Discontinue a Segment Product AG52 has revenues of 194300 va

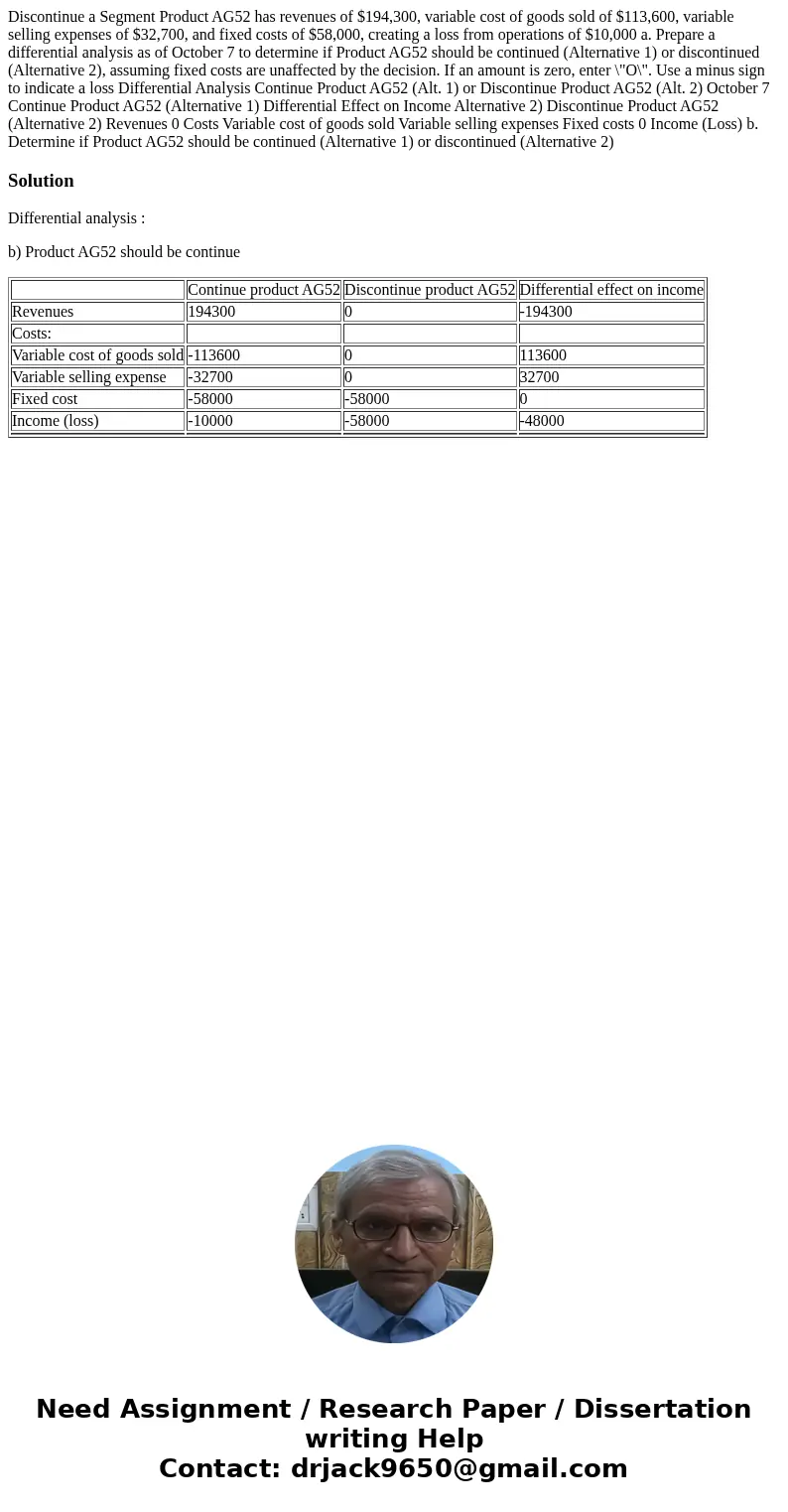

Discontinue a Segment Product AG52 has revenues of $194,300, variable cost of goods sold of $113,600, variable selling expenses of $32,700, and fixed costs of $58,000, creating a loss from operations of $10,000 a. Prepare a differential analysis as of October 7 to determine if Product AG52 should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision. If an amount is zero, enter \"O\". Use a minus sign to indicate a loss Differential Analysis Continue Product AG52 (Alt. 1) or Discontinue Product AG52 (Alt. 2) October 7 Continue Product AG52 (Alternative 1) Differential Effect on Income Alternative 2) Discontinue Product AG52 (Alternative 2) Revenues 0 Costs Variable cost of goods sold Variable selling expenses Fixed costs 0 Income (Loss) b. Determine if Product AG52 should be continued (Alternative 1) or discontinued (Alternative 2)

Solution

Differential analysis :

b) Product AG52 should be continue

| Continue product AG52 | Discontinue product AG52 | Differential effect on income | |

| Revenues | 194300 | 0 | -194300 |

| Costs: | |||

| Variable cost of goods sold | -113600 | 0 | 113600 |

| Variable selling expense | -32700 | 0 | 32700 |

| Fixed cost | -58000 | -58000 | 0 |

| Income (loss) | -10000 | -58000 | -48000 |

Homework Sourse

Homework Sourse