newconnectmheducationcom Hawkins Corporation B 810 PM Saved

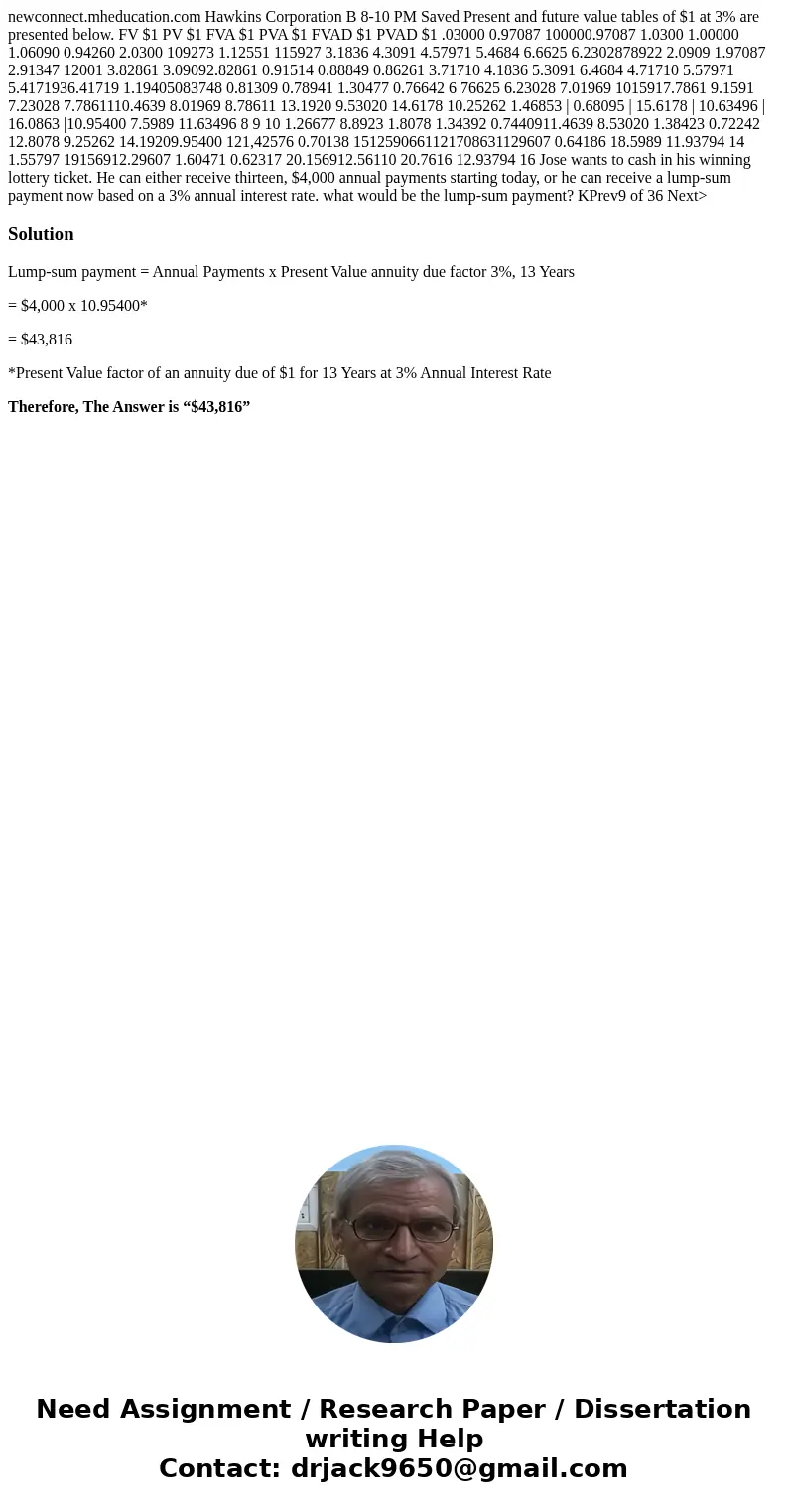

newconnect.mheducation.com Hawkins Corporation B 8-10 PM Saved Present and future value tables of $1 at 3% are presented below. FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 .03000 0.97087 100000.97087 1.0300 1.00000 1.06090 0.94260 2.0300 109273 1.12551 115927 3.1836 4.3091 4.57971 5.4684 6.6625 6.2302878922 2.0909 1.97087 2.91347 12001 3.82861 3.09092.82861 0.91514 0.88849 0.86261 3.71710 4.1836 5.3091 6.4684 4.71710 5.57971 5.4171936.41719 1.19405083748 0.81309 0.78941 1.30477 0.76642 6 76625 6.23028 7.01969 1015917.7861 9.1591 7.23028 7.7861110.4639 8.01969 8.78611 13.1920 9.53020 14.6178 10.25262 1.46853 | 0.68095 | 15.6178 | 10.63496 | 16.0863 |10.95400 7.5989 11.63496 8 9 10 1.26677 8.8923 1.8078 1.34392 0.7440911.4639 8.53020 1.38423 0.72242 12.8078 9.25262 14.19209.95400 121,42576 0.70138 1512590661121708631129607 0.64186 18.5989 11.93794 14 1.55797 19156912.29607 1.60471 0.62317 20.156912.56110 20.7616 12.93794 16 Jose wants to cash in his winning lottery ticket. He can either receive thirteen, $4,000 annual payments starting today, or he can receive a lump-sum payment now based on a 3% annual interest rate. what would be the lump-sum payment? KPrev9 of 36 Next>

Solution

Lump-sum payment = Annual Payments x Present Value annuity due factor 3%, 13 Years

= $4,000 x 10.95400*

= $43,816

*Present Value factor of an annuity due of $1 for 13 Years at 3% Annual Interest Rate

Therefore, The Answer is “$43,816”

Homework Sourse

Homework Sourse