Question 1 Amortization Schedule Year Cash Interest Amount U

Question 1

Amortization Schedule

Year

Cash

Interest

Amount

Unamortized

Carrying

Value

Date

Account Titles and Explanation

Debit

Credit

January 1, 2011

Date

Account Titles and Explanation

Debit

Credit

December 31, 2011

Date

Account Titles and Explanation

Debit

Credit

Solution

Answers

The Bonds are issued at a DISCOUNT. The Interest expense is more than cash interest paid.

Since the ‘amount unamortised’ column shows amortisation of different amount (decreasing trend) for each year by different amounts, the method used to amortise is EFFECTIVE INTEREST METHOD. Under Straight Line amortisation, the amortisation amount stays the same each year.

Stated rate = Cash Interest / Carrying value at the end = $15,240 / $ 152,400 = 10%

Effective Interest rate = Interest expensefor any year / Previous Carrying Valuefor previous year.

Year 2011: $ 16,221 / $ 135,177 = 12%

Year 2017: $ 17,177 / $ 143,140 = 12%

Hence Effective Interest rate = 12%

Date

Account Titles and Explanation

Debit

Credit

January 1, 2011

Cash

$ 135,177

Discount on Bonds Payable

$ 17,223

Bonds payable

$ 152,400

Date

Account Titles and Explanation

Debit

Credit

December 31, 2011

Interest expense

$ 16,221

Discounts on Bonds payable

$ 981

Interest payable

$ 15,240

Date

Account Titles and Explanation

Debit

Credit

January 1, 2018

Interest payable

$ 15,240

Cash

$ 15,240

December 31, 2018

Interest expense

$ 17,409

Discounts on Bonds payable

$ 2,169

Interest payable

$ 15,240

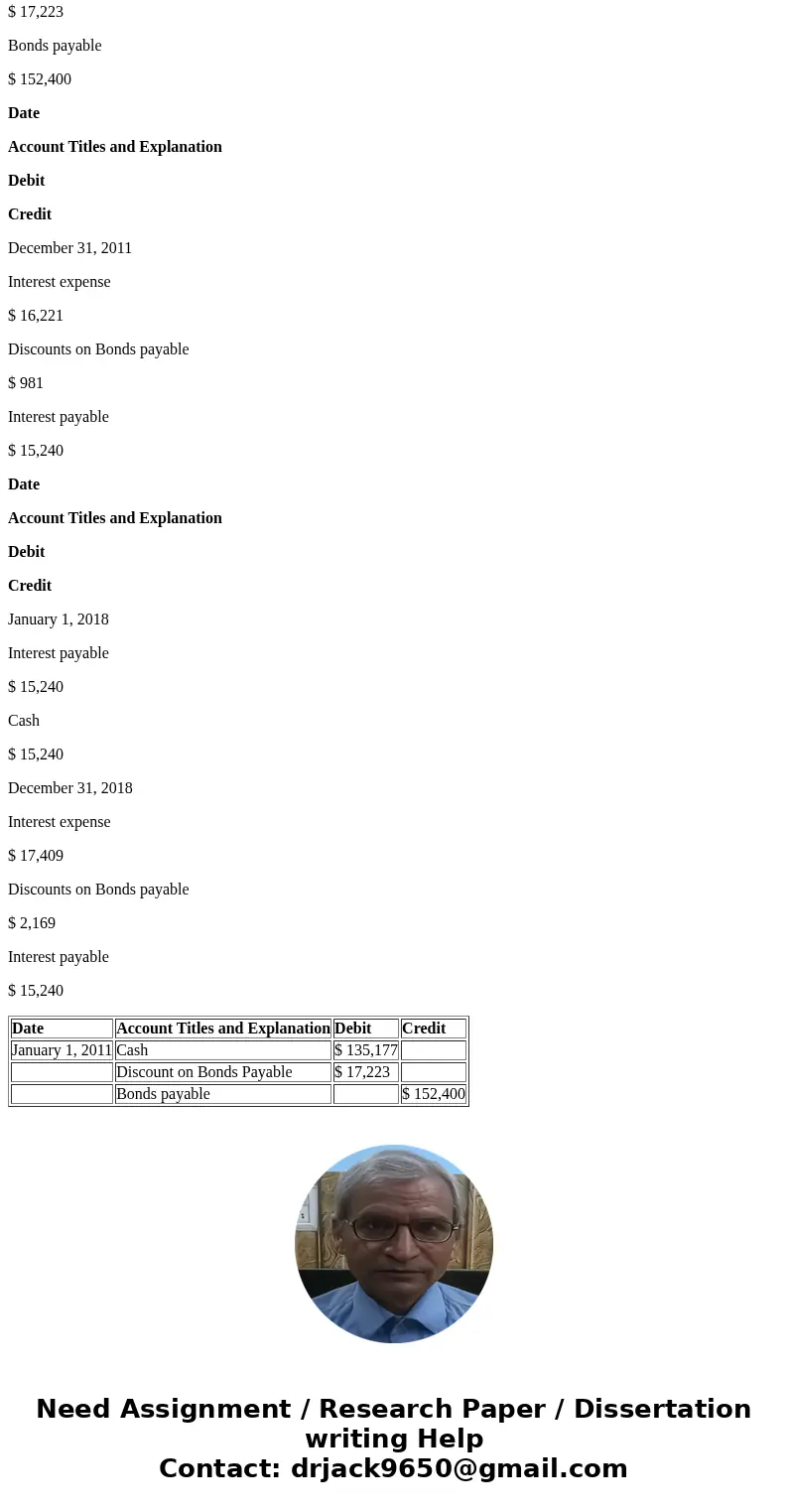

| Date | Account Titles and Explanation | Debit | Credit |

| January 1, 2011 | Cash | $ 135,177 | |

| Discount on Bonds Payable | $ 17,223 | ||

| Bonds payable | $ 152,400 |

Homework Sourse

Homework Sourse