Calla Company produces skateboards that sell for 55 per unit

Solution

Answers

Total

Fixed

Variable

Variable cost per unit

Direct Material

$ 8,76,360.00

$ -

$ 8,76,360.00

$ 10.900000

Direct labor

$ 6,19,080.00

$ -

$ 6,19,080.00

$ 7.700000

Overhead

$ 9,42,000.00

$ 4,71,000.00

$ 4,71,000.00

$ 5.858209

Selling expenses

$ 5,48,000.00

$ 1,64,400.00

$ 3,83,600.00

$ 4.771144

Administrative expenses

$ 4,61,000.00

$ 4,61,000.00

$ -

$ -

Total

$ 34,46,440.00

$ 10,96,400.00

$ 23,50,040.00

$ 29.229353

Normal Volume: 80400 units

Units

per unit

Variable amount

Fixed Amount

Total Amount

Sales revenue

80400

$ 55.000000

$ 44,22,000

$ -

$ 44,22,000

Cost & Expenses:

Direct Material

80400

$ 10.900000

$ 8,76,360

$ -

$ 8,76,360

Direct labor

80400

$ 7.700000

$ 6,19,080

$ -

$ 6,19,080

Overhead

80400

$ 5.858209

$ 4,71,000

$ 4,71,000

$ 9,42,000

Selling expenses

80400

$ 4.771144

$ 3,83,600

$ 1,64,400

$ 5,48,000

Administrative expenses

80400

$ -

$ -

$ 4,61,000

$ 4,61,000

Note: Selling expense per unit will be different from above, and administrative fixed cost is to increase from above

Additional Volume: 14600 units

Units

per unit

Variable amount

Fixed Amount

Total Amount

Sales revenue

14600

$ 55.000000

$ 8,03,000

$ -

$ 8,03,000

Cost & Expenses:

Direct Material

14600

$ 10.900000

$ 1,59,140

$ -

$ 1,59,140

Direct labor

14600

$ 7.700000

$ 1,12,420

$ -

$ 1,12,420

Overhead

14600

$ 5.858209

$ 85,530

$ -

$ 85,530

Selling expenses

14600

$ 7.271144

$ 1,06,159

$ -

$ 1,06,159

Administrative expenses

14600

$ -

$ -

$ 820

$ 820

Normal Volume

Additional Volume

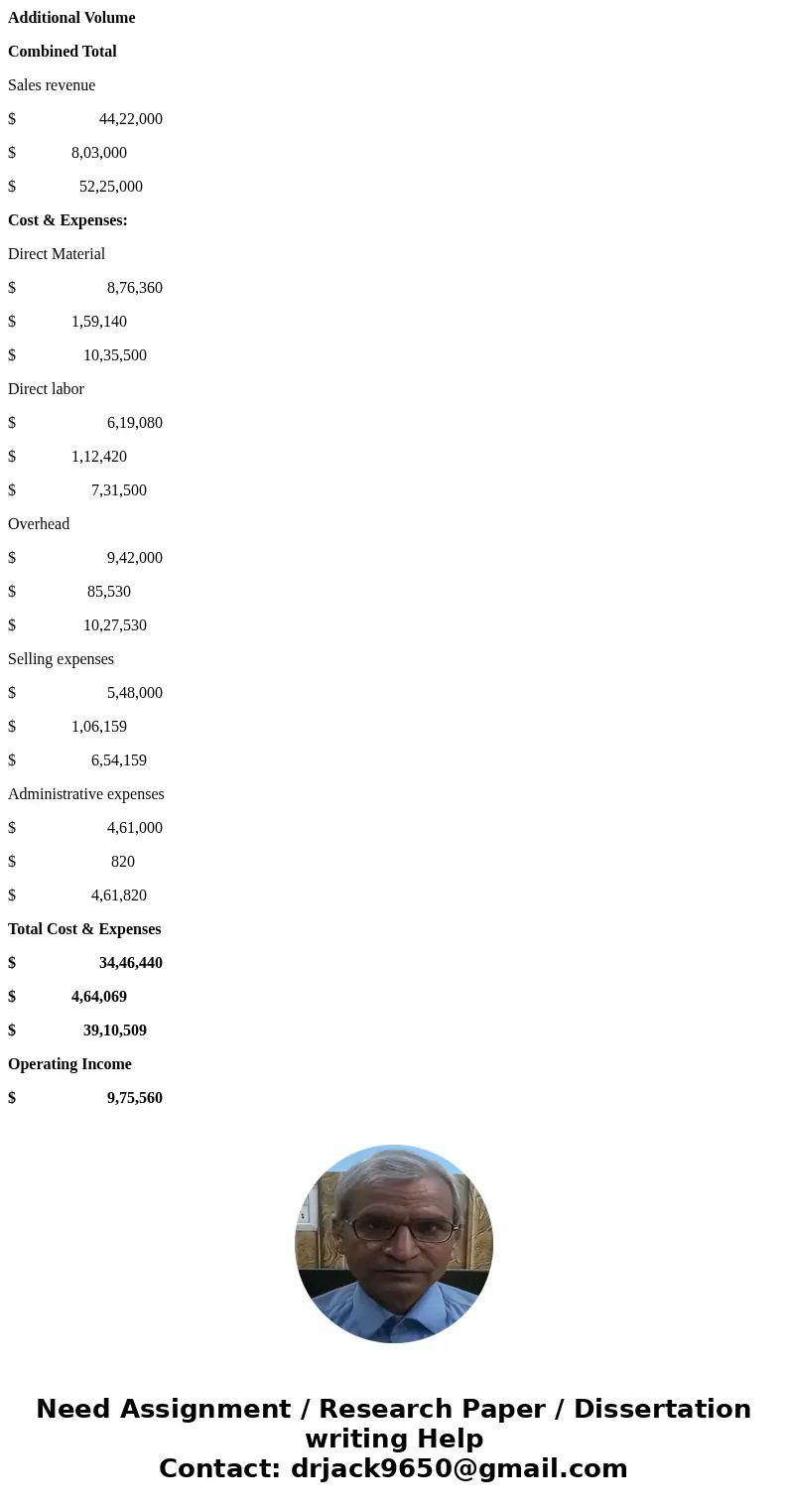

Combined Total

Sales revenue

$ 44,22,000

$ 8,03,000

$ 52,25,000

Cost & Expenses:

Direct Material

$ 8,76,360

$ 1,59,140

$ 10,35,500

Direct labor

$ 6,19,080

$ 1,12,420

$ 7,31,500

Overhead

$ 9,42,000

$ 85,530

$ 10,27,530

Selling expenses

$ 5,48,000

$ 1,06,159

$ 6,54,159

Administrative expenses

$ 4,61,000

$ 820

$ 4,61,820

Total Cost & Expenses

$ 34,46,440

$ 4,64,069

$ 39,10,509

Operating Income

$ 9,75,560

$ 3,38,931

$ 13,14,491

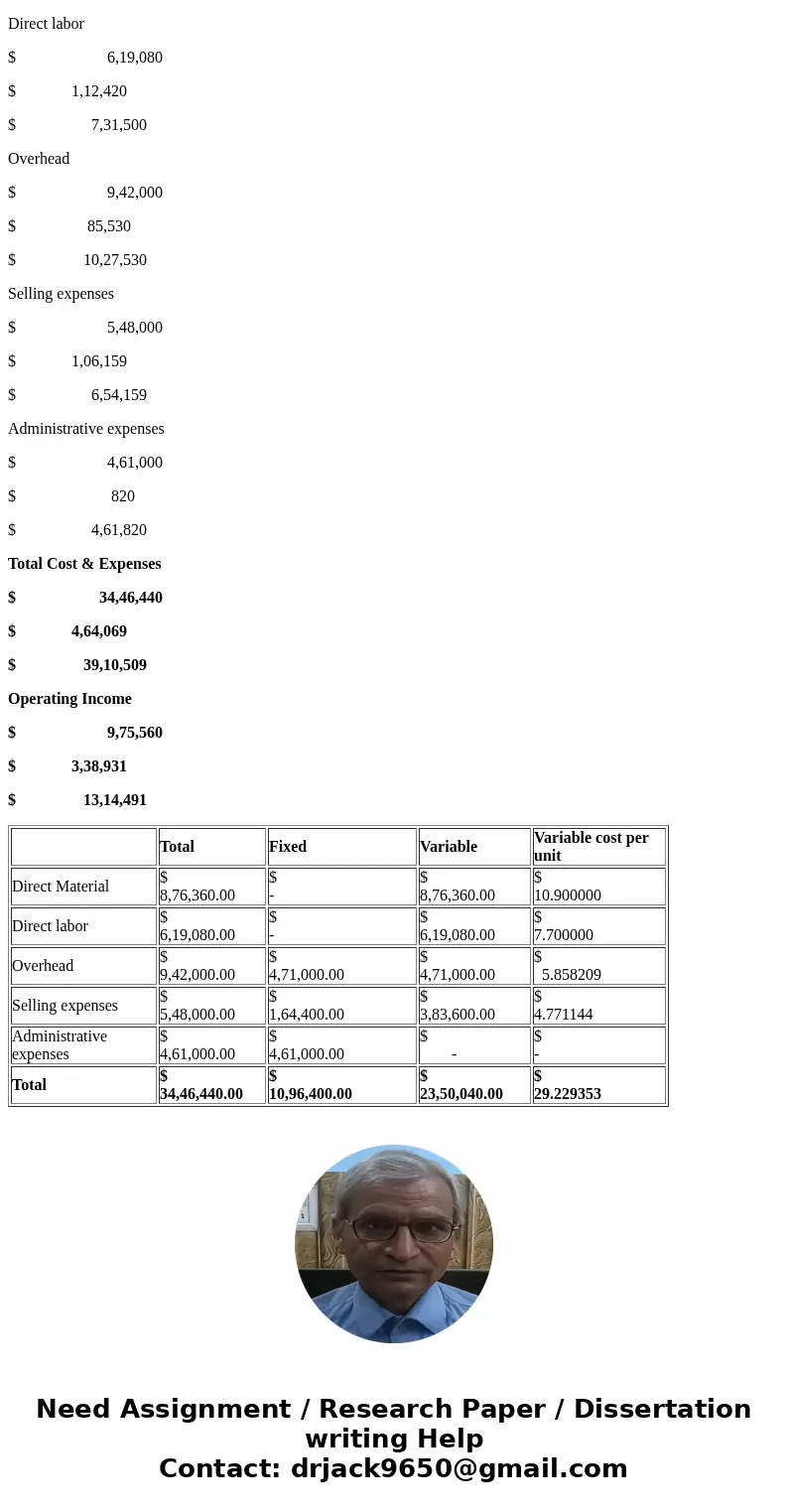

| Total | Fixed | Variable | Variable cost per unit | |

| Direct Material | $ 8,76,360.00 | $ - | $ 8,76,360.00 | $ 10.900000 |

| Direct labor | $ 6,19,080.00 | $ - | $ 6,19,080.00 | $ 7.700000 |

| Overhead | $ 9,42,000.00 | $ 4,71,000.00 | $ 4,71,000.00 | $ 5.858209 |

| Selling expenses | $ 5,48,000.00 | $ 1,64,400.00 | $ 3,83,600.00 | $ 4.771144 |

| Administrative expenses | $ 4,61,000.00 | $ 4,61,000.00 | $ - | $ - |

| Total | $ 34,46,440.00 | $ 10,96,400.00 | $ 23,50,040.00 | $ 29.229353 |

Homework Sourse

Homework Sourse