OBJECTIVE 1 Cornerstone Exercise 42 Overhead Variances and T

OBJECTIVE 1 Cornerstone Exercise 4.2 Overhead Variances and Their Disposal Warner Company has the following data for the past year: Actual overhead Applied overhead CORNERSTONE 4.2 $470,000 Work-in-process inventory Finished goods inventory Cost of goods sold Total $100,000 200,000 200,000 S500,000 Warner uses the overhead control account to accumulate both actual and applied overhead. Required: 1 Calculate the overhead variance for the year and close it to cost of goods sold. 2. Assume the variance calculated is material. After prorating, close the variances to the appropriate accounts and provide the final ending balances of these accounts What if the variance is of the opposite sign calculated in Requirement1? Provide the appro- priate adjusting journal entries for Requirements 1 and 2 3.

Solution

1) Overhead variance = 470000-500000 = 30000 Over applied

Cost of goods sold after close overhead variance = 200000-30000 = 170000

2) If variance is material :

Work in process = 100000-(30000*20%) = 94000

Finished goods inventory = 200000-12000 = 188000

Cost of goods sold = 200000-12000 = 188000

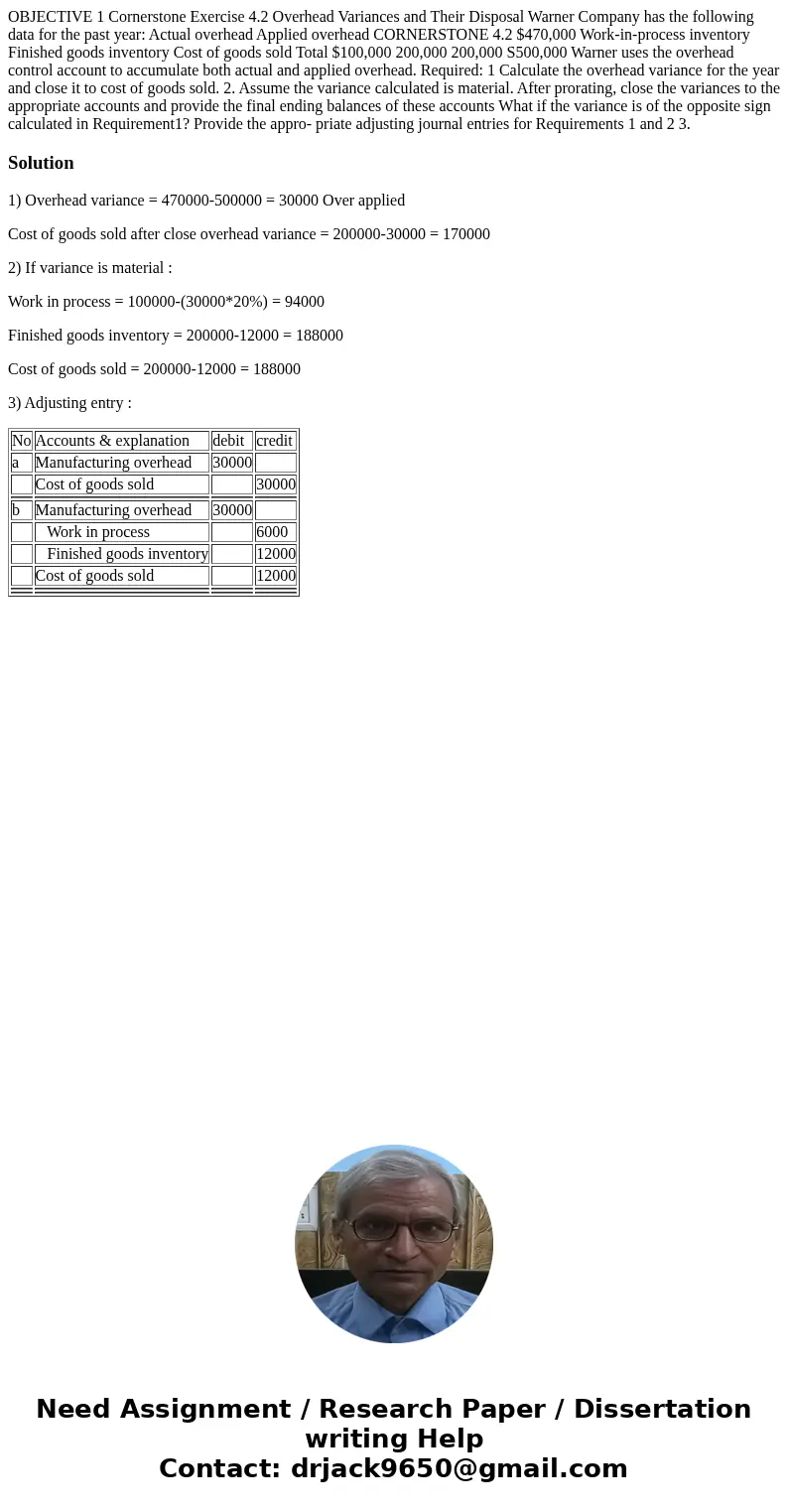

3) Adjusting entry :

| No | Accounts & explanation | debit | credit |

| a | Manufacturing overhead | 30000 | |

| Cost of goods sold | 30000 | ||

| b | Manufacturing overhead | 30000 | |

| Work in process | 6000 | ||

| Finished goods inventory | 12000 | ||

| Cost of goods sold | 12000 | ||

Homework Sourse

Homework Sourse