2 Prepare a horizontal analysis of Sports Unlimiteds 2018 ba

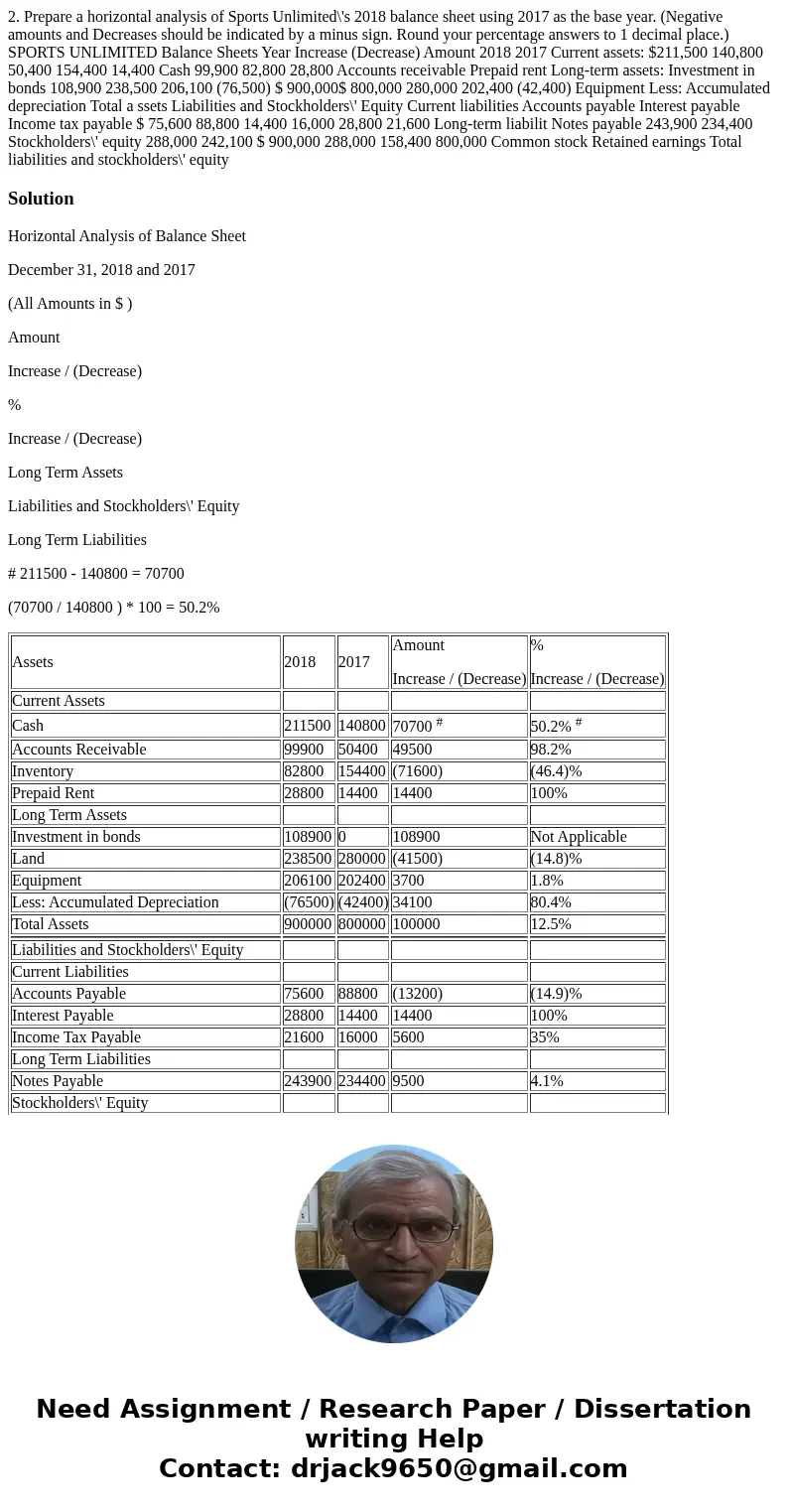

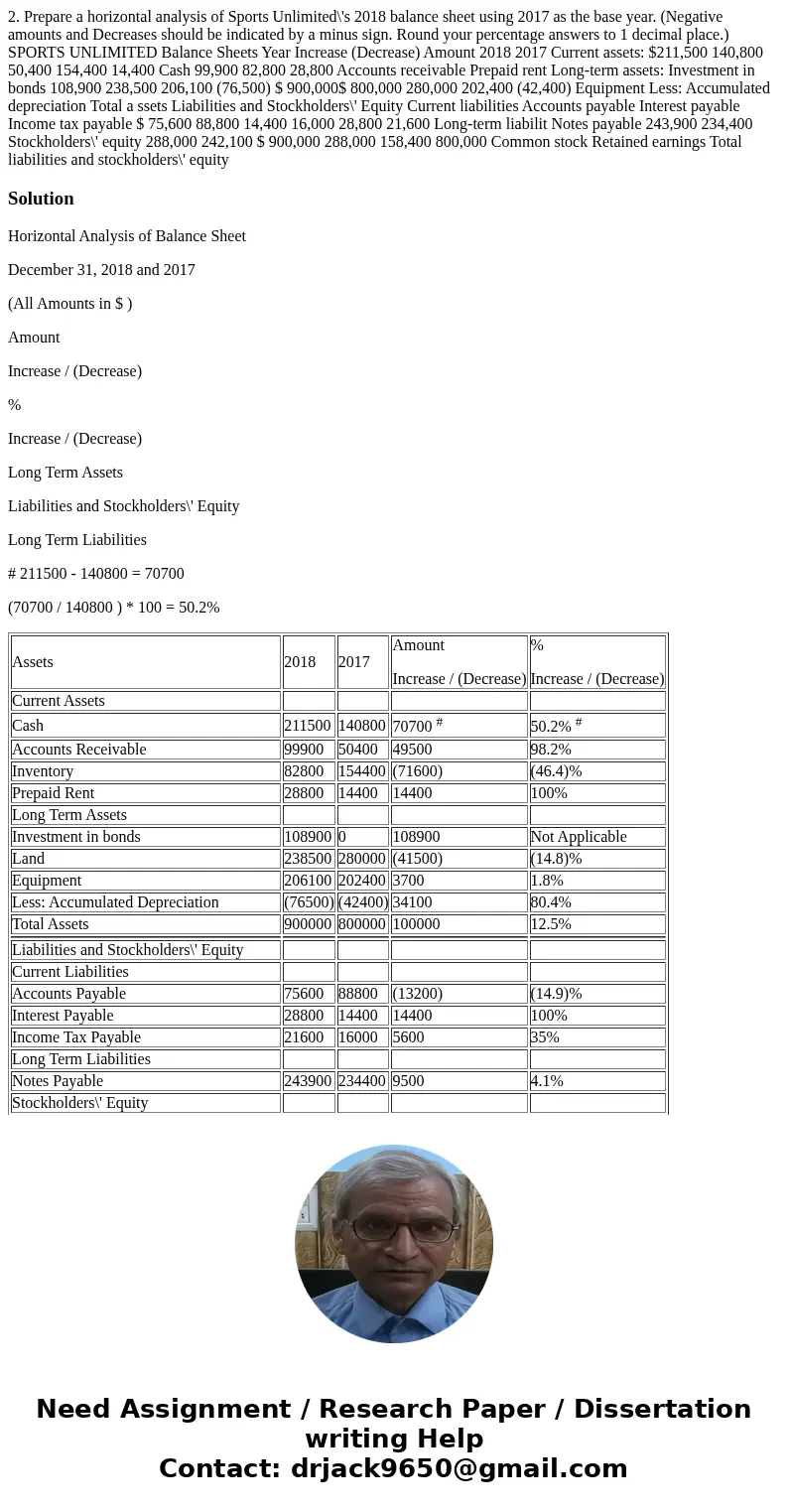

2. Prepare a horizontal analysis of Sports Unlimited\'s 2018 balance sheet using 2017 as the base year. (Negative amounts and Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) SPORTS UNLIMITED Balance Sheets Year Increase (Decrease) Amount 2018 2017 Current assets: $211,500 140,800 50,400 154,400 14,400 Cash 99,900 82,800 28,800 Accounts receivable Prepaid rent Long-term assets: Investment in bonds 108,900 238,500 206,100 (76,500) $ 900,000$ 800,000 280,000 202,400 (42,400) Equipment Less: Accumulated depreciation Total a ssets Liabilities and Stockholders\' Equity Current liabilities Accounts payable Interest payable Income tax payable $ 75,600 88,800 14,400 16,000 28,800 21,600 Long-term liabilit Notes payable 243,900 234,400 Stockholders\' equity 288,000 242,100 $ 900,000 288,000 158,400 800,000 Common stock Retained earnings Total liabilities and stockholders\' equity

Solution

Horizontal Analysis of Balance Sheet

December 31, 2018 and 2017

(All Amounts in $ )

Amount

Increase / (Decrease)

%

Increase / (Decrease)

Long Term Assets

Liabilities and Stockholders\' Equity

Long Term Liabilities

# 211500 - 140800 = 70700

(70700 / 140800 ) * 100 = 50.2%

| Assets | 2018 | 2017 | Amount Increase / (Decrease) | % Increase / (Decrease) |

| Current Assets | ||||

| Cash | 211500 | 140800 | 70700 # | 50.2% # |

| Accounts Receivable | 99900 | 50400 | 49500 | 98.2% |

| Inventory | 82800 | 154400 | (71600) | (46.4)% |

| Prepaid Rent | 28800 | 14400 | 14400 | 100% |

| Long Term Assets | ||||

| Investment in bonds | 108900 | 0 | 108900 | Not Applicable |

| Land | 238500 | 280000 | (41500) | (14.8)% |

| Equipment | 206100 | 202400 | 3700 | 1.8% |

| Less: Accumulated Depreciation | (76500) | (42400) | 34100 | 80.4% |

| Total Assets | 900000 | 800000 | 100000 | 12.5% |

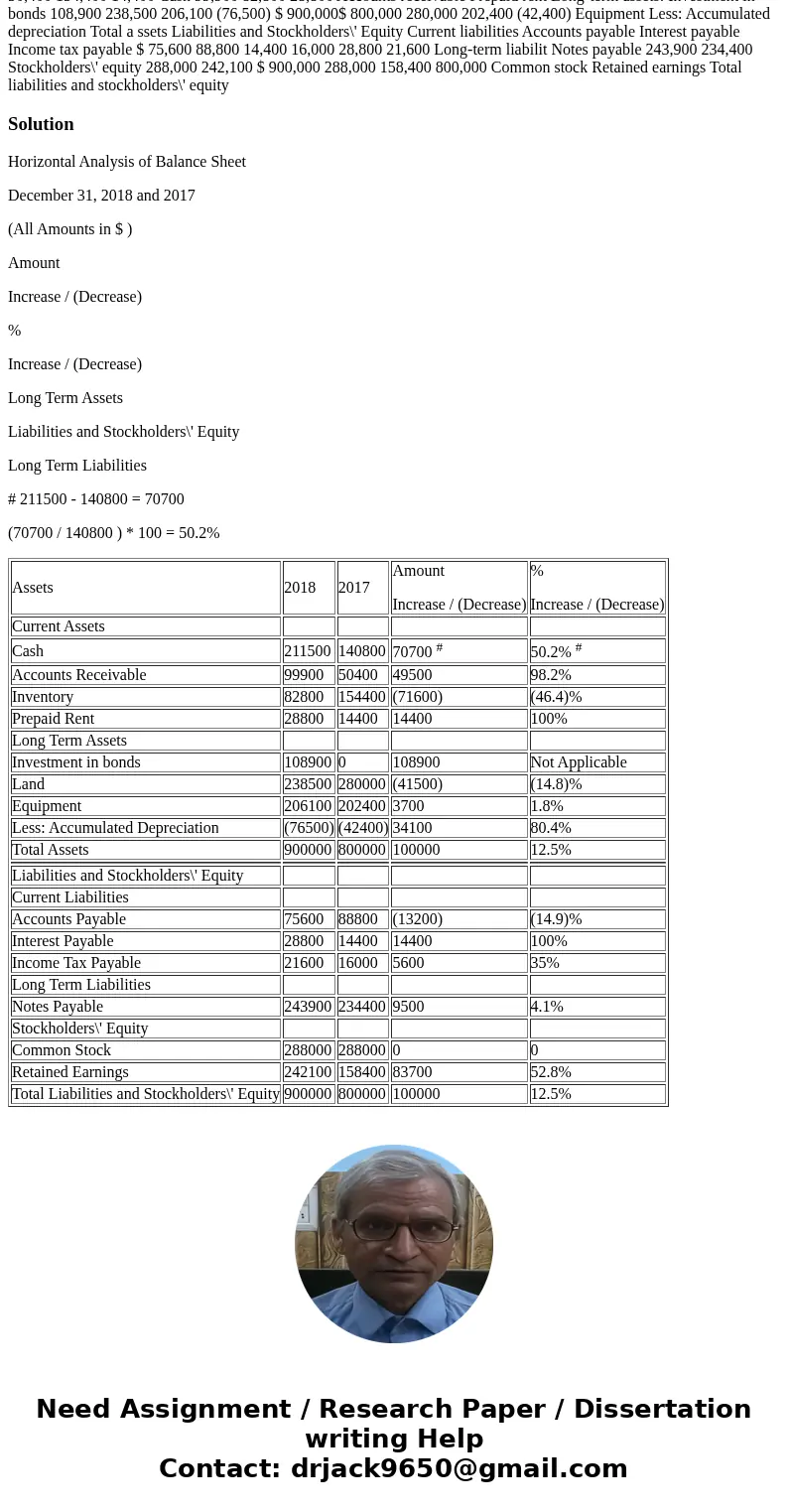

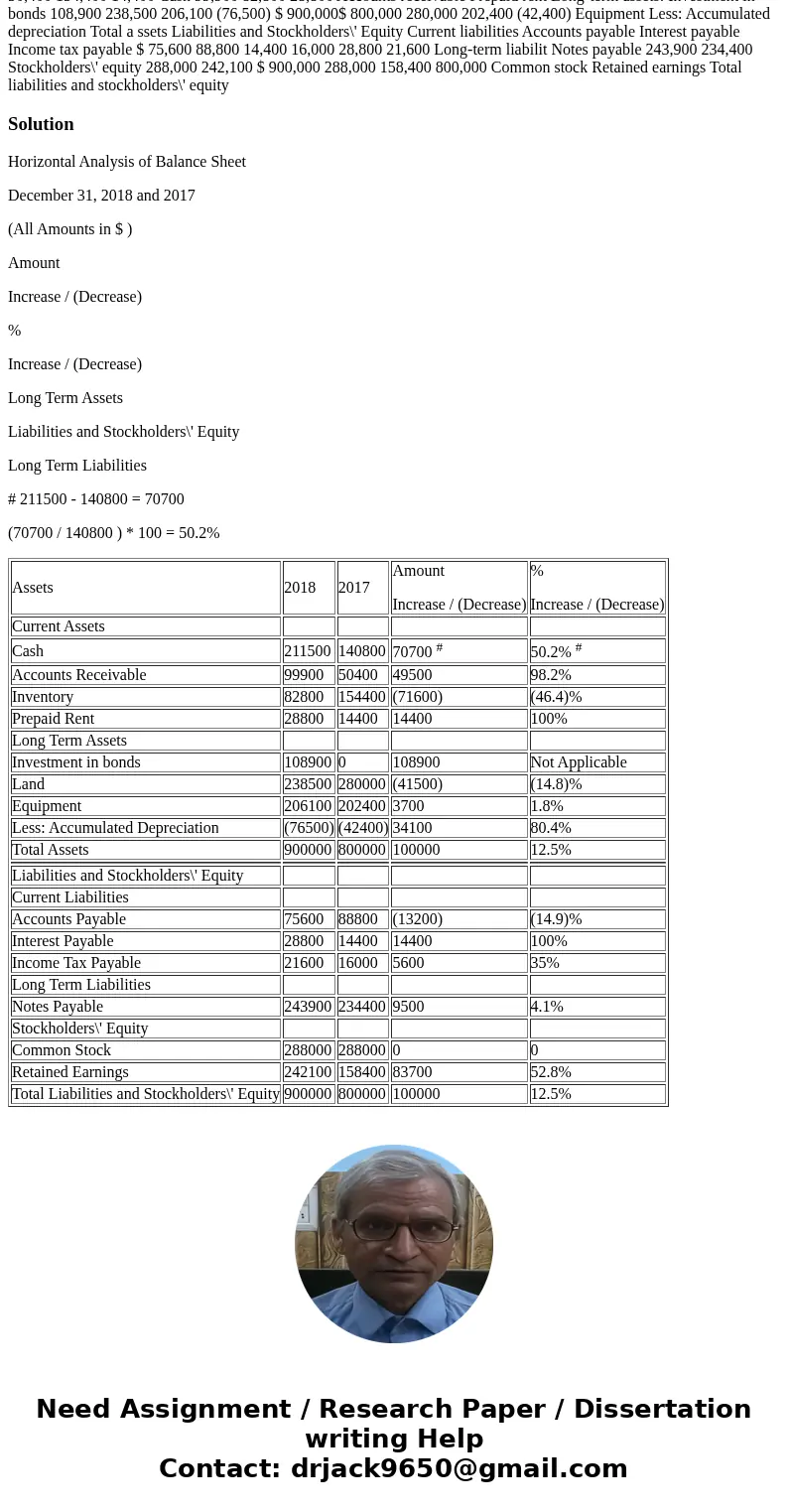

| Liabilities and Stockholders\' Equity | ||||

| Current Liabilities | ||||

| Accounts Payable | 75600 | 88800 | (13200) | (14.9)% |

| Interest Payable | 28800 | 14400 | 14400 | 100% |

| Income Tax Payable | 21600 | 16000 | 5600 | 35% |

| Long Term Liabilities | ||||

| Notes Payable | 243900 | 234400 | 9500 | 4.1% |

| Stockholders\' Equity | ||||

| Common Stock | 288000 | 288000 | 0 | 0 |

| Retained Earnings | 242100 | 158400 | 83700 | 52.8% |

| Total Liabilities and Stockholders\' Equity | 900000 | 800000 | 100000 | 12.5% |

Homework Sourse

Homework Sourse