thtml a search Check my wor omparing Traditional and Activ

Solution

Solution:

Part 1 --- Product Margin under traditional costing system

Product Margin is the difference between selling price and product cost.

Product cost is the cost of making the product.

Under traditional costing, product cost is the sum of direct materials, direct labor, variable manufacturing overhead and fixed manufacturing overhead.

In this costing system, overheads are allocated on the basis of predetermined overhead rate by taking actual activity level achieved by the company.

So, first of all we need to calculate the Predetermined Overhead Rate.

Allocation base is direct labor dollars.

Predetermined overhead rate = Total estimated manufacturing overhead $1,927,800 / Total Estimated Direct labor hours 113,400 = $17 per direct labor hour

Assigning Overheads per unit to each product

Xtreme = Number of Direct Labor Hours required per unit x Overhead Rate per DLH

= 1.70 DLHs x $17

= $28.90 per unit

Pathfinder = Number of Direct Labor Hours required per unit x Overhead Rate per DLH

= 1 DLH x $17

= $17 per unit

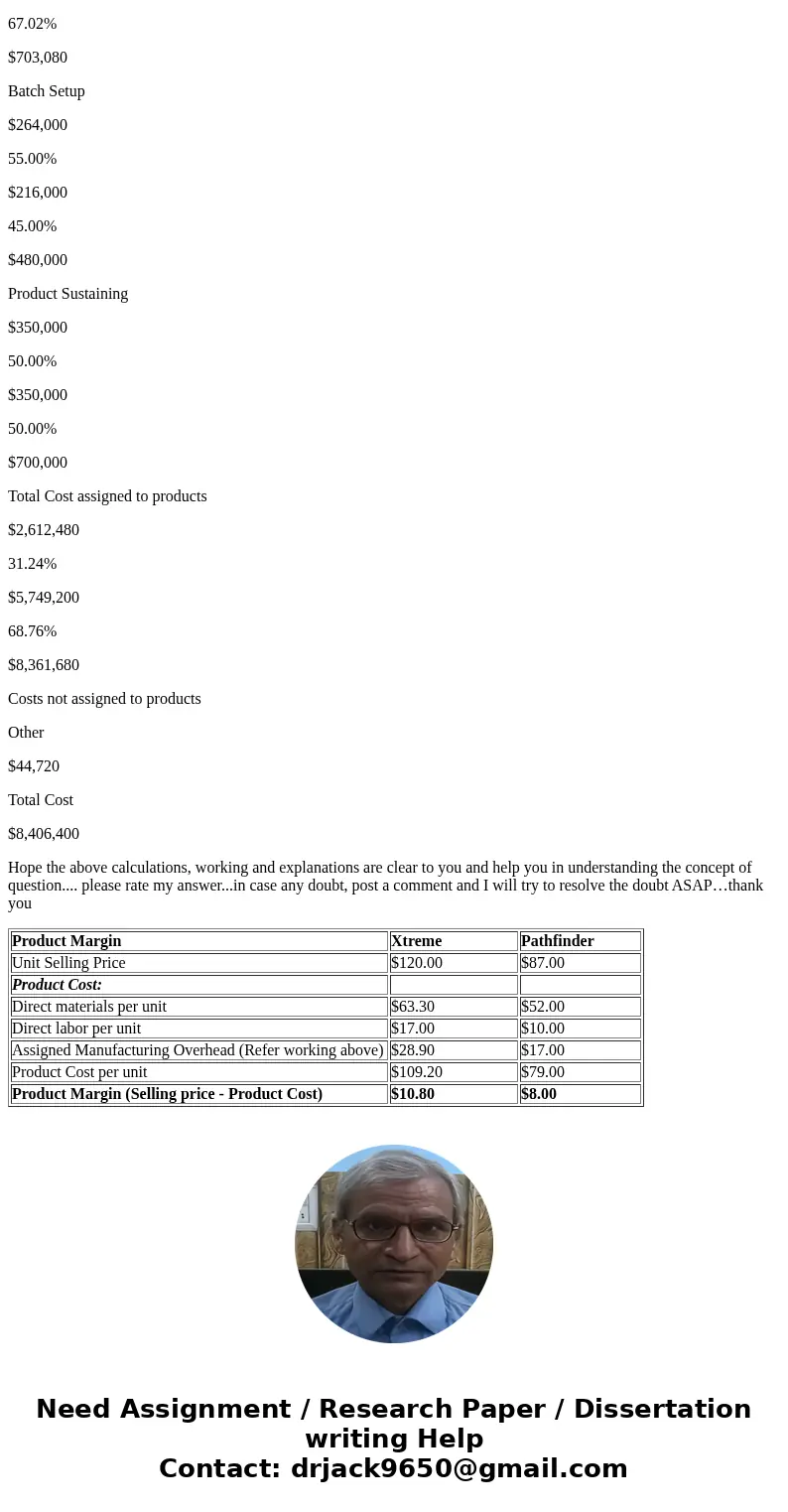

Calculation of Product Margin for each product

Product Margin

Xtreme

Pathfinder

Unit Selling Price

$120.00

$87.00

Product Cost:

Direct materials per unit

$63.30

$52.00

Direct labor per unit

$17.00

$10.00

Assigned Manufacturing Overhead (Refer working above)

$28.90

$17.00

Product Cost per unit

$109.20

$79.00

Product Margin (Selling price - Product Cost)

$10.80

$8.00

Part 2 --- Product Margin for each product under Activity Based Costing

Activity Based Costing System

- ABC is a costing method which identifies the activities in the organization and assigns the cost of each activity with resources to all the products or services according to the actual consumption of activity by the product or service.

- This system determines all the activities related to product or production process.

- This system calculates the cost of those activities which are related to product or production process and thereafter determine the cost of the product.

- In ABC costing the overhead costs are distributed to the product on the basis of benefit received from indirect activity.

- It helps to distribution of overheads on the basis of activities.

The Activity based overhead rate = Estimated Overheads related to the activity / Total Cost Driver per activity)

Calculation of Activity Rate and Assigning of Overheads to each product

Xtreme

Pathfinder

Activity Cost Pool

Expected Manufacturing Overhead Costs (A)

Expected Total Activity Cost Driver (B)

Activity Rate (C = A/B)

Activity Driver USAGE (H)

Overhead Assigned (C*H)

Activity Driver USAGE (E)

Overhead Assigned (C*E)

Supporting direct labors

$703,080

113,400

Direct labor hours

$6.20

per hour

37400

$231,880

76000

$471,200

Batch setups

$480,000

400

Setups

$1,200

per setup

220

$264,000

180

$216,000

Product sustaining

$700,000

2

Products

$350,000

per product

1

$350,000

1

$350,000

Other

$44,720

Total Assigned Manufacturing Overhead (A)

$1,927,800

$845,880

$1,037,200

/ Budgeted Production Volume (units) (B)

22000

76000

Applied Manufacturing Overhead Per Unit (A/B)

$38.45

$13.65

Product margin

Product Margin

Xtreme

Pathfinder

Unit Selling Price

$120.00

$87.00

Product Cost:

Direct materials per unit

$63.30

$52.00

Direct labor per unit

$17.00

$10.00

Assigned Manufacturing Overhead (Refer working above)

$38.45

$13.65

Product Cost per unit

$118.75

$75.65

Product Margin (Selling price - Product Cost)

$1.25

$11.35

Part 3 ---

Quantitative Comparison of Traditional and Activity Based Cost assignments

Xtreme

Pathfinder

Total Amount

Amount

% of Total Amount

Amount

% of Total Amount

Traditional Cost System

Direct materials

$1,392,600

26.06%

$3,952,000

73.94%

$5,344,600

Direct Labor

$374,000

32.98%

$760,000

67.02%

$1,134,000

Manufacturing Overhead

$635,800

32.98%

$1,292,000

67.02%

$1,927,800

Total Cost assigned to products

$2,402,400

28.58%

$6,004,000

71.42%

$8,406,400

Activity Based Costing System

Direct Costs:

Direct materials

$1,392,600

26.06%

$3,952,000

73.94%

$5,344,600

Direct Labor

$374,000

32.98%

$760,000

67.02%

$1,134,000

Indirect Costs:

Supporting direct labor

$231,880

32.98%

$471,200

67.02%

$703,080

Batch Setup

$264,000

55.00%

$216,000

45.00%

$480,000

Product Sustaining

$350,000

50.00%

$350,000

50.00%

$700,000

Total Cost assigned to products

$2,612,480

31.24%

$5,749,200

68.76%

$8,361,680

Costs not assigned to products

Other

$44,720

Total Cost

$8,406,400

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

| Product Margin | Xtreme | Pathfinder |

| Unit Selling Price | $120.00 | $87.00 |

| Product Cost: | ||

| Direct materials per unit | $63.30 | $52.00 |

| Direct labor per unit | $17.00 | $10.00 |

| Assigned Manufacturing Overhead (Refer working above) | $28.90 | $17.00 |

| Product Cost per unit | $109.20 | $79.00 |

| Product Margin (Selling price - Product Cost) | $10.80 | $8.00 |

Homework Sourse

Homework Sourse