v2cengagenovcom CengageNOiv21 online teaching an Calculator

Solution

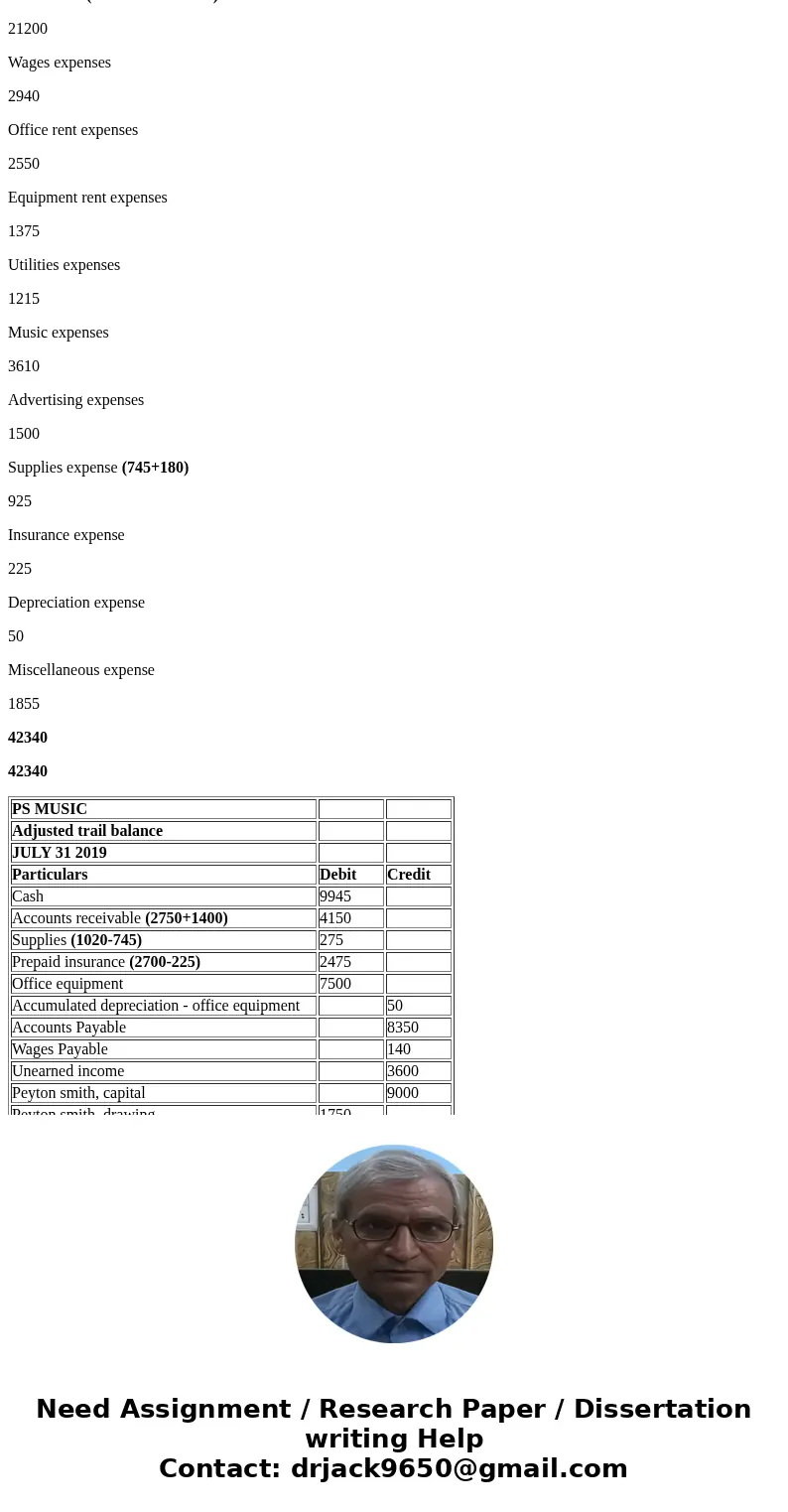

PS MUSIC

Adjusted trail balance

JULY 31 2019

Particulars

Debit

Credit

Cash

9945

Accounts receivable (2750+1400)

4150

Supplies (1020-745)

275

Prepaid insurance (2700-225)

2475

Office equipment

7500

Accumulated depreciation - office equipment

50

Accounts Payable

8350

Wages Payable

140

Unearned income

3600

Peyton smith, capital

9000

Peyton smith, drawing

1750

Fess earned (16200+3600+1400)

21200

Wages expenses

2940

Office rent expenses

2550

Equipment rent expenses

1375

Utilities expenses

1215

Music expenses

3610

Advertising expenses

1500

Supplies expense (745+180)

925

Insurance expense

225

Depreciation expense

50

Miscellaneous expense

1855

42340

42340

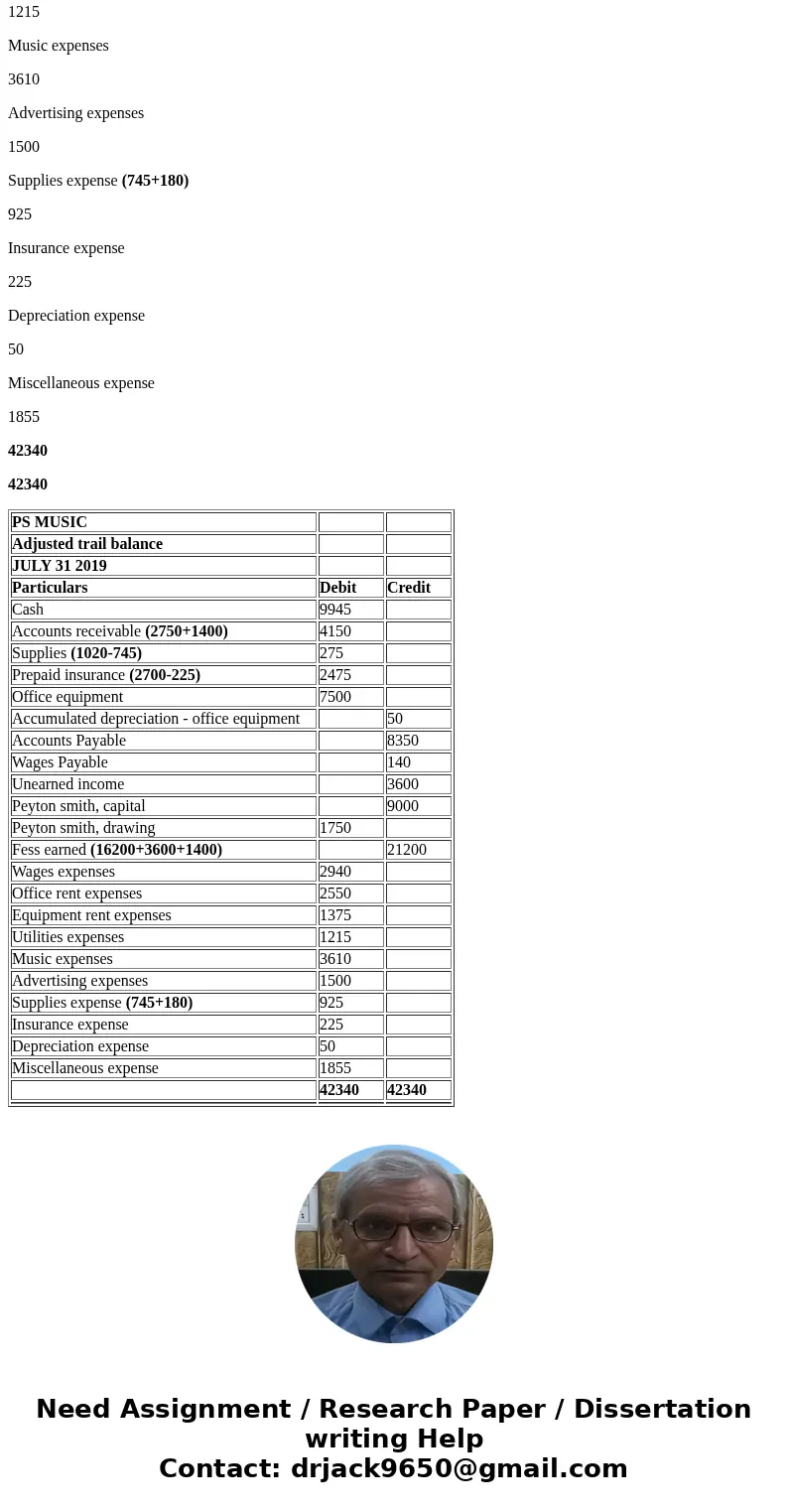

| PS MUSIC | ||

| Adjusted trail balance | ||

| JULY 31 2019 | ||

| Particulars | Debit | Credit |

| Cash | 9945 | |

| Accounts receivable (2750+1400) | 4150 | |

| Supplies (1020-745) | 275 | |

| Prepaid insurance (2700-225) | 2475 | |

| Office equipment | 7500 | |

| Accumulated depreciation - office equipment | 50 | |

| Accounts Payable | 8350 | |

| Wages Payable | 140 | |

| Unearned income | 3600 | |

| Peyton smith, capital | 9000 | |

| Peyton smith, drawing | 1750 | |

| Fess earned (16200+3600+1400) | 21200 | |

| Wages expenses | 2940 | |

| Office rent expenses | 2550 | |

| Equipment rent expenses | 1375 | |

| Utilities expenses | 1215 | |

| Music expenses | 3610 | |

| Advertising expenses | 1500 | |

| Supplies expense (745+180) | 925 | |

| Insurance expense | 225 | |

| Depreciation expense | 50 | |

| Miscellaneous expense | 1855 | |

| 42340 | 42340 | |

Homework Sourse

Homework Sourse