please with details and clear font QUESTION 1 AB C company i

please with details and clear font

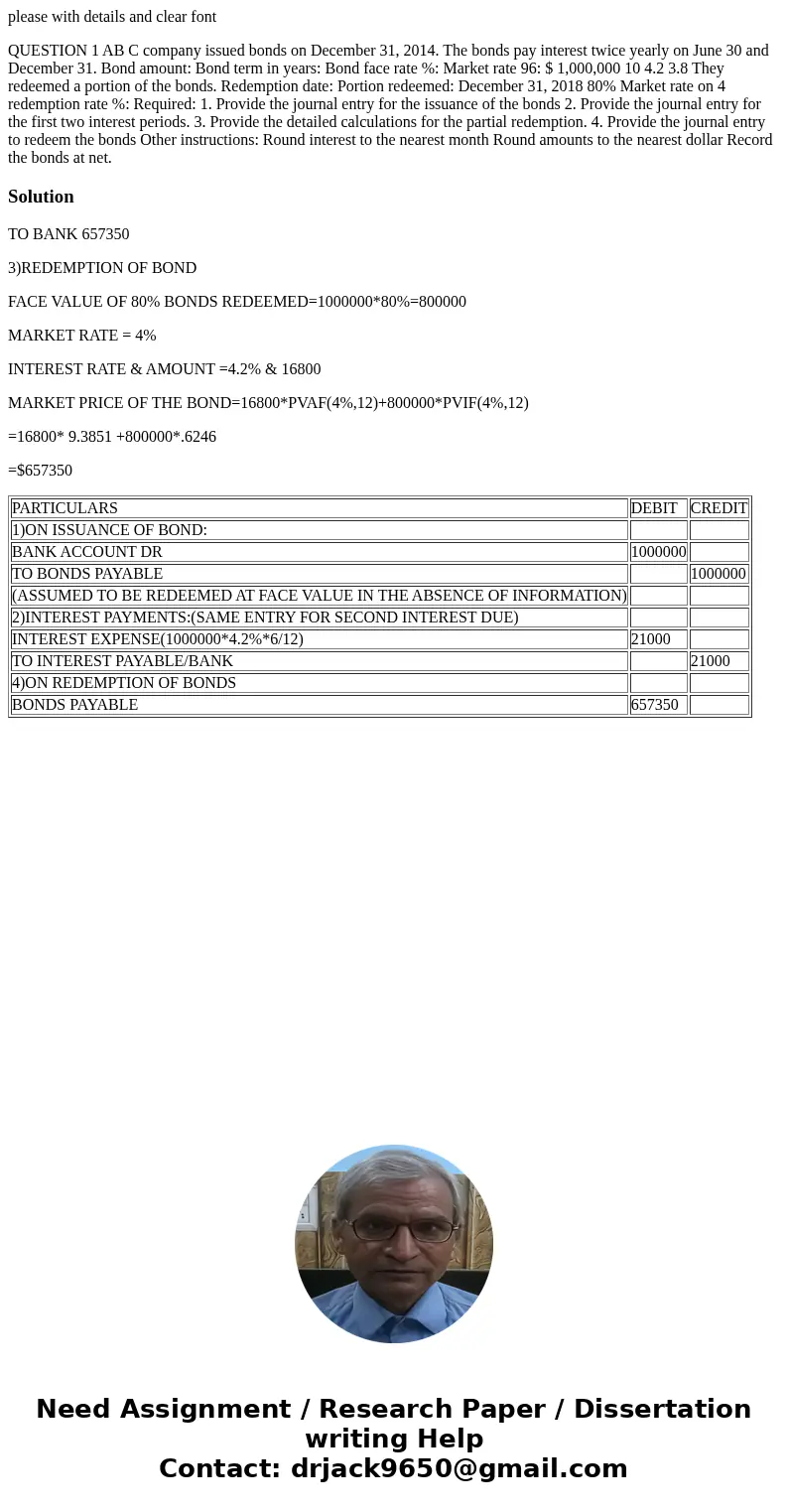

QUESTION 1 AB C company issued bonds on December 31, 2014. The bonds pay interest twice yearly on June 30 and December 31. Bond amount: Bond term in years: Bond face rate %: Market rate 96: $ 1,000,000 10 4.2 3.8 They redeemed a portion of the bonds. Redemption date: Portion redeemed: December 31, 2018 80% Market rate on 4 redemption rate %: Required: 1. Provide the journal entry for the issuance of the bonds 2. Provide the journal entry for the first two interest periods. 3. Provide the detailed calculations for the partial redemption. 4. Provide the journal entry to redeem the bonds Other instructions: Round interest to the nearest month Round amounts to the nearest dollar Record the bonds at net.Solution

TO BANK 657350

3)REDEMPTION OF BOND

FACE VALUE OF 80% BONDS REDEEMED=1000000*80%=800000

MARKET RATE = 4%

INTEREST RATE & AMOUNT =4.2% & 16800

MARKET PRICE OF THE BOND=16800*PVAF(4%,12)+800000*PVIF(4%,12)

=16800* 9.3851 +800000*.6246

=$657350

| PARTICULARS | DEBIT | CREDIT |

| 1)ON ISSUANCE OF BOND: | ||

| BANK ACCOUNT DR | 1000000 | |

| TO BONDS PAYABLE | 1000000 | |

| (ASSUMED TO BE REDEEMED AT FACE VALUE IN THE ABSENCE OF INFORMATION) | ||

| 2)INTEREST PAYMENTS:(SAME ENTRY FOR SECOND INTEREST DUE) | ||

| INTEREST EXPENSE(1000000*4.2%*6/12) | 21000 | |

| TO INTEREST PAYABLE/BANK | 21000 | |

| 4)ON REDEMPTION OF BONDS | ||

| BONDS PAYABLE | 657350 |

Homework Sourse

Homework Sourse