On January 31 Dewey Inc pays its one employee a check for th

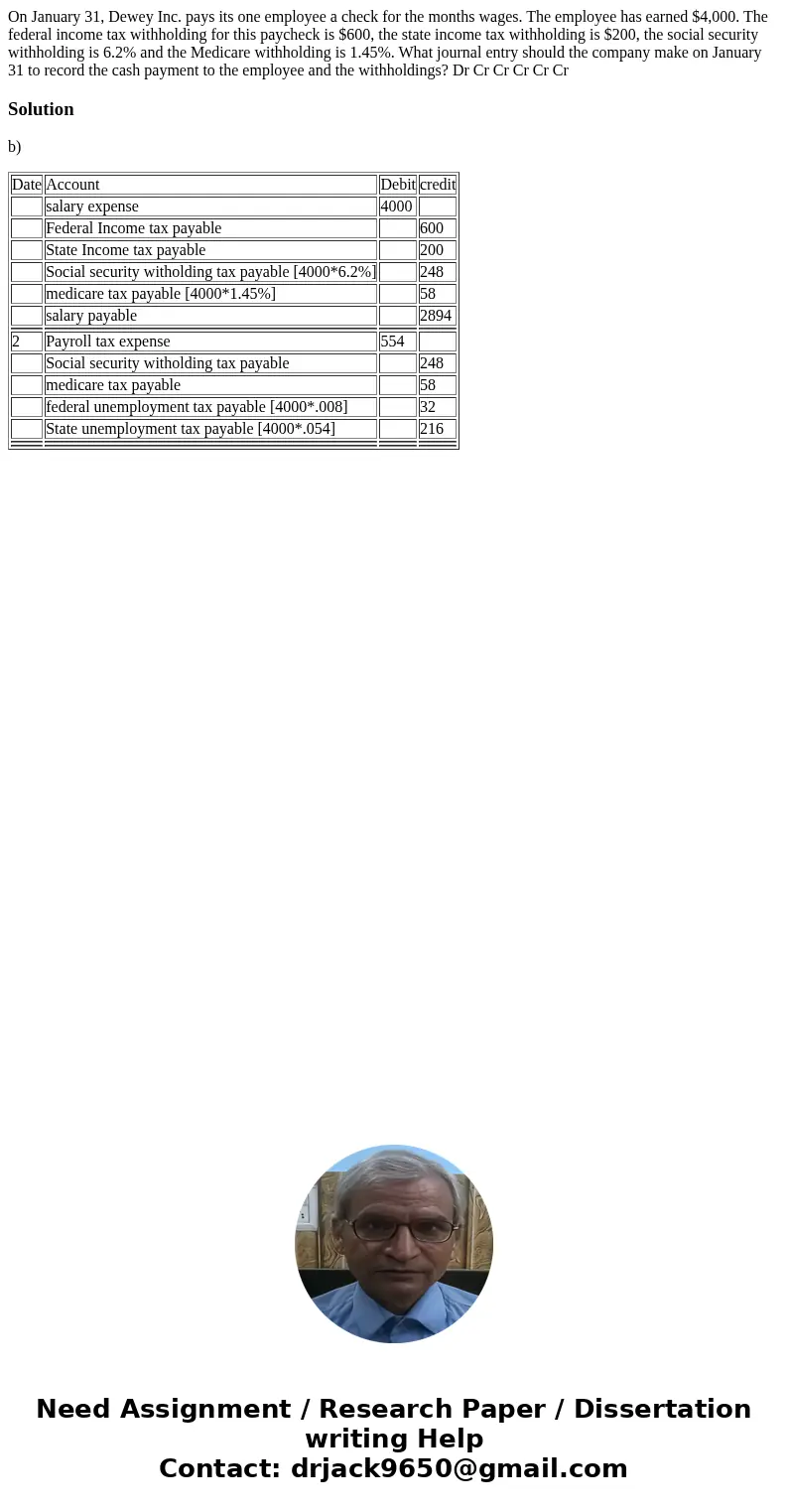

On January 31, Dewey Inc. pays its one employee a check for the months wages. The employee has earned $4,000. The federal income tax withholding for this paycheck is $600, the state income tax withholding is $200, the social security withholding is 6.2% and the Medicare withholding is 1.45%. What journal entry should the company make on January 31 to record the cash payment to the employee and the withholdings? Dr Cr Cr Cr Cr Cr

Solution

b)

| Date | Account | Debit | credit |

| salary expense | 4000 | ||

| Federal Income tax payable | 600 | ||

| State Income tax payable | 200 | ||

| Social security witholding tax payable [4000*6.2%] | 248 | ||

| medicare tax payable [4000*1.45%] | 58 | ||

| salary payable | 2894 | ||

| 2 | Payroll tax expense | 554 | |

| Social security witholding tax payable | 248 | ||

| medicare tax payable | 58 | ||

| federal unemployment tax payable [4000*.008] | 32 | ||

| State unemployment tax payable [4000*.054] | 216 | ||

Homework Sourse

Homework Sourse