Chapter 12 Hw 3 Han Products manufactures 34000 units of par

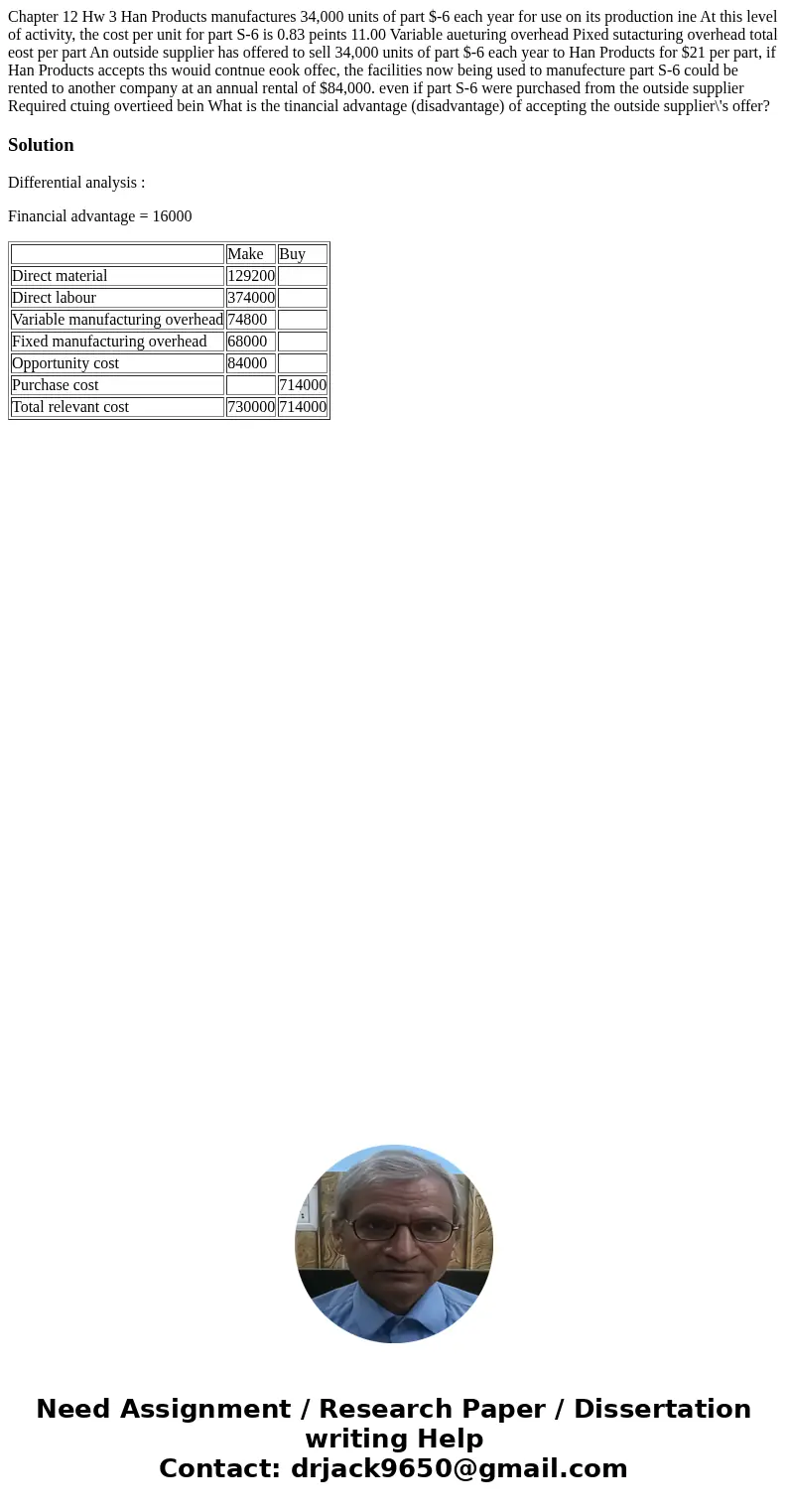

Chapter 12 Hw 3 Han Products manufactures 34,000 units of part $-6 each year for use on its production ine At this level of activity, the cost per unit for part S-6 is 0.83 peints 11.00 Variable aueturing overhead Pixed sutacturing overhead total eost per part An outside supplier has offered to sell 34,000 units of part $-6 each year to Han Products for $21 per part, if Han Products accepts ths wouid contnue eook offec, the facilities now being used to manufecture part S-6 could be rented to another company at an annual rental of $84,000. even if part S-6 were purchased from the outside supplier Required ctuing overtieed bein What is the tinancial advantage (disadvantage) of accepting the outside supplier\'s offer?

Solution

Differential analysis :

Financial advantage = 16000

| Make | Buy | |

| Direct material | 129200 | |

| Direct labour | 374000 | |

| Variable manufacturing overhead | 74800 | |

| Fixed manufacturing overhead | 68000 | |

| Opportunity cost | 84000 | |

| Purchase cost | 714000 | |

| Total relevant cost | 730000 | 714000 |

Homework Sourse

Homework Sourse