Viejol Corporation has collected the following information a

Viejol Corporation has collected the following information after its first year of sales. Sales were $1,250,000 on 125,000 units, selling expenses $240,000 (40% variable and 60% fixed), direct materials $512,000, direct labor $20,900, administrative expenses $276,000 (20% variable and 80% fixed), and manufacturing overhead $362,000 (70% variable and 30% fixed). Top management has asked you to do a CVP analysis so that it can make plans for the coming year. It has projected that unit sales will increase by 10% next year.

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

|

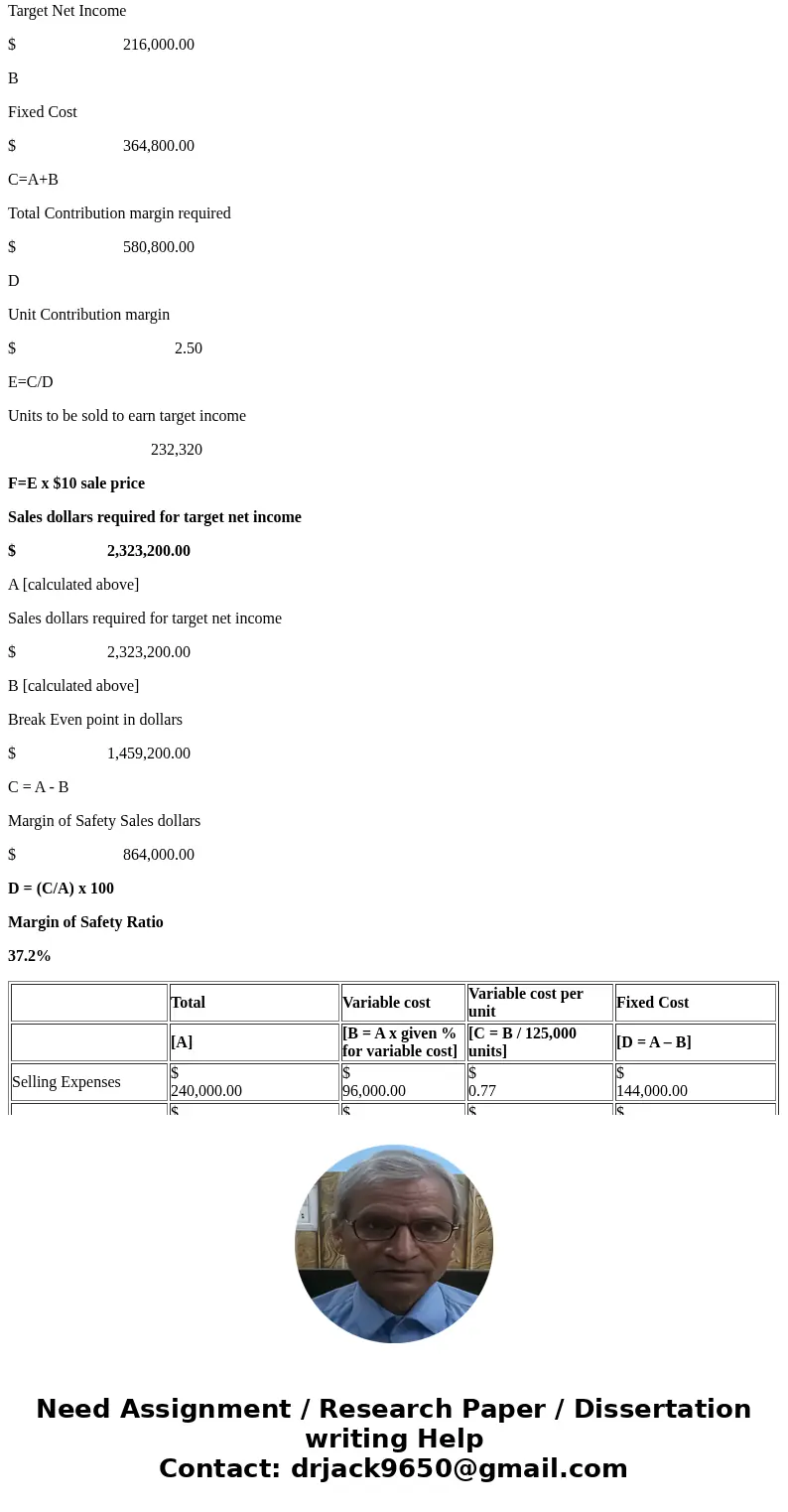

Solution

Answers

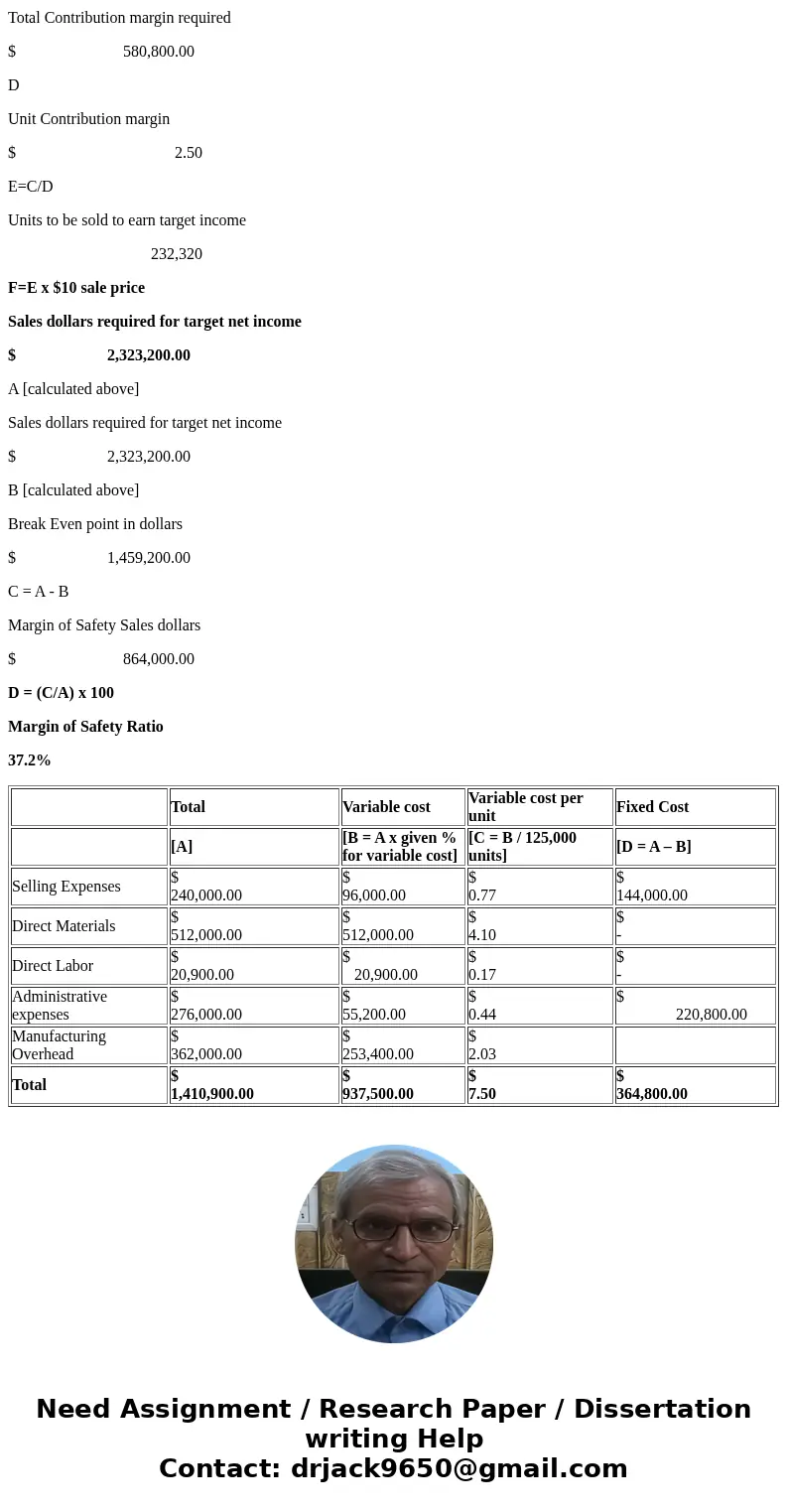

Total

Variable cost

Variable cost per unit

Fixed Cost

[A]

[B = A x given % for variable cost]

[C = B / 125,000 units]

[D = A – B]

Selling Expenses

$ 240,000.00

$ 96,000.00

$ 0.77

$ 144,000.00

Direct Materials

$ 512,000.00

$ 512,000.00

$ 4.10

$ -

Direct Labor

$ 20,900.00

$ 20,900.00

$ 0.17

$ -

Administrative expenses

$ 276,000.00

$ 55,200.00

$ 0.44

$ 220,800.00

Manufacturing Overhead

$ 362,000.00

$ 253,400.00

$ 2.03

Total

$ 1,410,900.00

$ 937,500.00

$ 7.50

$ 364,800.00

Working

Current Year

Projected Year

A

Sales Revenue

$ 1,250,000.00

$ 1,375,000.00

B

Variable cost

$ 937,500.00

$ 1,031,250.00

C=A - B

Contribution Margin

$ 312,500.00

$ 343,750.00

D [calculated above]

Fixed Cost

$ 364,800.00

A [calculated in workings]

Fixed Cost

$ 364,800.00

B

Sale Price per unit

$ 10.00

C [calculated in workings]

Unit Variable cost

$ 7.50

D = B - C

Unit Contribution margin

$ 2.50

E = A/D

Break Even Point in Units

145,920

F = E x B

Break Even point in dollars

$ 1,459,200.00

A

Target Net Income

$ 216,000.00

B

Fixed Cost

$ 364,800.00

C=A+B

Total Contribution margin required

$ 580,800.00

D

Unit Contribution margin

$ 2.50

E=C/D

Units to be sold to earn target income

232,320

F=E x $10 sale price

Sales dollars required for target net income

$ 2,323,200.00

A [calculated above]

Sales dollars required for target net income

$ 2,323,200.00

B [calculated above]

Break Even point in dollars

$ 1,459,200.00

C = A - B

Margin of Safety Sales dollars

$ 864,000.00

D = (C/A) x 100

Margin of Safety Ratio

37.2%

| Total | Variable cost | Variable cost per unit | Fixed Cost | |

| [A] | [B = A x given % for variable cost] | [C = B / 125,000 units] | [D = A – B] | |

| Selling Expenses | $ 240,000.00 | $ 96,000.00 | $ 0.77 | $ 144,000.00 |

| Direct Materials | $ 512,000.00 | $ 512,000.00 | $ 4.10 | $ - |

| Direct Labor | $ 20,900.00 | $ 20,900.00 | $ 0.17 | $ - |

| Administrative expenses | $ 276,000.00 | $ 55,200.00 | $ 0.44 | $ 220,800.00 |

| Manufacturing Overhead | $ 362,000.00 | $ 253,400.00 | $ 2.03 | |

| Total | $ 1,410,900.00 | $ 937,500.00 | $ 7.50 | $ 364,800.00 |

Homework Sourse

Homework Sourse