Practice 11 The company ntial pool of assets on which the gr

Solution

Asset

Cost of the Asset

Salvage Value

Depreciable value

Useful Life

Depreciation per year

Asset 1

$64,000

$4,000

$60,000

6

$10,000

Asset 2

$90,000

$10,000

$80,000

10

$8,000

Asset 3

$42,000

$6,000

$36,000

9

$4,000

Asset 4

$30,000

-

$30,000

5

$6,000

TOTAL

$2,26,000

$20,000

$2,06,000

$28,000

Composite Rate of Depreciation = [Total Depreciation Expense / Total Cost of the asset] x 100

= [$28,000 / 226,000] x 100

= 12.39% [Rounded to 2 Decimal places]

Journal Entry to record Depreciation Expense for the year

Account Titles and Explanation

Debit ($)

Credit($)

Depreciation Expense A/c

28,000

To Accumulated Depreciation A/c

28,000

[Entry To record depreciation for the year]

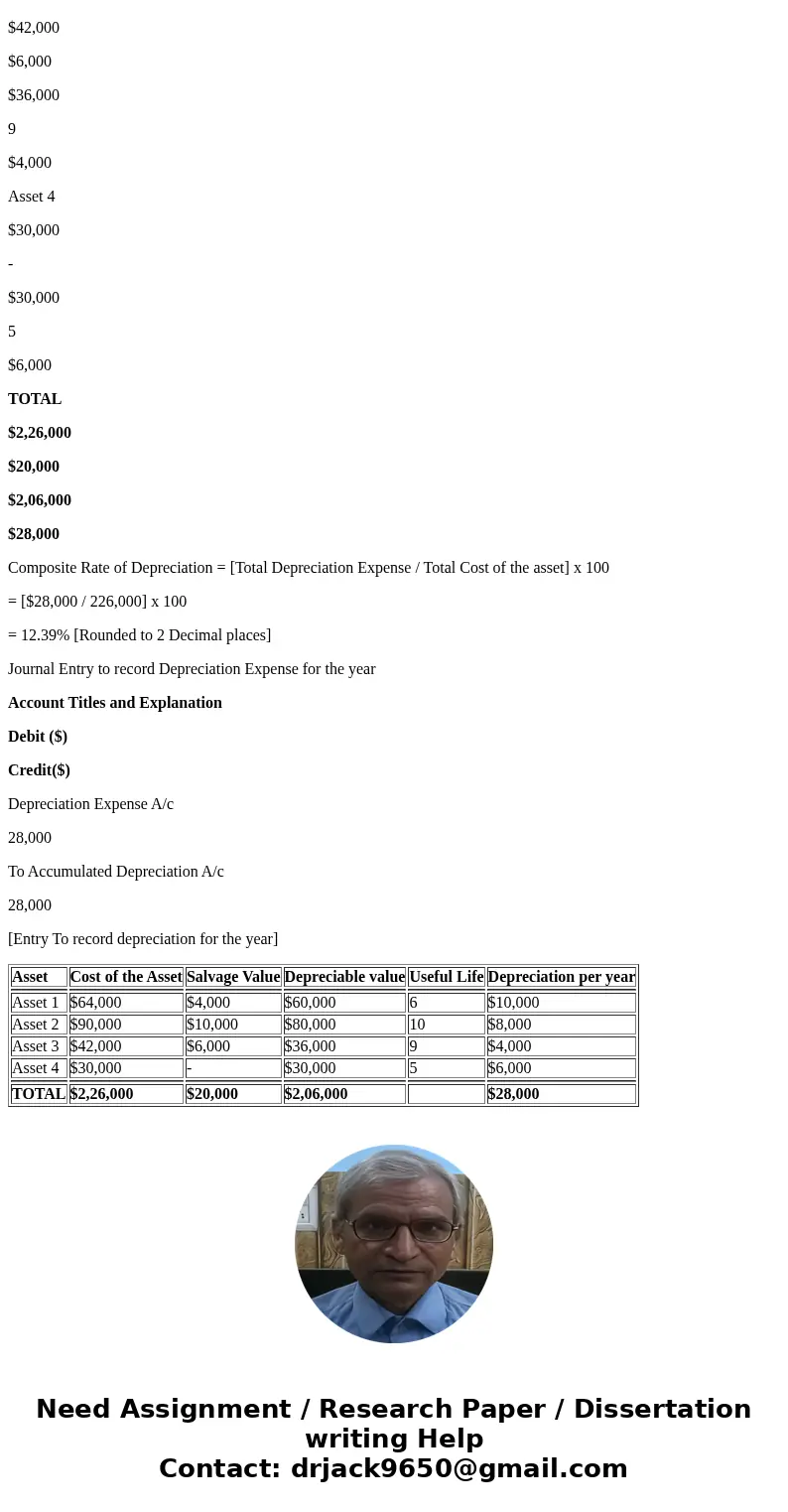

| Asset | Cost of the Asset | Salvage Value | Depreciable value | Useful Life | Depreciation per year |

| Asset 1 | $64,000 | $4,000 | $60,000 | 6 | $10,000 |

| Asset 2 | $90,000 | $10,000 | $80,000 | 10 | $8,000 |

| Asset 3 | $42,000 | $6,000 | $36,000 | 9 | $4,000 |

| Asset 4 | $30,000 | - | $30,000 | 5 | $6,000 |

| TOTAL | $2,26,000 | $20,000 | $2,06,000 | $28,000 |

Homework Sourse

Homework Sourse