Direct mater Direct labor Variable manufacturing overhead Supervisor\'s salary Depreciation of special equipment $8.90 Allocated general overhead $4.50 each. if this offer is An outside supplier has offered to produce this part and sell it to the company for $16.10 accepted, the supervisor\'s salary and all of the variable costs, inctuding direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or use. The allocated general overhead represents fixed costs of the entire company. 1f offer were accepted, only $6,000 of these allocated general overhead costs If managemen what would be the annual impact on the company\'s overall net operating income? other would be avoided t decides to buy part S00 from the outside supplier rather than to continue making the part, A) Net operating income would decrease by $3,000 per year. B) Net operating income would decrease by $71,400 per year. C) Net operating income would decrease by $77,400 per year. D) Net operating income would decrease by $65,400 per year MAKE SOO BUY SO0 Direct materials Direct labor Variable overhead Supervisor\'s salary Depreciation of special equipment Allocated general overhead Purchase Total in favor of making/purchasing 6,000 units $ Change in cost per unit sx (choose one)

Solution

Answer: Option A is correct - Net Operating Income would decrease by $3000 per year

Procedure:

Change in cost per unit $0.5 ($28- $26) * 6000 units = $3000 in favour of making the part S00.

Therefore, it is recommended to manufacture the product by the company on it\'s own rather than going for the outside customer since it results in ultimate decrease in operating profit by $3000.

| Particulars | Make S00 | Buy S00 |

| Direct Material | $1.40 | |

| Direct Labor | $2.40 | |

| Variable overhead | $7.20 | |

| Supervisor\'s salary | $3.60 | |

| Depreciation of equipment | $8.90 | $8.90 |

| Allocated general overhead | $4.50 | $3.50 |

| Purchase | $16.10 | |

| Total | $28 | $28.5 |

Homework Sourse

Homework Sourse