21 Bond Amortization LO3 On January 1 2012 Thompson Company

Solution

a)

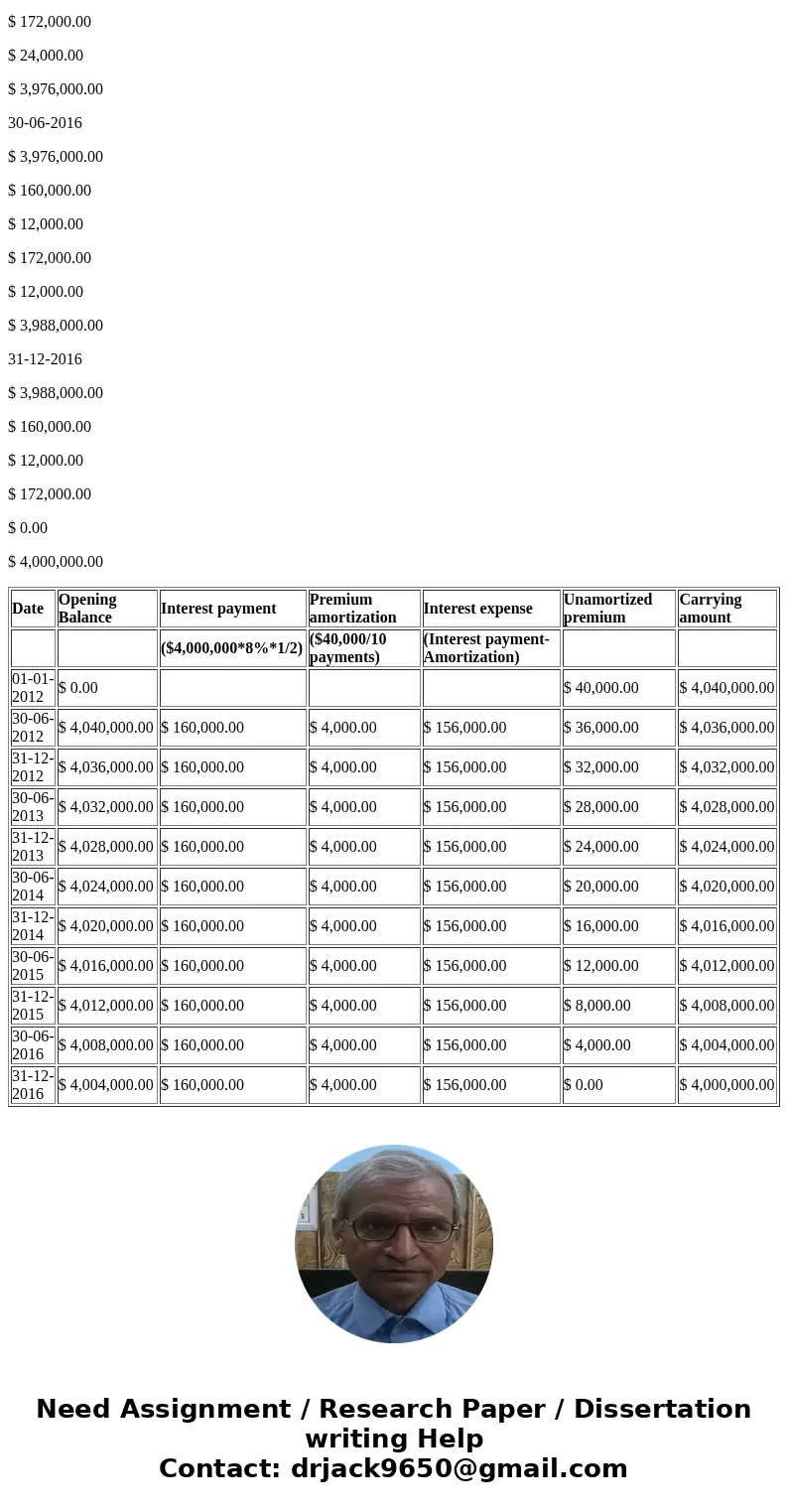

Date

Opening Balance

Interest payment

Premium amortization

Interest expense

Unamortized premium

Carrying amount

($4,000,000*8%*1/2)

($40,000/10 payments)

(Interest payment-Amortization)

01-01-2012

$ 0.00

$ 40,000.00

$ 4,040,000.00

30-06-2012

$ 4,040,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 36,000.00

$ 4,036,000.00

31-12-2012

$ 4,036,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 32,000.00

$ 4,032,000.00

30-06-2013

$ 4,032,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 28,000.00

$ 4,028,000.00

31-12-2013

$ 4,028,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 24,000.00

$ 4,024,000.00

30-06-2014

$ 4,024,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 20,000.00

$ 4,020,000.00

31-12-2014

$ 4,020,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 16,000.00

$ 4,016,000.00

30-06-2015

$ 4,016,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 12,000.00

$ 4,012,000.00

31-12-2015

$ 4,012,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 8,000.00

$ 4,008,000.00

30-06-2016

$ 4,008,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 4,000.00

$ 4,004,000.00

31-12-2016

$ 4,004,000.00

$ 160,000.00

$ 4,000.00

$ 156,000.00

$ 0.00

$ 4,000,000.00

b)

Date

Opening Balance

Interest payment

Discount amortization

Interest expense

Unamortized discount

Carrying amount

($4,000,000*8%*1/2)

($120,000/10 payments)

(Interest payment+Discount amortization)

01-01-2012

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 120,000.00

$ 3,880,000.00

30-06-2012

$ 3,880,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 108,000.00

$ 3,892,000.00

31-12-2012

$ 3,892,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 96,000.00

$ 3,904,000.00

30-06-2013

$ 3,904,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 84,000.00

$ 3,916,000.00

31-12-2013

$ 3,916,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 72,000.00

$ 3,928,000.00

30-06-2014

$ 3,928,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 60,000.00

$ 3,940,000.00

31-12-2014

$ 3,940,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 48,000.00

$ 3,952,000.00

30-06-2015

$ 3,952,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 36,000.00

$ 3,964,000.00

31-12-2015

$ 3,964,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 24,000.00

$ 3,976,000.00

30-06-2016

$ 3,976,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 12,000.00

$ 3,988,000.00

31-12-2016

$ 3,988,000.00

$ 160,000.00

$ 12,000.00

$ 172,000.00

$ 0.00

$ 4,000,000.00

| Date | Opening Balance | Interest payment | Premium amortization | Interest expense | Unamortized premium | Carrying amount |

| ($4,000,000*8%*1/2) | ($40,000/10 payments) | (Interest payment-Amortization) | ||||

| 01-01-2012 | $ 0.00 | $ 40,000.00 | $ 4,040,000.00 | |||

| 30-06-2012 | $ 4,040,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 36,000.00 | $ 4,036,000.00 |

| 31-12-2012 | $ 4,036,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 32,000.00 | $ 4,032,000.00 |

| 30-06-2013 | $ 4,032,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 28,000.00 | $ 4,028,000.00 |

| 31-12-2013 | $ 4,028,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 24,000.00 | $ 4,024,000.00 |

| 30-06-2014 | $ 4,024,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 20,000.00 | $ 4,020,000.00 |

| 31-12-2014 | $ 4,020,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 16,000.00 | $ 4,016,000.00 |

| 30-06-2015 | $ 4,016,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 12,000.00 | $ 4,012,000.00 |

| 31-12-2015 | $ 4,012,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 8,000.00 | $ 4,008,000.00 |

| 30-06-2016 | $ 4,008,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 4,000.00 | $ 4,004,000.00 |

| 31-12-2016 | $ 4,004,000.00 | $ 160,000.00 | $ 4,000.00 | $ 156,000.00 | $ 0.00 | $ 4,000,000.00 |

Homework Sourse

Homework Sourse