Noble Bicycles of Glen Arbor Michigan is a small batch manuf

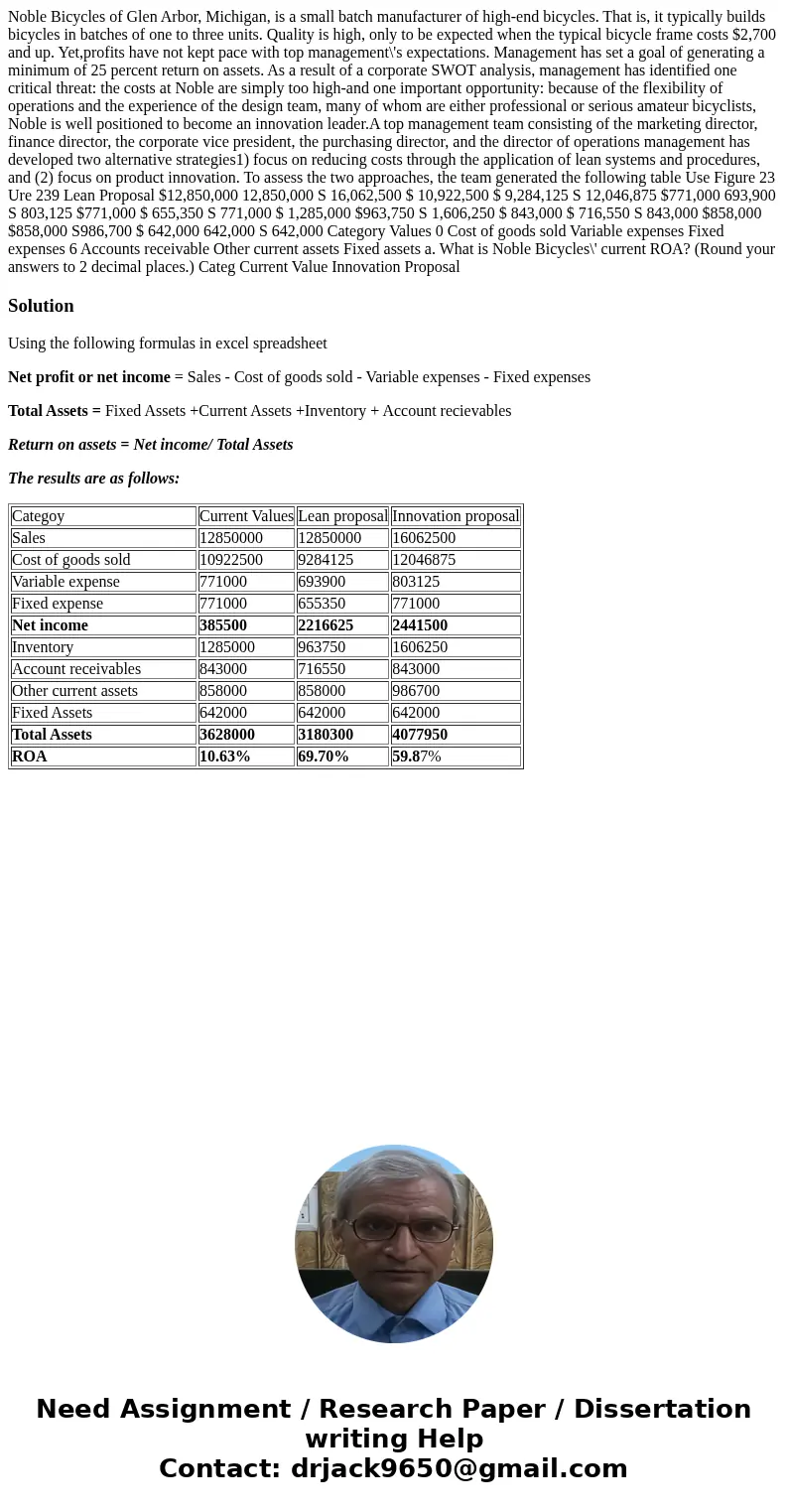

Noble Bicycles of Glen Arbor, Michigan, is a small batch manufacturer of high-end bicycles. That is, it typically builds bicycles in batches of one to three units. Quality is high, only to be expected when the typical bicycle frame costs $2,700 and up. Yet,profits have not kept pace with top management\'s expectations. Management has set a goal of generating a minimum of 25 percent return on assets. As a result of a corporate SWOT analysis, management has identified one critical threat: the costs at Noble are simply too high-and one important opportunity: because of the flexibility of operations and the experience of the design team, many of whom are either professional or serious amateur bicyclists, Noble is well positioned to become an innovation leader.A top management team consisting of the marketing director, finance director, the corporate vice president, the purchasing director, and the director of operations management has developed two alternative strategies1) focus on reducing costs through the application of lean systems and procedures, and (2) focus on product innovation. To assess the two approaches, the team generated the following table Use Figure 23 Ure 239 Lean Proposal $12,850,000 12,850,000 S 16,062,500 $ 10,922,500 $ 9,284,125 S 12,046,875 $771,000 693,900 S 803,125 $771,000 $ 655,350 S 771,000 $ 1,285,000 $963,750 S 1,606,250 $ 843,000 $ 716,550 S 843,000 $858,000 $858,000 S986,700 $ 642,000 642,000 S 642,000 Category Values 0 Cost of goods sold Variable expenses Fixed expenses 6 Accounts receivable Other current assets Fixed assets a. What is Noble Bicycles\' current ROA? (Round your answers to 2 decimal places.) Categ Current Value Innovation Proposal

Solution

Using the following formulas in excel spreadsheet

Net profit or net income = Sales - Cost of goods sold - Variable expenses - Fixed expenses

Total Assets = Fixed Assets +Current Assets +Inventory + Account recievables

Return on assets = Net income/ Total Assets

The results are as follows:

| Categoy | Current Values | Lean proposal | Innovation proposal |

| Sales | 12850000 | 12850000 | 16062500 |

| Cost of goods sold | 10922500 | 9284125 | 12046875 |

| Variable expense | 771000 | 693900 | 803125 |

| Fixed expense | 771000 | 655350 | 771000 |

| Net income | 385500 | 2216625 | 2441500 |

| Inventory | 1285000 | 963750 | 1606250 |

| Account receivables | 843000 | 716550 | 843000 |

| Other current assets | 858000 | 858000 | 986700 |

| Fixed Assets | 642000 | 642000 | 642000 |

| Total Assets | 3628000 | 3180300 | 4077950 |

| ROA | 10.63% | 69.70% | 59.87% |

Homework Sourse

Homework Sourse