Mary Walker president of Rusco Company considers 43000 to be

Solution

1)

Cash Flow from Operating Activities:

Amount

Amount

Sales

$ 1,260,000.00

Adjustment to a Cash Basis

Decrease In Accounts Receivables

$ 12,300.00

$ 1,272,300.00

Cost Of Goods Sold

$ 787,500.00

Adjustment to a Cash Basis

Increase In Inventory

$ 60,900.00

Decrease In Accounts Payable

$ 59,600.00

$ -908,000.00

Selling And Administrative Expenses

$ 337,050.00

Adjustment to a Cash Basis

Decrease In Prepaid Expenses

$ -19,500.00

Decrease in Accrued Liabilities

$ 9,300.00

$ -239,250.00

Depreciation Expenses

$ -87,600.00

Income taxes

$ 36,890.00

Adjustment to a Cash Basis

$ -36,890.00

$ 88,160.00

2)

Cash Flow Statement

For the year ended 31-07-2015

Cash Flow from Operating Activities:

Amount in

Amount

Cash Receipts From Customers

$ 1,272,300.00

Less-Cash Disbursment for

Suppliers

$ -908,000.00

Selling and Administrative Expenses

$ -239,250.00

Income taxes Expenses

$ -36,890.00

A. Cash Flow from Operating Activities

$ 88,160.00

Cash Flow from Investing Activities:

sale of Long Tern Investment

$ 107,500.00

Purchase of Equipment

$ -269,000.00

sale of Equipment

$ 62,400.00

B. Cash Used in Investing Activities

$ -99,100.00

Cash Flow from Financing Activities:

Issue of Common Stock

$ 21,000.00

Issue of Bonds

$ 269,000.00

Dividend paid

$ -301,660.00

C. Cash Flow from Financing Activities

$ -11,660.00

Increase (Decrease) in cash [A+B+C]

$ -22,600.00

Add: cash at the beginning [2014 balance]

$ 60,600.00

Cash at the end [2015 Balance]

$ 38,000.00

Equipment Account

Particulars

Amount

Particulars

Amount

To Balance B/d

$ 773,000.00

By Accumulated Depreciation (on sold Asset)

$ 63,000.00

To Bank (Balancinf Figure Equipment Purchased)

$ 269,000.00

By Cash

$ 62,400.00

By Loss on sale of Asset

$ 10,600.00

By balance C/d

$ 906,000.00

$ 1,042,000.00

$ 1,042,000.00

Accumulated Depreciation Account

Particulars

Amount

Particulars

Amount

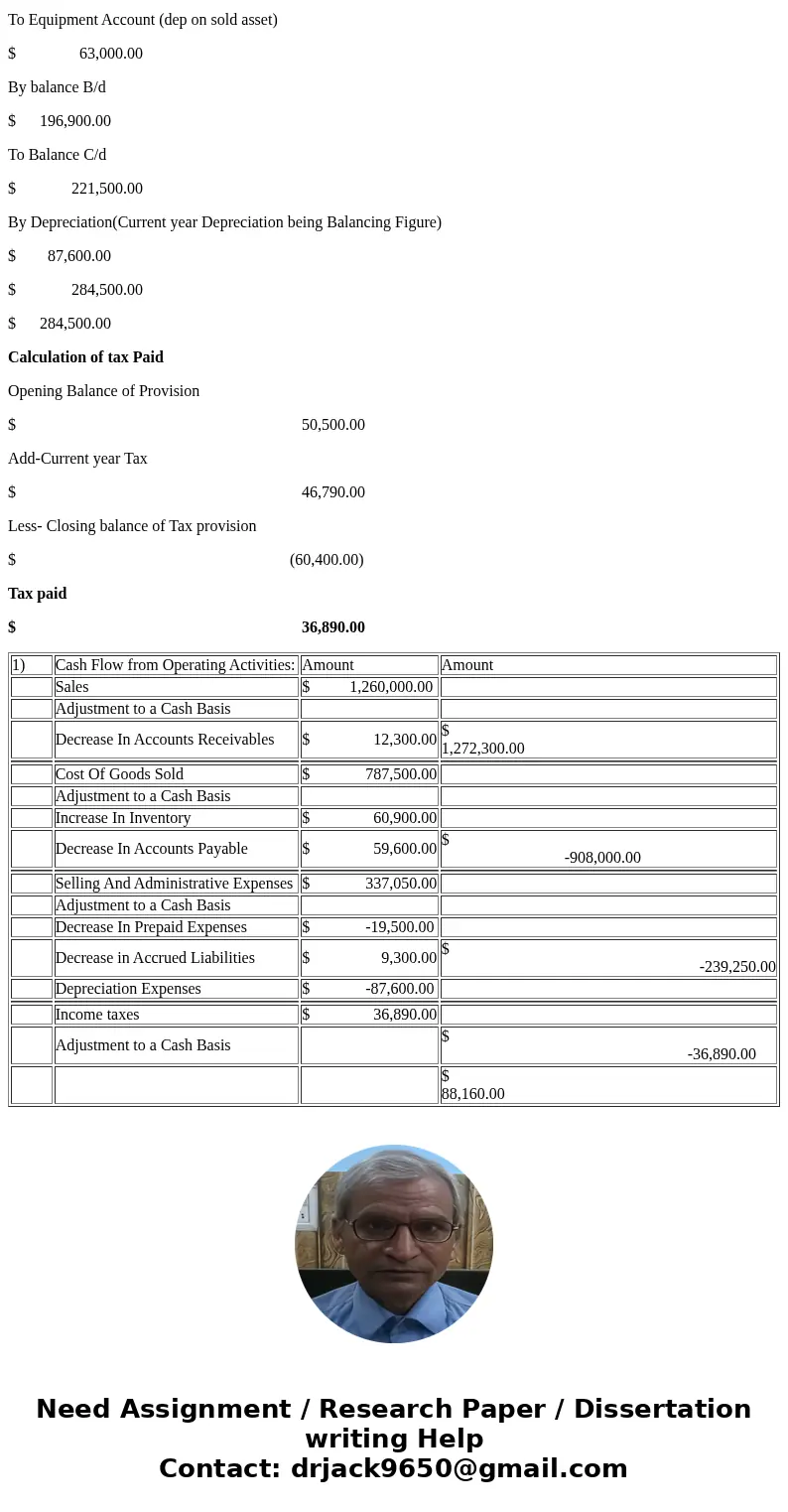

To Equipment Account (dep on sold asset)

$ 63,000.00

By balance B/d

$ 196,900.00

To Balance C/d

$ 221,500.00

By Depreciation(Current year Depreciation being Balancing Figure)

$ 87,600.00

$ 284,500.00

$ 284,500.00

Calculation of tax Paid

Opening Balance of Provision

$ 50,500.00

Add-Current year Tax

$ 46,790.00

Less- Closing balance of Tax provision

$ (60,400.00)

Tax paid

$ 36,890.00

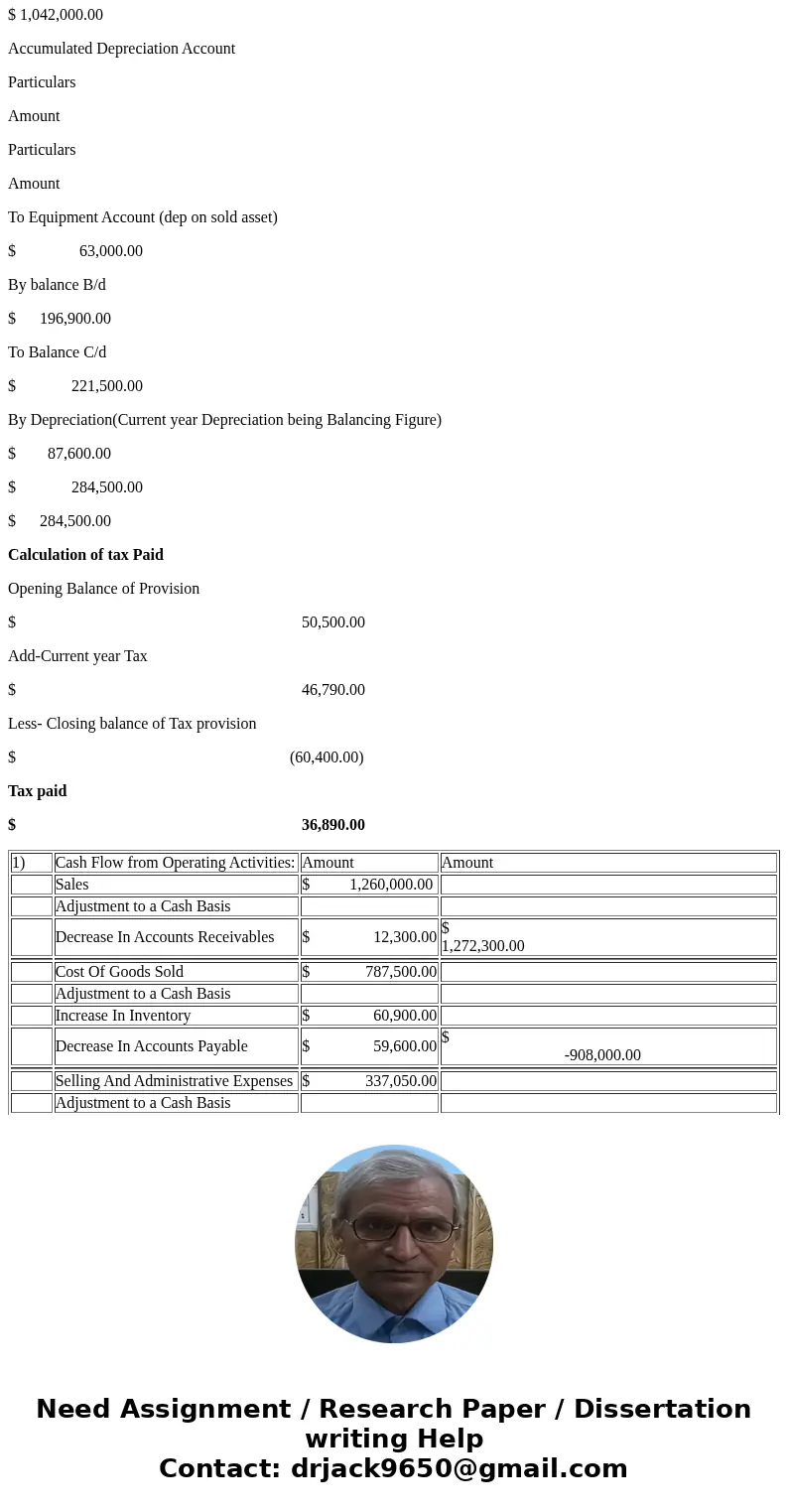

| 1) | Cash Flow from Operating Activities: | Amount | Amount |

| Sales | $ 1,260,000.00 | ||

| Adjustment to a Cash Basis | |||

| Decrease In Accounts Receivables | $ 12,300.00 | $ 1,272,300.00 | |

| Cost Of Goods Sold | $ 787,500.00 | ||

| Adjustment to a Cash Basis | |||

| Increase In Inventory | $ 60,900.00 | ||

| Decrease In Accounts Payable | $ 59,600.00 | $ -908,000.00 | |

| Selling And Administrative Expenses | $ 337,050.00 | ||

| Adjustment to a Cash Basis | |||

| Decrease In Prepaid Expenses | $ -19,500.00 | ||

| Decrease in Accrued Liabilities | $ 9,300.00 | $ -239,250.00 | |

| Depreciation Expenses | $ -87,600.00 | ||

| Income taxes | $ 36,890.00 | ||

| Adjustment to a Cash Basis | $ -36,890.00 | ||

| $ 88,160.00 |

Homework Sourse

Homework Sourse