Brown Limited is a manufacturer of wallets The companys peak

Solution

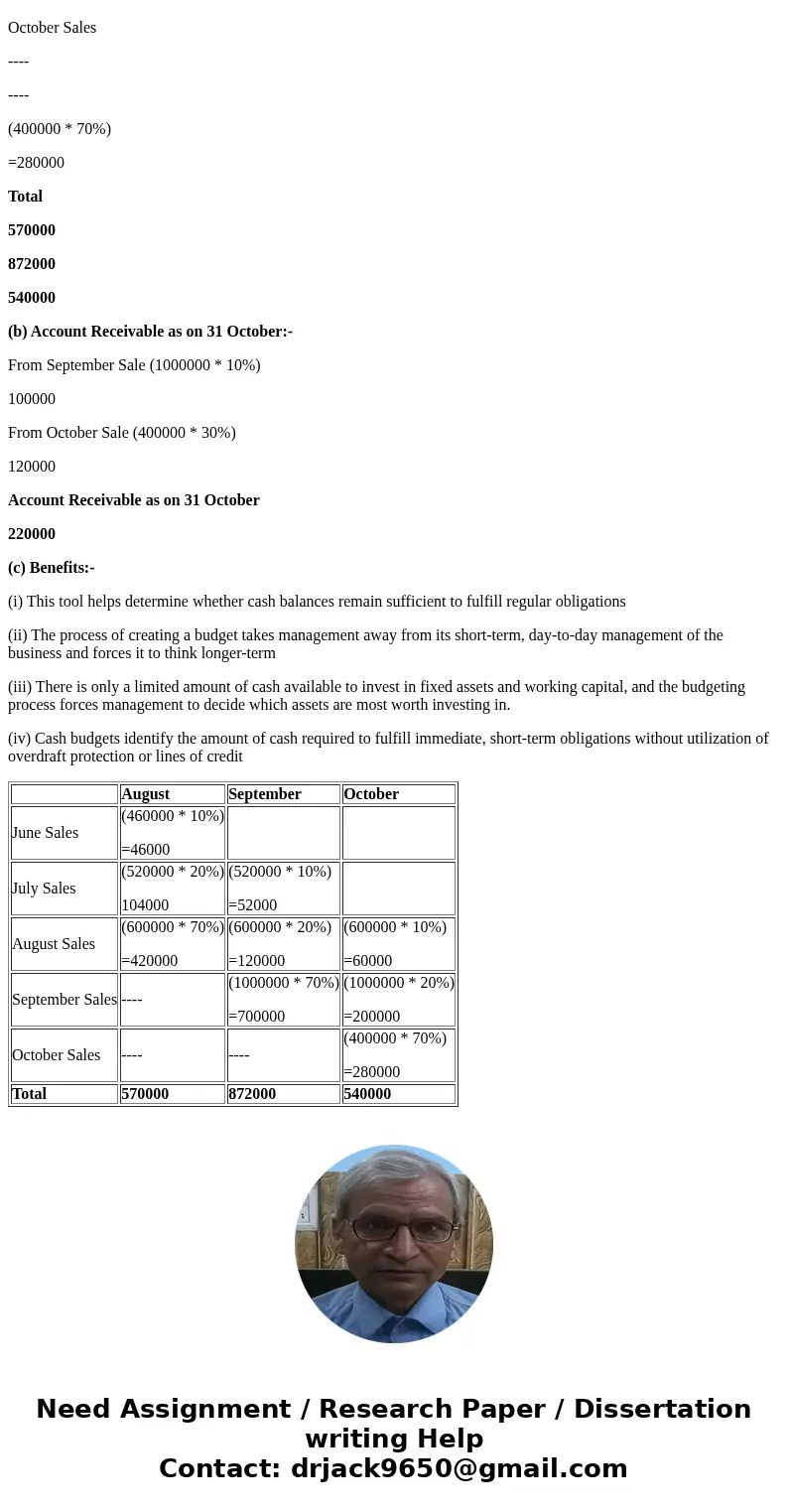

(a) Cash Collection Budget:-

August

September

October

June Sales

(460000 * 10%)

=46000

July Sales

(520000 * 20%)

104000

(520000 * 10%)

=52000

August Sales

(600000 * 70%)

=420000

(600000 * 20%)

=120000

(600000 * 10%)

=60000

September Sales

----

(1000000 * 70%)

=700000

(1000000 * 20%)

=200000

October Sales

----

----

(400000 * 70%)

=280000

Total

570000

872000

540000

(b) Account Receivable as on 31 October:-

From September Sale (1000000 * 10%)

100000

From October Sale (400000 * 30%)

120000

Account Receivable as on 31 October

220000

(c) Benefits:-

(i) This tool helps determine whether cash balances remain sufficient to fulfill regular obligations

(ii) The process of creating a budget takes management away from its short-term, day-to-day management of the business and forces it to think longer-term

(iii) There is only a limited amount of cash available to invest in fixed assets and working capital, and the budgeting process forces management to decide which assets are most worth investing in.

(iv) Cash budgets identify the amount of cash required to fulfill immediate, short-term obligations without utilization of overdraft protection or lines of credit

| August | September | October | |

| June Sales | (460000 * 10%) =46000 | ||

| July Sales | (520000 * 20%) 104000 | (520000 * 10%) =52000 | |

| August Sales | (600000 * 70%) =420000 | (600000 * 20%) =120000 | (600000 * 10%) =60000 |

| September Sales | ---- | (1000000 * 70%) =700000 | (1000000 * 20%) =200000 |

| October Sales | ---- | ---- | (400000 * 70%) =280000 |

| Total | 570000 | 872000 | 540000 |

Homework Sourse

Homework Sourse