25. Given the following accounts have normal balances, what is the total of Current Asocts? $1,000 Accounts Receivable $5,000 Prepaid Insurance $1,200 Land Equipment Accounts Payable Notes Payable due in 5 years 53,00 $2,000 $5,000 $10,000 a. $19,200 b. $22,200 c. $14,200 d. $7,200 e.$25,200 26. A company began the accounting period with $50,000 in owner\'s capital and ended it with $75,000 in owner\'s capital. The owner withdrew $30,000 during the period for personal usc. What was the company\'s net income or loss for the period? (Hints use either a T account or the format of the Statement of Owners Equity to solve this problem.) a. S55,000 net income b. $30,000 net loss c. $5,000 net loss d. $5,000 net income 27. Which of the following is an example of a temporary account? a. Prepaid Rent b. Unearned Revenues c. Wages Expense d. Accumulated Depreciation-Building 28. The difference between the balance of the Equipment account and its related Accumulated Depreciation account is a. the market value b. the carrying (or book) value c. a contra asset d. a liability 29. A business pays weekly salaries of $20,000 on Friday for each 5 day work adjusting entry at the end of a fiscal period ending on Thursday, December 31st? week. What is the a. debit Salary expense $4,000 credit Salaries Payable $4,000 b. debit Salary expense $16,000 credit Salaries Payable $16,000 c. debit Salary expense $4,000 credit Cash $4,000 d. debit Capital $16,000 credit Wages Payable $16,000

25) Option D : $7200

Cash 1000 + Accounts Receivable $5000 + Prepaid Insurance $1200 = S7200

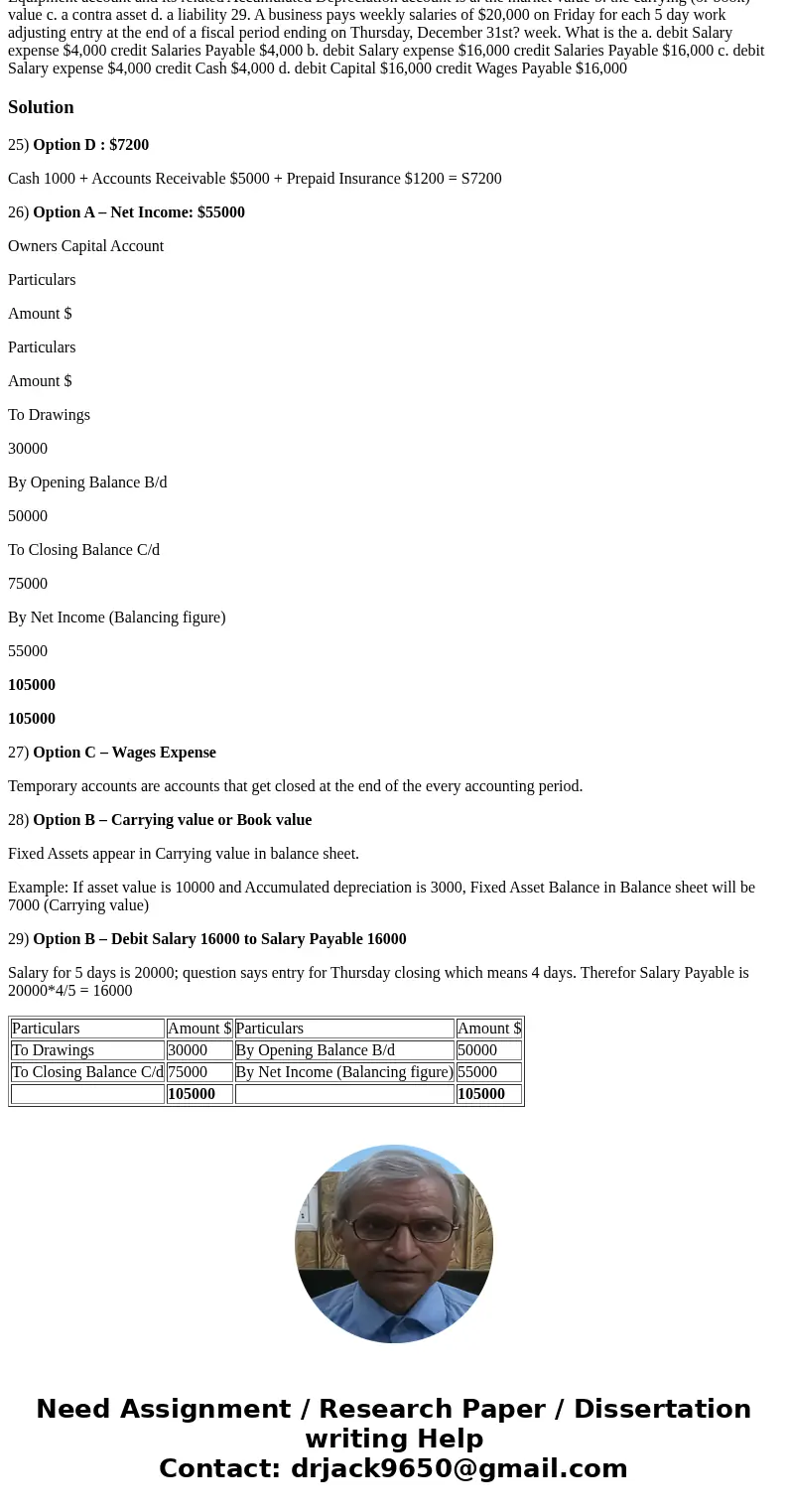

26) Option A – Net Income: $55000

Owners Capital Account

Particulars

Amount $

Particulars

Amount $

To Drawings

30000

By Opening Balance B/d

50000

To Closing Balance C/d

75000

By Net Income (Balancing figure)

55000

105000

105000

27) Option C – Wages Expense

Temporary accounts are accounts that get closed at the end of the every accounting period.

28) Option B – Carrying value or Book value

Fixed Assets appear in Carrying value in balance sheet.

Example: If asset value is 10000 and Accumulated depreciation is 3000, Fixed Asset Balance in Balance sheet will be 7000 (Carrying value)

29) Option B – Debit Salary 16000 to Salary Payable 16000

Salary for 5 days is 20000; question says entry for Thursday closing which means 4 days. Therefor Salary Payable is 20000*4/5 = 16000

| Particulars | Amount $ | Particulars | Amount $ |

| To Drawings | 30000 | By Opening Balance B/d | 50000 |

| To Closing Balance C/d | 75000 | By Net Income (Balancing figure) | 55000 |

| 105000 | | 105000 |

Homework Sourse

Homework Sourse